Massachusetts Form 355u

What is the Massachusetts Form 355u

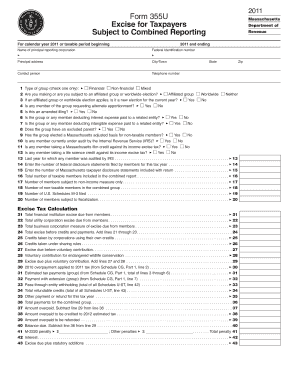

The Massachusetts Form 355u is a tax form specifically designed for excise taxpayers operating within the state. This form is used to report and pay the corporate excise tax, which is assessed on corporations doing business in Massachusetts. The form captures essential information about the corporation's income, deductions, and tax liabilities. It is important for businesses to accurately complete this form to ensure compliance with state tax regulations.

How to use the Massachusetts Form 355u

To use the Massachusetts Form 355u, businesses must first gather the necessary financial information, including gross receipts, allowable deductions, and any credits applicable to their situation. The form requires detailed reporting of various financial metrics, which will determine the corporation's tax liability. Once the form is filled out, it must be submitted to the Massachusetts Department of Revenue by the specified deadlines to avoid penalties.

Steps to complete the Massachusetts Form 355u

Completing the Massachusetts Form 355u involves several key steps:

- Gather financial documents, including income statements and balance sheets.

- Fill in the corporation's identifying information at the top of the form.

- Report gross receipts and any applicable deductions in the designated sections.

- Calculate the total excise tax due based on the provided formulas.

- Review the completed form for accuracy before submission.

Key elements of the Massachusetts Form 355u

The Massachusetts Form 355u includes several critical elements that businesses must be aware of:

- Identification Information: This section requires the corporation's name, address, and federal identification number.

- Income Reporting: Corporations must report total income and any deductions allowed under Massachusetts tax law.

- Tax Calculation: The form includes specific lines for calculating the excise tax owed based on the corporation's income.

- Signature and Date: The form must be signed by an authorized representative of the corporation, along with the date of signing.

Filing Deadlines / Important Dates

Filing deadlines for the Massachusetts Form 355u are crucial for compliance. Typically, the form is due on the fifteenth day of the fourth month following the close of the corporation's fiscal year. For corporations operating on a calendar year, this means the form is due by April 15. It is essential for businesses to mark these dates on their calendars to avoid late fees and penalties.

Penalties for Non-Compliance

Failure to file the Massachusetts Form 355u on time can result in significant penalties. The Massachusetts Department of Revenue may impose fines based on the length of delay and the amount of tax owed. Additionally, interest may accrue on any unpaid taxes, further increasing the total liability. Businesses are encouraged to file the form accurately and on time to avoid these consequences.

Quick guide on how to complete massachusetts form 355u

Complete Massachusetts Form 355u effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage Massachusetts Form 355u using airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

How to modify and eSign Massachusetts Form 355u without hassle

- Locate Massachusetts Form 355u and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, text message (SMS), invite link, or download it to your computer.

Move past the issues of missing or lost documents, tedious form searches, or errors that necessitate the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign Massachusetts Form 355u and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the massachusetts form 355u

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 355u and how can airSlate SignNow help?

Form 355u is a specific document used for tax purposes. airSlate SignNow simplifies the process of completing and signing form 355u by providing an intuitive platform that allows users to fill out, eSign, and send the document securely.

-

What features does airSlate SignNow offer for managing form 355u?

airSlate SignNow offers features such as customizable templates, real-time collaboration, and secure cloud storage specifically for form 355u. These tools enhance efficiency and ensure that your documents are always accessible and up-to-date.

-

Is there a cost associated with using airSlate SignNow for form 355u?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that streamline the process of managing form 355u, making it a cost-effective solution for businesses of all sizes.

-

Can I integrate airSlate SignNow with other applications for form 355u?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage form 355u alongside your existing workflows. This integration capability enhances productivity and ensures that all your documents are in sync.

-

What are the benefits of using airSlate SignNow for form 355u?

Using airSlate SignNow for form 355u offers numerous benefits, including faster turnaround times, reduced paperwork, and enhanced security. The platform's user-friendly interface makes it easy for anyone to complete and eSign the document without hassle.

-

How secure is airSlate SignNow when handling form 355u?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your form 355u and other documents. You can trust that your sensitive information is safe while using our platform.

-

Can I track the status of my form 355u with airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your form 355u in real-time. This transparency helps you stay informed about who has signed the document and when it was completed.

Get more for Massachusetts Form 355u

Find out other Massachusetts Form 355u

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template