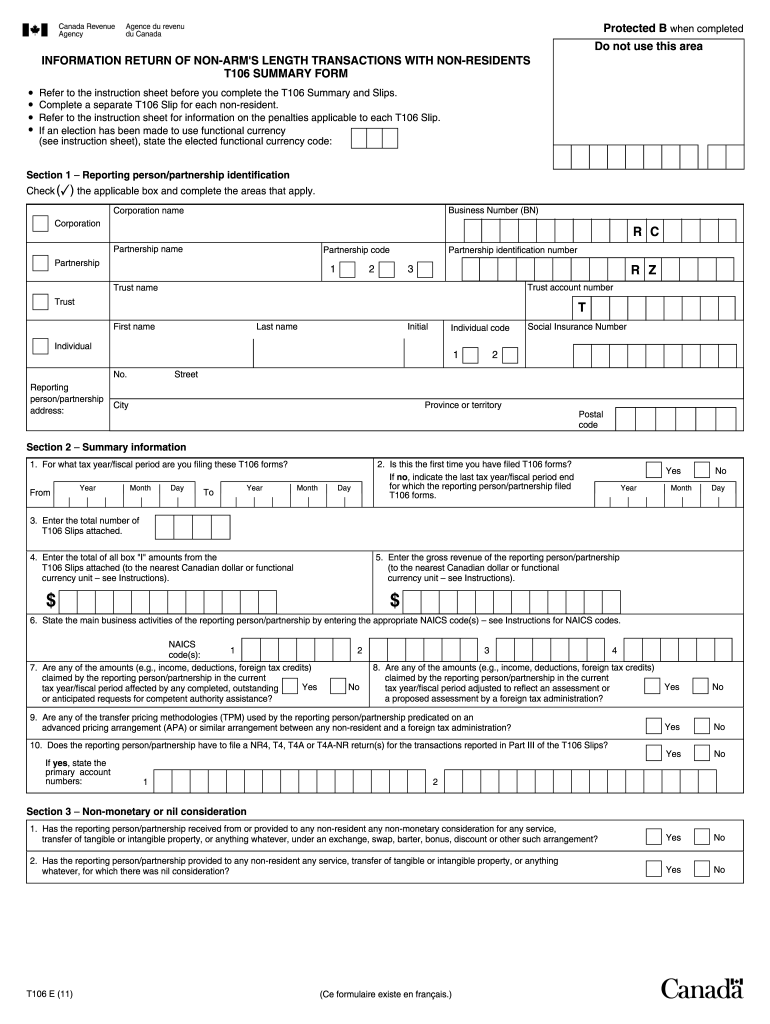

INFORMATION RETURN of NON ARM'S LENGTH TRANSACTIONS with NON RESIDENTS T106 SUMMARY FORM Download a Printable March C 2011

What is the INFORMATION RETURN OF NON ARM'S LENGTH TRANSACTIONS WITH NON RESIDENTS T106 SUMMARY FORM Download A Printable March C

The INFORMATION RETURN OF NON ARM'S LENGTH TRANSACTIONS WITH NON RESIDENTS T106 SUMMARY FORM is a crucial document used in the United States for reporting transactions that occur between related parties, particularly when one party is a non-resident. This form ensures compliance with tax regulations and provides transparency regarding financial dealings that could potentially affect tax liabilities. It is essential for businesses engaging in cross-border transactions to accurately report these dealings to avoid penalties and ensure proper tax treatment.

Steps to complete the INFORMATION RETURN OF NON ARM'S LENGTH TRANSACTIONS WITH NON RESIDENTS T106 SUMMARY FORM Download A Printable March C

Completing the INFORMATION RETURN OF NON ARM'S LENGTH TRANSACTIONS WITH NON RESIDENTS T106 SUMMARY FORM involves several key steps:

- Gather necessary information: Collect all relevant data about the transaction, including details about the parties involved, the nature of the transaction, and the amounts.

- Fill out the form: Carefully input the gathered information into the appropriate fields of the form. Ensure accuracy to avoid issues with compliance.

- Review the form: Double-check all entries for completeness and correctness. Incomplete or incorrect forms may lead to delays or penalties.

- Submit the form: Follow the appropriate submission method, whether online, by mail, or in person, as specified by the IRS guidelines.

Legal use of the INFORMATION RETURN OF NON ARM'S LENGTH TRANSACTIONS WITH NON RESIDENTS T106 SUMMARY FORM Download A Printable March C

The legal use of the INFORMATION RETURN OF NON ARM'S LENGTH TRANSACTIONS WITH NON RESIDENTS T106 SUMMARY FORM is vital for maintaining compliance with U.S. tax laws. This form must be completed accurately and submitted within specified deadlines to avoid legal repercussions. Failure to file or inaccuracies in reporting can lead to significant penalties, including fines or audits. It is important for businesses to understand the legal implications of their transactions and to ensure that all required information is reported correctly.

How to obtain the INFORMATION RETURN OF NON ARM'S LENGTH TRANSACTIONS WITH NON RESIDENTS T106 SUMMARY FORM Download A Printable March C

Obtaining the INFORMATION RETURN OF NON ARM'S LENGTH TRANSACTIONS WITH NON RESIDENTS T106 SUMMARY FORM is straightforward. The form can typically be downloaded from the official IRS website or other trusted tax resources. Users should ensure they are accessing the most recent version of the form to comply with current regulations. It is advisable to review the instructions provided with the form to understand the requirements and ensure all necessary information is included.

Filing Deadlines / Important Dates

Filing deadlines for the INFORMATION RETURN OF NON ARM'S LENGTH TRANSACTIONS WITH NON RESIDENTS T106 SUMMARY FORM are crucial for compliance. The form must be submitted by the specified due date to avoid penalties. Typically, the deadline aligns with the annual tax filing dates. It is essential for businesses to mark these dates on their calendars and prepare their submissions in advance to ensure timely filing.

Key elements of the INFORMATION RETURN OF NON ARM'S LENGTH TRANSACTIONS WITH NON RESIDENTS T106 SUMMARY FORM Download A Printable March C

Key elements of the INFORMATION RETURN OF NON ARM'S LENGTH TRANSACTIONS WITH NON RESIDENTS T106 SUMMARY FORM include:

- Identification of parties: Names and addresses of the related parties involved in the transaction.

- Description of the transaction: A detailed account of the nature and purpose of the transaction.

- Financial details: Amounts involved and the terms of the transaction.

- Compliance information: Any relevant information that demonstrates adherence to tax regulations.

Quick guide on how to complete information return of non arms length transactions with non residents t106 summary form download a free printable march 2014

A brief guide on how to prepare your INFORMATION RETURN OF NON ARM'S LENGTH TRANSACTIONS WITH NON RESIDENTS T106 SUMMARY FORM Download A Printable March C

Locating the appropriate template can be a difficulty when you have to supply formal foreign documents. Even if you possess the form you require, it may be cumbersome to swiftly fill it out according to all the stipulations if you utilize printed copies instead of managing everything digitally. airSlate SignNow is the web-based eSignature solution that assists you in overcoming all of that. It allows you to obtain your INFORMATION RETURN OF NON ARM'S LENGTH TRANSACTIONS WITH NON RESIDENTS T106 SUMMARY FORM Download A Printable March C and rapidly complete and sign it on-site without the need to reprint documents in case of any errors.

Here are the actions you need to undertake to prepare your INFORMATION RETURN OF NON ARM'S LENGTH TRANSACTIONS WITH NON RESIDENTS T106 SUMMARY FORM Download A Printable March C with airSlate SignNow:

- Click the Get Form button to instantly upload your document to our editor.

- Begin with the first empty field, enter details, and continue with the Next tool.

- Fill in the empty boxes using the Cross and Check tools from the panel above.

- Select the Highlight or Line options to emphasize the most important information.

- Click on Image and import one if your INFORMATION RETURN OF NON ARM'S LENGTH TRANSACTIONS WITH NON RESIDENTS T106 SUMMARY FORM Download A Printable March C necessitates it.

- Make use of the right-side panel to add more fields for you or others to fill out if necessary.

- Review your responses and authorize the form by clicking Date, Initials, and Sign.

- Draw, type, upload your eSignature, or capture it using a camera or QR code.

- Complete modifying the form by clicking the Done button and selecting your file-sharing options.

Once your INFORMATION RETURN OF NON ARM'S LENGTH TRANSACTIONS WITH NON RESIDENTS T106 SUMMARY FORM Download A Printable March C is ready, you can share it as you prefer - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely store all your completed documents in your account, organized in folders according to your preferences. Don’t waste time on manual document completion; try airSlate SignNow!

Create this form in 5 minutes or less

Find and fill out the correct information return of non arms length transactions with non residents t106 summary form download a free printable march 2014

Create this form in 5 minutes!

How to create an eSignature for the information return of non arms length transactions with non residents t106 summary form download a free printable march 2014

How to create an electronic signature for your Information Return Of Non Arms Length Transactions With Non Residents T106 Summary Form Download A Free Printable March 2014 in the online mode

How to generate an eSignature for your Information Return Of Non Arms Length Transactions With Non Residents T106 Summary Form Download A Free Printable March 2014 in Google Chrome

How to create an electronic signature for putting it on the Information Return Of Non Arms Length Transactions With Non Residents T106 Summary Form Download A Free Printable March 2014 in Gmail

How to make an eSignature for the Information Return Of Non Arms Length Transactions With Non Residents T106 Summary Form Download A Free Printable March 2014 right from your mobile device

How to make an eSignature for the Information Return Of Non Arms Length Transactions With Non Residents T106 Summary Form Download A Free Printable March 2014 on iOS devices

How to generate an eSignature for the Information Return Of Non Arms Length Transactions With Non Residents T106 Summary Form Download A Free Printable March 2014 on Android

People also ask

-

What is the INFORMATION RETURN OF NON ARM'S LENGTH TRANSACTIONS WITH NON RESIDENTS T106 SUMMARY FORM?

The INFORMATION RETURN OF NON ARM'S LENGTH TRANSACTIONS WITH NON RESIDENTS T106 SUMMARY FORM is a critical document for Canadian businesses detailing specific transactions between non-residents. Downloading the printable version in March allows businesses to comply with tax regulations efficiently and accurately.

-

How can I download the INFORMATION RETURN OF NON ARM'S LENGTH TRANSACTIONS WITH NON RESIDENTS T106 SUMMARY FORM?

You can easily download the INFORMATION RETURN OF NON ARM'S LENGTH TRANSACTIONS WITH NON RESIDENTS T106 SUMMARY FORM in a printable format directly from our platform. Simply select the document, review the requirements, and click on the download link available on our landing page.

-

What features does airSlate SignNow offer for managing the T106 form?

airSlate SignNow provides an intuitive interface for filling out and managing the INFORMATION RETURN OF NON ARM'S LENGTH TRANSACTIONS WITH NON RESIDENTS T106 SUMMARY FORM. With electronic signature capabilities, tracking, and audit trails, you can ensure your documents are securely handled and compliant with regulations.

-

Is there a cost associated with downloading the T106 summary form?

Downloading the INFORMATION RETURN OF NON ARM'S LENGTH TRANSACTIONS WITH NON RESIDENTS T106 SUMMARY FORM is part of our service offerings, which include various pricing plans to suit business needs. Visit our pricing page to explore the different options and find the best plan for your document management.

-

How does airSlate SignNow ensure the security of my T106 documents?

Security is a top priority at airSlate SignNow. We employ advanced encryption protocols and secure cloud storage to protect your INFORMATION RETURN OF NON ARM'S LENGTH TRANSACTIONS WITH NON RESIDENTS T106 SUMMARY FORM and other sensitive documents, ensuring that your data remains confidential and safe.

-

Can I integrate airSlate SignNow with other software for processing the T106 form?

Yes, airSlate SignNow offers seamless integrations with various third-party applications to enhance your productivity. Whether you're using accounting software or document management systems, you can easily automate workflows concerning the INFORMATION RETURN OF NON ARM'S LENGTH TRANSACTIONS WITH NON RESIDENTS T106 SUMMARY FORM.

-

What are the benefits of using airSlate SignNow for the T106 summary form?

Using airSlate SignNow for the INFORMATION RETURN OF NON ARM'S LENGTH TRANSACTIONS WITH NON RESIDENTS T106 SUMMARY FORM streamlines your workflow. You benefit from an easy-to-use interface, quick access to essential forms, and the ability to eSign documents, making compliance simpler and more efficient.

Get more for INFORMATION RETURN OF NON ARM'S LENGTH TRANSACTIONS WITH NON RESIDENTS T106 SUMMARY FORM Download A Printable March C

Find out other INFORMATION RETURN OF NON ARM'S LENGTH TRANSACTIONS WITH NON RESIDENTS T106 SUMMARY FORM Download A Printable March C

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile