What Property Tax Deduction Can You Claim for 2021

Understanding the Property Tax Deduction

The property tax deduction allows homeowners to deduct the amount they pay in property taxes from their taxable income. This deduction can significantly reduce the overall tax burden for eligible taxpayers. To qualify, the property must be owned and used as a primary residence or a qualified second home. The deduction applies to real estate taxes assessed on the property, but it does not cover other types of taxes, such as assessments for local benefits or charges for services.

Eligibility Criteria for Claiming the Deduction

To claim the property tax deduction, taxpayers must meet specific eligibility criteria. The property must be located in the United States and owned by the taxpayer. Additionally, the taxpayer must itemize deductions on their federal tax return using Schedule A. Homeowners should ensure that they have paid the property taxes during the tax year for which they are claiming the deduction. It is essential to keep records of payments and any relevant documentation to support the claim.

Steps to Claim the Property Tax Deduction

Claiming the property tax deduction involves several steps:

- Gather documentation, including property tax statements and proof of payment.

- Determine if you will itemize deductions on your tax return.

- Complete Schedule A of Form 1040, listing the total amount of property taxes paid.

- Submit your tax return by the filing deadline, ensuring all information is accurate.

IRS Guidelines on Property Tax Deductions

The IRS provides specific guidelines regarding property tax deductions. Only state and local property taxes that are based on the assessed value of the property are deductible. Taxpayers should be aware of the $10,000 limit on the total deduction for state and local taxes, which includes property taxes. It is crucial to refer to the IRS publications for detailed instructions and updates regarding eligibility and limits.

State-Specific Rules for Property Tax Deductions

Property tax deduction rules can vary by state. Some states offer additional deductions or credits for certain populations, such as seniors or veterans. Taxpayers should research their state's specific regulations and any forms required to claim these benefits. Understanding local laws can help maximize potential deductions and ensure compliance with state tax regulations.

Required Documents for Claiming the Deduction

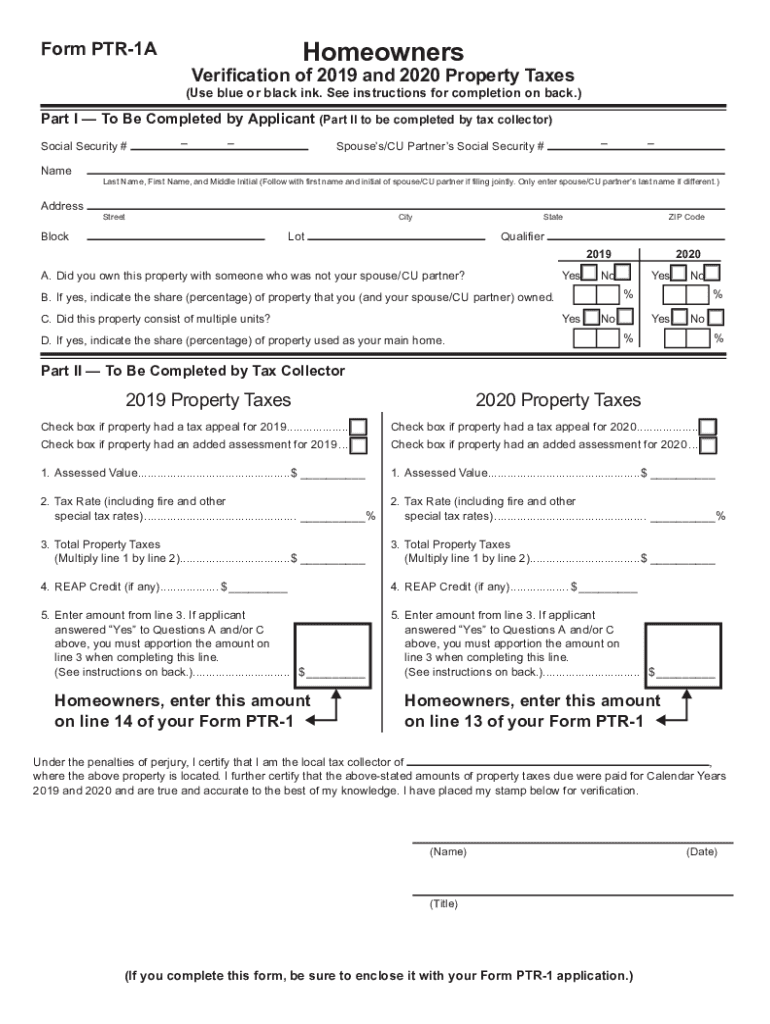

When claiming the property tax deduction, taxpayers need to provide specific documents to support their claim. Essential documents include:

- Property tax bills or statements from the local tax authority.

- Proof of payment, such as canceled checks or bank statements.

- Any additional documentation required by the state or local tax authority.

Maintaining organized records can simplify the process and help avoid issues during tax filing.

Quick guide on how to complete what property tax deduction can you claim for

Prepare What Property Tax Deduction Can You Claim For effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and safely store it online. airSlate SignNow provides you with all the tools you require to create, alter, and electronically sign your documents swiftly without delays. Manage What Property Tax Deduction Can You Claim For on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign What Property Tax Deduction Can You Claim For with ease

- Locate What Property Tax Deduction Can You Claim For and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes seconds and holds the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device of your choice. Edit and electronically sign What Property Tax Deduction Can You Claim For and ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct what property tax deduction can you claim for

Create this form in 5 minutes!

How to create an eSignature for the what property tax deduction can you claim for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What property tax deduction can you claim for your home office?

If you use part of your home exclusively for business, you may be eligible to claim a property tax deduction for that space. The deduction can be calculated based on the percentage of your home used for business purposes. It's important to keep accurate records to substantiate your claim.

-

How does airSlate SignNow help with property tax deduction documentation?

airSlate SignNow provides a seamless way to eSign and manage documents related to property tax deductions. By using our platform, you can easily store and retrieve important tax documents, ensuring you have everything you need when claiming your deductions. This simplifies the process and helps you stay organized.

-

What property tax deduction can you claim for rental properties?

For rental properties, you can claim property tax deductions based on the amount you pay in property taxes. This deduction can signNowly reduce your taxable income, making it essential for landlords to understand. Always consult with a tax professional to ensure you maximize your deductions.

-

Are there any limits on the property tax deductions you can claim?

Yes, there are limits on the property tax deductions you can claim, particularly for high-income earners. The Tax Cuts and Jobs Act has placed a cap on state and local tax deductions, which includes property taxes. It's crucial to stay informed about these limits to accurately assess what property tax deduction you can claim for.

-

What features does airSlate SignNow offer for tax-related documents?

airSlate SignNow offers features like customizable templates, secure eSigning, and document tracking, which are essential for managing tax-related documents. These features ensure that you can efficiently handle all paperwork associated with claiming property tax deductions. Our platform is designed to streamline your document management process.

-

Can I integrate airSlate SignNow with my accounting software for tax deductions?

Yes, airSlate SignNow can be integrated with various accounting software solutions, making it easier to manage your financial documents. This integration allows you to streamline the process of claiming property tax deductions by keeping all relevant documents in one place. It enhances efficiency and reduces the risk of errors.

-

What property tax deduction can you claim for improvements made to your property?

Improvements that increase the value of your property may not be immediately deductible, but they can be added to your property's basis, which may reduce capital gains tax when you sell. Understanding what property tax deduction you can claim for improvements is vital for long-term tax planning. Always consult a tax advisor for specific guidance.

Get more for What Property Tax Deduction Can You Claim For

- W 8ben written explanation form

- Canulc s536 04 fire alarm annual inspection test form

- Referral form harbor health plan

- Washoe county ccw form

- Barbercosmo 100574939 form

- Medicare enrolment or new medicare number request for use by child protection agencies form

- Standard joining agreement for integrated project delivery for use with the form

- Surrey trekkers volkssport club members shaw form

Find out other What Property Tax Deduction Can You Claim For

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure