Fiduciary FAQ SC Department of Revenue Form

What is the Fiduciary FAQ SC Department Of Revenue

The Fiduciary FAQ provided by the South Carolina Department of Revenue serves as a comprehensive resource for individuals and entities acting as fiduciaries. A fiduciary is someone who manages assets or interests on behalf of another party, typically in a trust or estate context. This FAQ addresses common questions regarding tax obligations, filing requirements, and the responsibilities of fiduciaries in South Carolina.

How to use the Fiduciary FAQ SC Department Of Revenue

The Fiduciary FAQ can be utilized by fiduciaries to understand their legal obligations and ensure compliance with state tax laws. Users can navigate through various sections that cover topics such as filing procedures, required documentation, and deadlines. It is advisable to refer to this FAQ when preparing to file fiduciary tax returns or when managing estate-related financial matters.

Steps to complete the Fiduciary FAQ SC Department Of Revenue

To effectively use the Fiduciary FAQ, follow these steps:

- Identify your role as a fiduciary and the specific responsibilities associated with it.

- Review the relevant sections of the FAQ that pertain to your situation, such as filing requirements and deadlines.

- Gather necessary documents required for compliance, including tax forms and financial statements.

- Complete the fiduciary tax return accurately, ensuring all information aligns with the guidelines provided in the FAQ.

- Submit the completed forms through the appropriate channels as outlined in the FAQ.

Required Documents

When completing the Fiduciary FAQ process, certain documents are essential for compliance. These typically include:

- Tax identification numbers for the fiduciary and the estate or trust.

- Financial statements detailing income and expenses related to the trust or estate.

- Any prior tax returns for the estate or trust, if applicable.

- Documentation of distributions made to beneficiaries.

Filing Deadlines / Important Dates

Fiduciaries must be aware of specific deadlines to ensure timely filing and avoid penalties. Key dates include:

- The annual tax return due date for fiduciaries, typically aligned with the federal tax deadline.

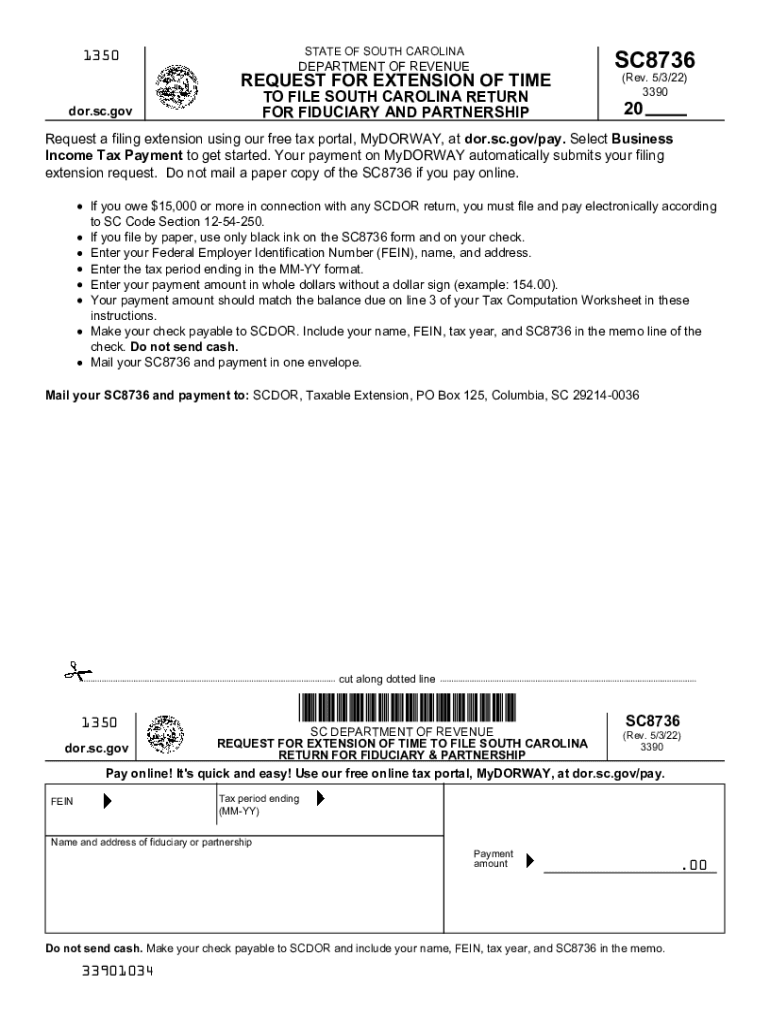

- Extensions available for filing, which may require separate forms to be submitted.

- Deadlines for making distributions to beneficiaries to avoid tax implications.

Penalties for Non-Compliance

Failure to comply with fiduciary tax obligations can result in significant penalties. These may include:

- Monetary fines based on the amount of tax owed.

- Interest on unpaid taxes that accrue over time.

- Potential legal action if fiduciaries fail to fulfill their responsibilities.

Quick guide on how to complete fiduciary faq sc department of revenue

Effortlessly Prepare Fiduciary FAQ SC Department Of Revenue on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed forms since you can access the necessary documents and securely store them online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Handle Fiduciary FAQ SC Department Of Revenue on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The Easiest Way to Modify and Electronically Sign Fiduciary FAQ SC Department Of Revenue

- Find Fiduciary FAQ SC Department Of Revenue and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize key sections of your documents or redact sensitive information with tools provided specifically for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, text message (SMS), or using an invitation link, or download it to your computer.

Leave behind lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Alter and electronically sign Fiduciary FAQ SC Department Of Revenue and ensure exceptional communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fiduciary faq sc department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Fiduciary FAQ SC Department Of Revenue?

The Fiduciary FAQ SC Department Of Revenue provides essential information regarding fiduciary responsibilities and tax obligations in South Carolina. It serves as a resource for individuals and businesses to understand their duties when managing estates or trusts. This FAQ can help clarify common queries and ensure compliance with state regulations.

-

How can airSlate SignNow assist with fiduciary documents?

airSlate SignNow offers a streamlined platform for sending and eSigning fiduciary documents, making it easier to manage legal paperwork. With features designed for efficiency, users can quickly prepare, send, and track documents related to fiduciary duties. This ensures that all necessary documents are handled promptly and securely.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow provides flexible pricing plans tailored to meet the needs of various users, including individuals and businesses. Each plan offers different features, ensuring that you can find a cost-effective solution that fits your requirements. For detailed pricing information, visit our website or contact our sales team.

-

What features does airSlate SignNow offer for fiduciary management?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage, all of which are beneficial for fiduciary management. These tools help streamline the process of preparing and signing fiduciary documents, ensuring compliance with the Fiduciary FAQ SC Department Of Revenue. Additionally, users can track document status in real-time.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow offers integrations with various software applications, enhancing its functionality for fiduciary management. This allows users to connect their existing tools and streamline their workflows. Integrating with accounting or legal software can help ensure that all fiduciary obligations are met efficiently.

-

What are the benefits of using airSlate SignNow for fiduciary duties?

Using airSlate SignNow for fiduciary duties simplifies document management and enhances compliance with the Fiduciary FAQ SC Department Of Revenue. The platform's user-friendly interface and robust security features ensure that sensitive information is protected. Additionally, the ability to eSign documents saves time and reduces the need for physical paperwork.

-

Is airSlate SignNow secure for handling fiduciary documents?

Absolutely, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling fiduciary documents. The platform employs advanced encryption and security protocols to protect sensitive information. Users can confidently manage their fiduciary responsibilities while adhering to the guidelines outlined in the Fiduciary FAQ SC Department Of Revenue.

Get more for Fiduciary FAQ SC Department Of Revenue

- California applicants only job application form

- Final exam phlebotomy form

- Housing form

- Virginia form dc 475

- Customer request form axis bank

- Cbp 507employee report of unsafe conditions local 2595 form

- 4924 withholding certificate for michigan pension or annuity payments mi w 4p 771975077 form

- Joint bidding agreement template form

Find out other Fiduciary FAQ SC Department Of Revenue

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP