C 8043, Michigan SBT Statutory Exemption Schedule C 8043, Michigan SBT Statutory Exemption Schedule Form

Understanding the C 8043, Michigan SBT Statutory Exemption Schedule

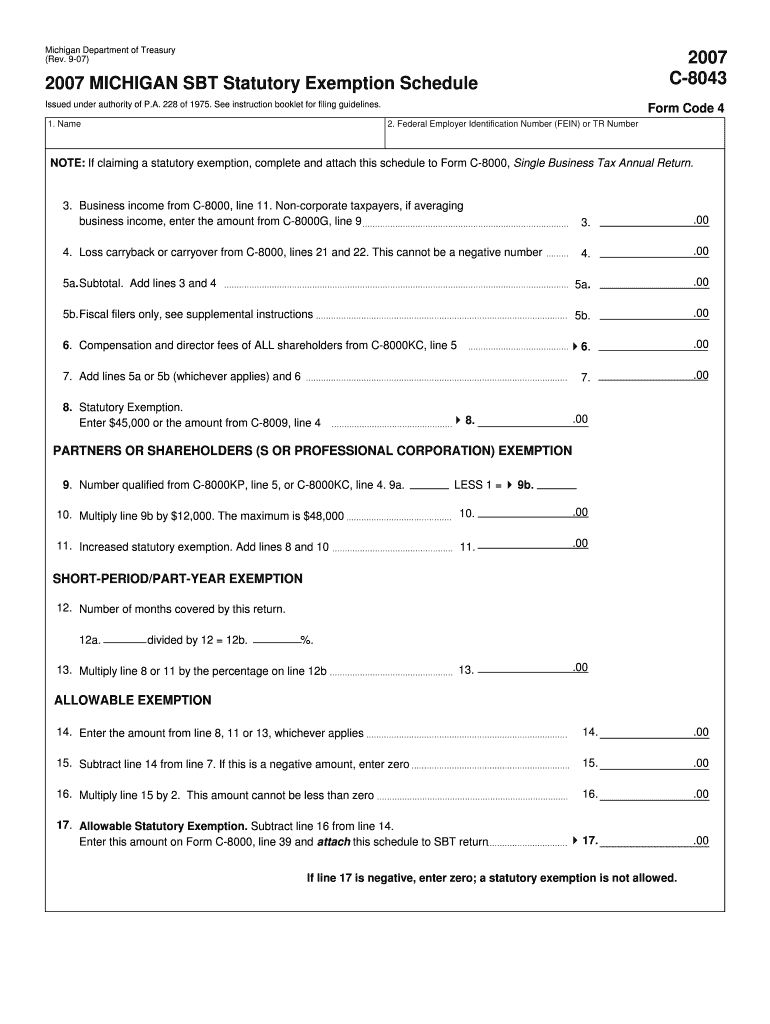

The C 8043, Michigan SBT Statutory Exemption Schedule is a crucial document used by businesses in Michigan to claim statutory exemptions from the Michigan Single Business Tax (SBT). This form allows eligible entities to report their exemption status, ensuring compliance with state tax regulations. It is essential for businesses to understand the specific exemptions available and the criteria that must be met to qualify for these exemptions.

Steps to Complete the C 8043, Michigan SBT Statutory Exemption Schedule

Completing the C 8043 form involves several key steps:

- Gather necessary documentation that supports your exemption claim.

- Fill out the form accurately, ensuring all required fields are completed.

- Double-check the information for accuracy to avoid delays or penalties.

- Submit the form by the designated deadline, either online or via mail, as per state guidelines.

Eligibility Criteria for the C 8043, Michigan SBT Statutory Exemption Schedule

To qualify for the exemptions listed on the C 8043, businesses must meet specific eligibility criteria. These may include:

- Being a recognized business entity in Michigan, such as a corporation, partnership, or LLC.

- Operating within the parameters defined by the Michigan Department of Treasury.

- Meeting revenue thresholds or other conditions set forth in the state tax code.

Required Documents for the C 8043, Michigan SBT Statutory Exemption Schedule

When filing the C 8043, businesses must provide supporting documents. Commonly required documents include:

- Proof of business registration in Michigan.

- Financial statements or tax returns that demonstrate eligibility for the exemption.

- Any additional documentation specified by the Michigan Department of Treasury.

Form Submission Methods for the C 8043, Michigan SBT Statutory Exemption Schedule

The C 8043 form can be submitted through various methods:

- Online submission via the Michigan Department of Treasury's website.

- Mailing the completed form to the appropriate state office.

- In-person submission at designated locations, if applicable.

Key Elements of the C 8043, Michigan SBT Statutory Exemption Schedule

Understanding the key elements of the C 8043 is vital for successful completion. Important sections of the form include:

- Business identification information, including name and tax identification number.

- Details of the statutory exemption being claimed.

- Signature and date fields to validate the submission.

Quick guide on how to complete c 8043 michigan sbt statutory exemption schedule c 8043 michigan sbt statutory exemption schedule

Effortlessly prepare [SKS] on any device

The management of online documents has become popular among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the right form and securely save it online. airSlate SignNow offers all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using the airSlate SignNow applications for Android or iOS and enhance your document-centered tasks today.

How to edit and electronically sign [SKS] smoothly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to retain your changes.

- Choose how you wish to share your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management requirements with just a few clicks from whichever device you prefer. Edit and electronically sign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to C 8043, Michigan SBT Statutory Exemption Schedule C 8043, Michigan SBT Statutory Exemption Schedule

Create this form in 5 minutes!

How to create an eSignature for the c 8043 michigan sbt statutory exemption schedule c 8043 michigan sbt statutory exemption schedule

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the C 8043, Michigan SBT Statutory Exemption Schedule?

The C 8043, Michigan SBT Statutory Exemption Schedule is a form used by businesses in Michigan to claim statutory exemptions from the Single Business Tax. This schedule allows eligible businesses to report their exemptions accurately, ensuring compliance with state regulations. Understanding this schedule is crucial for businesses looking to optimize their tax obligations.

-

How can airSlate SignNow help with the C 8043, Michigan SBT Statutory Exemption Schedule?

airSlate SignNow provides an efficient platform for businesses to prepare, send, and eSign the C 8043, Michigan SBT Statutory Exemption Schedule. With its user-friendly interface, businesses can streamline the documentation process, ensuring that all necessary forms are completed and submitted on time. This helps in maintaining compliance and avoiding potential penalties.

-

What are the pricing options for using airSlate SignNow for the C 8043, Michigan SBT Statutory Exemption Schedule?

airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. Each plan provides access to essential features for managing documents, including the C 8043, Michigan SBT Statutory Exemption Schedule. You can choose a plan that fits your budget while ensuring you have the tools necessary for efficient document management.

-

What features does airSlate SignNow offer for managing the C 8043, Michigan SBT Statutory Exemption Schedule?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for managing the C 8043, Michigan SBT Statutory Exemption Schedule. These features enhance the efficiency of document handling, allowing businesses to focus on their core operations while ensuring compliance with tax regulations.

-

Are there any integrations available with airSlate SignNow for the C 8043, Michigan SBT Statutory Exemption Schedule?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms, enhancing the management of the C 8043, Michigan SBT Statutory Exemption Schedule. These integrations allow businesses to connect their existing workflows, making it easier to manage documents and streamline processes. This flexibility is essential for businesses looking to optimize their operations.

-

What are the benefits of using airSlate SignNow for the C 8043, Michigan SBT Statutory Exemption Schedule?

Using airSlate SignNow for the C 8043, Michigan SBT Statutory Exemption Schedule offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform simplifies the eSigning process, allowing businesses to complete their documentation quickly and securely. This not only saves time but also minimizes the risk of errors in tax submissions.

-

Is airSlate SignNow suitable for small businesses handling the C 8043, Michigan SBT Statutory Exemption Schedule?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses managing the C 8043, Michigan SBT Statutory Exemption Schedule. Its cost-effective solutions and user-friendly interface make it an ideal choice for small businesses looking to streamline their document management processes without incurring high costs.

Get more for C 8043, Michigan SBT Statutory Exemption Schedule C 8043, Michigan SBT Statutory Exemption Schedule

- Letter students form

- Request a transcript from tcc pdf tulsa community college form

- Documentation for dspdisabled students program form

- Jorcyk cv long 6 13 sigma xi form

- Apology letter template form

- Hp template pdf form

- Northeast ohio agri culture newsletter ohio state university form

- Www andrews edu life housingandrews university apartment rental application form

Find out other C 8043, Michigan SBT Statutory Exemption Schedule C 8043, Michigan SBT Statutory Exemption Schedule

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form