Reset Footprint Form Amended Return Select If Fili

What is the Reset Footprint Form Amended Return Select If Fili

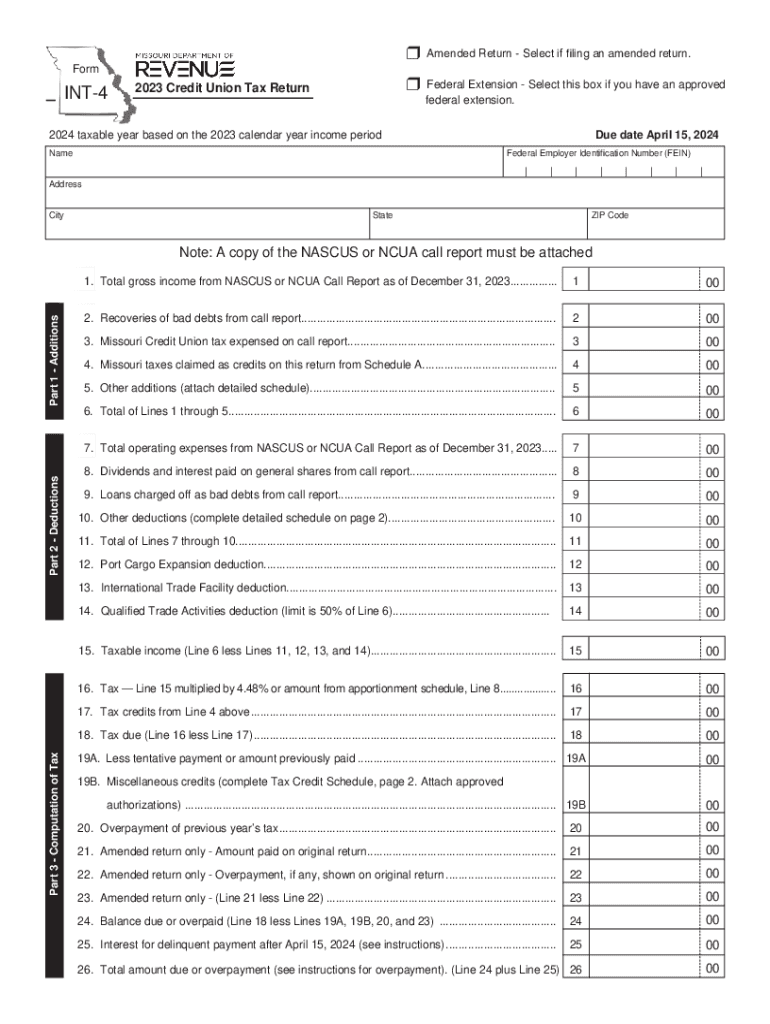

The Reset Footprint Form Amended Return Select If Fili is a specific tax form used in the United States for amending previously filed tax returns. This form allows taxpayers to correct errors or make changes to their tax filings, ensuring that their financial records are accurate and up to date. It is particularly important for individuals who may have misreported income, deductions, or credits on their original returns. By submitting this form, taxpayers can rectify any discrepancies and potentially receive refunds or reduce their tax liabilities.

How to use the Reset Footprint Form Amended Return Select If Fili

Using the Reset Footprint Form Amended Return Select If Fili involves several key steps. First, gather all relevant documentation related to the original tax return, including W-2s, 1099s, and any supporting documents for deductions or credits. Next, accurately complete the form by providing the necessary information, including the tax year being amended and the specific changes being made. After filling out the form, review it carefully to ensure all details are correct. Finally, submit the form according to the instructions, either electronically or by mail, depending on the guidelines provided by the IRS.

Steps to complete the Reset Footprint Form Amended Return Select If Fili

Completing the Reset Footprint Form Amended Return Select If Fili requires careful attention to detail. Follow these steps:

- Gather your original tax return and any supporting documents.

- Identify the specific errors or changes that need to be addressed.

- Fill out the amended return form, ensuring that you include all necessary information.

- Clearly indicate the changes made and provide explanations where required.

- Double-check the form for accuracy before submission.

- Submit the form as directed, keeping a copy for your records.

Key elements of the Reset Footprint Form Amended Return Select If Fili

Several key elements are essential when filling out the Reset Footprint Form Amended Return Select If Fili. These include:

- Tax Year: Specify the year for which you are amending the return.

- Personal Information: Include your name, address, and Social Security number.

- Changes Made: Clearly outline the modifications to income, deductions, or credits.

- Reason for Amendment: Provide a brief explanation of why the changes are necessary.

- Signature: Ensure the form is signed and dated before submission.

Filing Deadlines / Important Dates

Filing deadlines for the Reset Footprint Form Amended Return Select If Fili are crucial to avoid penalties. Generally, the form must be submitted within three years of the original filing date or within two years of paying any tax owed, whichever is later. It is important to stay informed about any changes to IRS deadlines, as these may vary based on specific circumstances, such as extensions or special provisions enacted by the IRS.

Form Submission Methods (Online / Mail / In-Person)

The Reset Footprint Form Amended Return Select If Fili can be submitted through various methods. Taxpayers may choose to file electronically using IRS-approved software, which often streamlines the process and allows for quicker processing times. Alternatively, the form can be mailed directly to the IRS at the address specified in the form instructions. In-person submission is generally not available for this type of form, as the IRS encourages electronic or mail submissions for efficiency.

Quick guide on how to complete reset footprint form amended return select if fili

Effortlessly prepare Reset Footprint Form Amended Return Select If Fili on any device

Managing documents online has become increasingly popular among businesses and individuals. It presents a superb eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Reset Footprint Form Amended Return Select If Fili on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Reset Footprint Form Amended Return Select If Fili seamlessly

- Obtain Reset Footprint Form Amended Return Select If Fili and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Mark relevant parts of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, the hassle of browsing through forms, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Reset Footprint Form Amended Return Select If Fili while ensuring exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the reset footprint form amended return select if fili

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Reset Footprint Form Amended Return Select If Fili?

The Reset Footprint Form Amended Return Select If Fili is a specific document used for amending tax returns. It allows users to correct previously filed returns efficiently. By utilizing this form, businesses can ensure compliance and accuracy in their tax filings.

-

How can airSlate SignNow help with the Reset Footprint Form Amended Return Select If Fili?

airSlate SignNow provides a streamlined platform for sending and eSigning the Reset Footprint Form Amended Return Select If Fili. Our solution simplifies the process, making it easy to manage and track document submissions. This ensures that your amended returns are filed correctly and on time.

-

Is there a cost associated with using airSlate SignNow for the Reset Footprint Form Amended Return Select If Fili?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Our plans are cost-effective, providing excellent value for the features offered. You can choose a plan that best suits your requirements for handling the Reset Footprint Form Amended Return Select If Fili.

-

What features does airSlate SignNow offer for managing the Reset Footprint Form Amended Return Select If Fili?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking. These tools enhance the efficiency of managing the Reset Footprint Form Amended Return Select If Fili. Additionally, our platform ensures that all documents are stored securely and are easily accessible.

-

Can I integrate airSlate SignNow with other software for the Reset Footprint Form Amended Return Select If Fili?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow. You can easily connect our platform with accounting software or CRM systems to streamline the process of handling the Reset Footprint Form Amended Return Select If Fili.

-

What are the benefits of using airSlate SignNow for the Reset Footprint Form Amended Return Select If Fili?

Using airSlate SignNow for the Reset Footprint Form Amended Return Select If Fili provides numerous benefits, including increased efficiency and reduced turnaround time. Our platform ensures that your documents are processed quickly and securely. This allows you to focus on your core business activities while we handle your document needs.

-

Is airSlate SignNow user-friendly for filing the Reset Footprint Form Amended Return Select If Fili?

Yes, airSlate SignNow is designed with user experience in mind. Our intuitive interface makes it easy for anyone to navigate and manage the Reset Footprint Form Amended Return Select If Fili. You don’t need extensive technical skills to use our platform effectively.

Get more for Reset Footprint Form Amended Return Select If Fili

- Idfc bank rtgs form in excel format

- Odometer disclosure statement california form

- St elizabeth doctors note form

- Berkeley extension extension transcript or extension login form

- Tx okla kiwanis background form

- Veterinary drop off form 453445263

- Tenant management communication form revised xls shra

- Request for withdrawal of application ssa 521 form

Find out other Reset Footprint Form Amended Return Select If Fili

- eSign Iowa Standard rental agreement Free

- eSignature Florida Profit Sharing Agreement Template Online

- eSignature Florida Profit Sharing Agreement Template Myself

- eSign Massachusetts Simple rental agreement form Free

- eSign Nebraska Standard residential lease agreement Now

- eSign West Virginia Standard residential lease agreement Mobile

- Can I eSign New Hampshire Tenant lease agreement

- eSign Arkansas Commercial real estate contract Online

- eSign Hawaii Contract Easy

- How Do I eSign Texas Contract

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template