Form it 2106 Estimated Income Tax Payment Voucher for Fiduciaries Tax Year 2025-2026

Understanding the IT 2106 Estimated Income Tax Payment Voucher for Fiduciaries

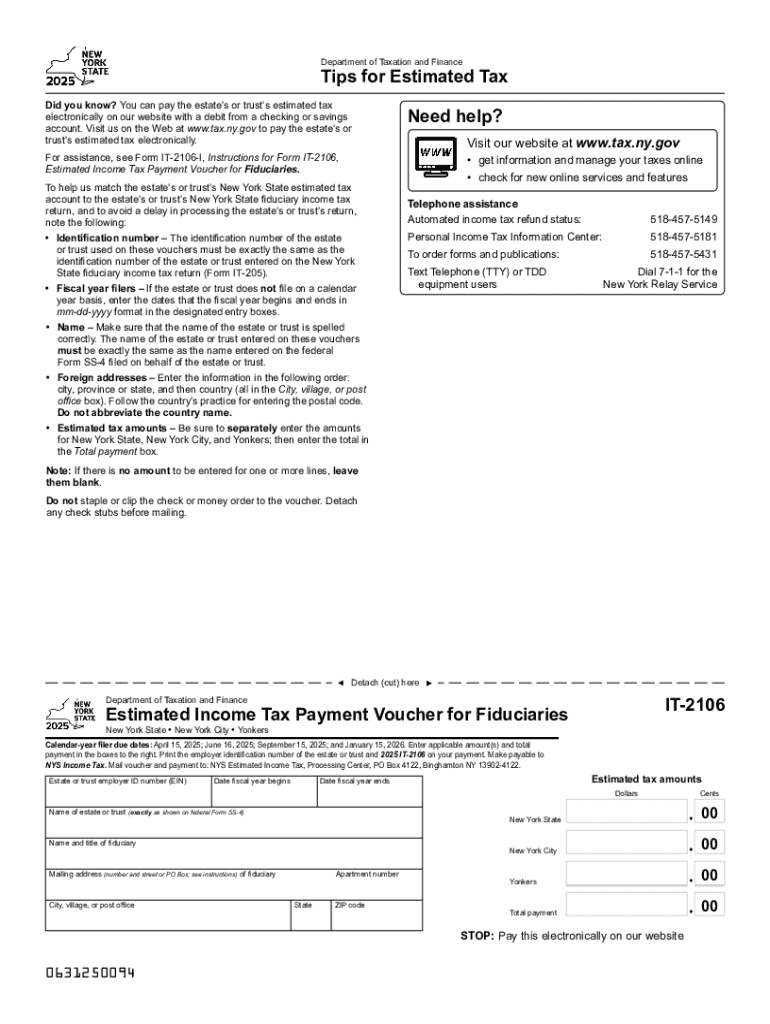

The IT 2106 Estimated Income Tax Payment Voucher is specifically designed for fiduciaries managing estates or trusts in the United States. This form allows fiduciaries to make estimated tax payments on behalf of the entities they represent. It is essential for ensuring compliance with tax obligations, as fiduciaries are responsible for reporting and paying taxes on income generated by the estate or trust. This form is particularly relevant for tax years where fiduciaries anticipate owing taxes and need to make timely payments to avoid penalties.

Steps to Complete the IT 2106 Estimated Income Tax Payment Voucher

Filling out the IT 2106 form requires careful attention to detail. Here are the key steps:

- Gather necessary information: Collect details about the estate or trust, including the federal identification number and income estimates.

- Calculate estimated income: Determine the expected income for the tax year to accurately estimate tax liabilities.

- Fill out the form: Enter the required information in the appropriate fields, ensuring accuracy to prevent delays.

- Review for errors: Double-check all entries for correctness before submission.

- Submit the form: Choose your preferred submission method, whether online or via mail.

Obtaining the IT 2106 Estimated Income Tax Payment Voucher

The IT 2106 form can be obtained through various channels. Fiduciaries can download the form directly from the official state tax website or request a physical copy from their local tax office. It is advisable to ensure that the version of the form is up-to-date to comply with current tax regulations. Additionally, many tax preparation software programs include the IT 2106 form, allowing for easier completion and submission.

Legal Use of the IT 2106 Estimated Income Tax Payment Voucher

The IT 2106 form serves a critical legal function for fiduciaries. It ensures that they fulfill their tax obligations on behalf of the estate or trust, thereby protecting them from potential legal repercussions. Proper use of this form demonstrates that fiduciaries are acting in accordance with tax laws, which is essential for maintaining the integrity of the estate or trust. Failure to use the form correctly can result in penalties or legal challenges.

Filing Deadlines for the IT 2106 Estimated Income Tax Payment Voucher

Fiduciaries must be aware of the filing deadlines associated with the IT 2106 form to avoid late penalties. Generally, estimated payments are due quarterly, with specific dates set by the state tax authority. It is crucial to mark these dates on the calendar and ensure that payments are made on time. Missing a deadline can lead to interest charges and penalties, which can significantly impact the financial standing of the estate or trust.

Examples of Using the IT 2106 Estimated Income Tax Payment Voucher

Understanding practical scenarios can help fiduciaries grasp the importance of the IT 2106 form. For instance, if a trust generates significant income from investments, the fiduciary must estimate the tax liability and submit payments using the IT 2106 form. Similarly, if an estate has rental properties that yield income, the fiduciary will need to calculate expected taxes and file the form accordingly. These examples highlight the necessity of accurate estimations and timely submissions to ensure compliance with tax laws.

Create this form in 5 minutes or less

Find and fill out the correct form it 2106 estimated income tax payment voucher for fiduciaries tax year 772032559

Create this form in 5 minutes!

How to create an eSignature for the form it 2106 estimated income tax payment voucher for fiduciaries tax year 772032559

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are payment fiduciaries and how do they work with airSlate SignNow?

Payment fiduciaries are entities that manage and oversee financial transactions on behalf of clients. With airSlate SignNow, businesses can streamline their document signing processes while ensuring that payment fiduciaries handle sensitive financial information securely and efficiently.

-

How does airSlate SignNow ensure the security of payment fiduciaries?

airSlate SignNow prioritizes security by implementing advanced encryption and compliance measures. This ensures that all documents signed and processed through our platform, including those involving payment fiduciaries, are protected against unauthorized access and data bsignNowes.

-

What features does airSlate SignNow offer for payment fiduciaries?

airSlate SignNow provides features such as customizable templates, automated workflows, and real-time tracking of document status. These tools are designed to enhance the efficiency of payment fiduciaries, allowing them to manage transactions and client communications seamlessly.

-

Is airSlate SignNow cost-effective for payment fiduciaries?

Yes, airSlate SignNow offers a cost-effective solution for payment fiduciaries, with flexible pricing plans that cater to businesses of all sizes. By reducing the time and resources spent on document management, our platform helps payment fiduciaries save money while improving service delivery.

-

Can airSlate SignNow integrate with other tools used by payment fiduciaries?

Absolutely! airSlate SignNow integrates with various third-party applications, making it easier for payment fiduciaries to connect their existing tools. This integration capability enhances workflow efficiency and ensures that all aspects of document management and payment processing are streamlined.

-

What benefits do payment fiduciaries gain from using airSlate SignNow?

Payment fiduciaries benefit from increased efficiency, improved compliance, and enhanced client satisfaction when using airSlate SignNow. Our platform simplifies the signing process, allowing fiduciaries to focus on their core responsibilities while ensuring that all transactions are handled professionally.

-

How can payment fiduciaries get started with airSlate SignNow?

Getting started with airSlate SignNow is easy for payment fiduciaries. Simply sign up for a free trial on our website, explore the features, and see how our platform can enhance your document management processes. Our user-friendly interface ensures a smooth onboarding experience.

Get more for Form IT 2106 Estimated Income Tax Payment Voucher For Fiduciaries Tax Year

Find out other Form IT 2106 Estimated Income Tax Payment Voucher For Fiduciaries Tax Year

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple

- eSign Maine Mechanic's Lien Computer

- eSign Maryland Mechanic's Lien Free

- How To eSign Illinois IOU

- Help Me With eSign Oregon Mechanic's Lien

- eSign South Carolina Mechanic's Lien Secure

- eSign Tennessee Mechanic's Lien Later

- eSign Iowa Revocation of Power of Attorney Online

- How Do I eSign Maine Revocation of Power of Attorney

- eSign Hawaii Expense Statement Fast

- eSign Minnesota Share Donation Agreement Simple