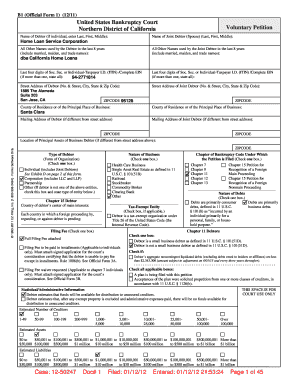

ITIN Complete EIN Form

What is the ITIN Complete EIN

The ITIN Complete EIN refers to the combination of an Individual Taxpayer Identification Number (ITIN) and an Employer Identification Number (EIN). An ITIN is a tax processing number issued by the Internal Revenue Service (IRS) for individuals who are required to have a U.S. taxpayer identification number but do not have, and are not eligible to obtain, a Social Security Number (SSN). An EIN, on the other hand, is used to identify a business entity for tax purposes. This combination is essential for non-resident aliens and foreign nationals who conduct business in the United States, allowing them to comply with federal tax obligations.

How to obtain the ITIN Complete EIN

To obtain an ITIN, individuals must complete Form W-7, Application for IRS Individual Taxpayer Identification Number. This form requires documentation that proves both identity and foreign status. For the EIN, businesses must submit Form SS-4, Application for Employer Identification Number. This can be done online, by mail, or by fax. It is important to ensure that all information provided is accurate to avoid delays in processing. Both forms may require supporting documentation, such as a passport or other identification, and should be submitted to the appropriate IRS office.

Steps to complete the ITIN Complete EIN

Completing the ITIN Complete EIN involves several key steps:

- Gather necessary documentation, including proof of identity and foreign status for the ITIN.

- Fill out Form W-7 for the ITIN and Form SS-4 for the EIN.

- Submit the completed forms to the IRS, either online, by mail, or by fax.

- Wait for the IRS to process the applications and issue the ITIN and EIN.

- Receive confirmation from the IRS, which will include the assigned ITIN and EIN.

Legal use of the ITIN Complete EIN

The ITIN Complete EIN is legally required for individuals and businesses that do not qualify for a Social Security Number but need to fulfill tax obligations in the United States. The ITIN allows individuals to file tax returns, while the EIN is necessary for businesses to report taxes and hire employees. Both numbers must be used in compliance with IRS regulations to avoid penalties or legal issues. It is crucial to ensure that these identifiers are used appropriately in all tax-related documentation.

Required Documents

When applying for the ITIN and EIN, specific documents are required to validate identity and eligibility. For the ITIN, applicants must provide:

- Form W-7 completed accurately.

- Proof of identity, such as a passport, national identification card, or other government-issued documents.

- Documentation proving foreign status, which may include a visa or other immigration documents.

For the EIN, the required documents include:

- Form SS-4 completed with accurate business information.

- Details about the business structure, such as LLC, corporation, or partnership.

IRS Guidelines

The IRS provides specific guidelines for obtaining and using the ITIN Complete EIN. It is essential to follow these guidelines to ensure compliance and avoid potential issues. The IRS outlines the eligibility criteria for both the ITIN and EIN, including who can apply and the necessary documentation. Additionally, the IRS offers resources and instructions on how to fill out the required forms correctly, as well as information on where to submit them. Adhering to these guidelines helps streamline the application process and ensures that all tax obligations are met.

Quick guide on how to complete itin complete ein

Effortlessly Complete [SKS] on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents efficiently without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and eSign [SKS] with Ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically offered by airSlate SignNow for this purpose.

- Create your eSignature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sharing your form—via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from your chosen device. Modify and eSign [SKS] while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to ITIN Complete EIN

Create this form in 5 minutes!

How to create an eSignature for the itin complete ein

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ITIN Complete EIN service offered by airSlate SignNow?

The ITIN Complete EIN service by airSlate SignNow simplifies the process of obtaining an Individual Taxpayer Identification Number (ITIN) and an Employer Identification Number (EIN). This service is designed for businesses and individuals who need to comply with tax regulations efficiently. With airSlate SignNow, you can manage your ITIN Complete EIN applications seamlessly.

-

How much does the ITIN Complete EIN service cost?

The pricing for the ITIN Complete EIN service varies based on the specific needs of your business. airSlate SignNow offers competitive rates that ensure you receive a cost-effective solution for your ITIN and EIN requirements. For detailed pricing information, please visit our website or contact our sales team.

-

What features are included with the ITIN Complete EIN service?

The ITIN Complete EIN service includes features such as document eSigning, secure storage, and easy tracking of your application status. Additionally, airSlate SignNow provides templates and guidance to help you complete your ITIN Complete EIN forms accurately. Our user-friendly interface ensures a smooth experience throughout the process.

-

How can the ITIN Complete EIN service benefit my business?

Utilizing the ITIN Complete EIN service can signNowly streamline your tax compliance process, saving you time and reducing stress. By ensuring that you have the correct ITIN and EIN, your business can operate more efficiently and avoid potential penalties. airSlate SignNow empowers you to focus on your core business activities while we handle your ITIN Complete EIN needs.

-

Is the ITIN Complete EIN service easy to use?

Yes, the ITIN Complete EIN service is designed to be user-friendly, making it accessible for everyone, regardless of technical expertise. With step-by-step guidance and intuitive navigation, you can complete your ITIN Complete EIN applications with ease. airSlate SignNow prioritizes a hassle-free experience for all users.

-

Can I integrate the ITIN Complete EIN service with other tools?

Absolutely! airSlate SignNow offers integrations with various business tools and applications to enhance your workflow. By integrating the ITIN Complete EIN service with your existing systems, you can streamline document management and improve overall efficiency. Check our integrations page for a list of compatible applications.

-

What support options are available for the ITIN Complete EIN service?

airSlate SignNow provides comprehensive support for users of the ITIN Complete EIN service. Our customer support team is available via chat, email, and phone to assist you with any questions or issues you may encounter. We are committed to ensuring that you have a positive experience while using our ITIN Complete EIN service.

Get more for ITIN Complete EIN

- Continuous biometric authentication for form

- Reb of florida inc form

- Bankruptcy forms tai pacific inc robert m aronson 81487

- Fy 101 930 request for small contracts ncdsv form

- Bankruptcy forms northern illinois brick ampampampamp supply inc stephen j costello 6187315

- Ownership of mutual funds shareholder sentiment and use of the form

- Sample application certificate of competency building department form

- Form it 2106 estimated income tax payment voucher for fiduciaries tax year 772032559

Find out other ITIN Complete EIN

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document