PT 701PU Annual Return for Taxation Railroad Equipment Car Form

What is the PT 701PU Annual Return For Taxation Railroad Equipment Car

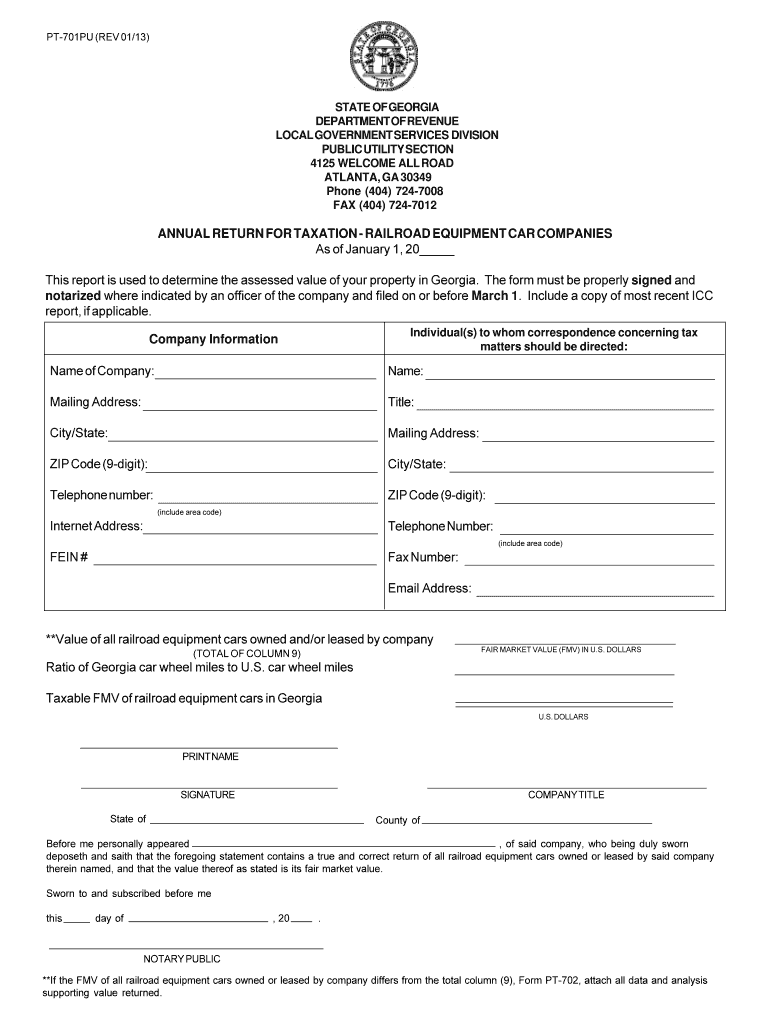

The PT 701PU Annual Return For Taxation Railroad Equipment Car is a specific tax form used in the United States for reporting the value of railroad equipment. This form is essential for railroad companies to comply with state taxation requirements. It provides a detailed account of the equipment owned, its value, and any applicable tax obligations. Understanding this form is crucial for ensuring accurate tax reporting and compliance with state laws regarding railroad property taxation.

How to use the PT 701PU Annual Return For Taxation Railroad Equipment Car

Using the PT 701PU Annual Return involves several steps to ensure that the information provided is accurate and complete. First, gather all necessary information about the railroad equipment, including purchase dates, values, and any relevant depreciation. Next, fill out the form carefully, ensuring that all fields are completed as required. After completing the form, review it for accuracy before submitting it to the appropriate state tax authority. Maintaining a copy for your records is also advisable for future reference.

Steps to complete the PT 701PU Annual Return For Taxation Railroad Equipment Car

Completing the PT 701PU Annual Return involves a systematic approach:

- Gather all relevant documentation related to railroad equipment.

- Determine the total value of the equipment for the reporting year.

- Fill out the form with accurate details, including equipment descriptions and values.

- Review the completed form for any errors or omissions.

- Submit the form to the designated state tax authority by the deadline.

Filing Deadlines / Important Dates

Filing deadlines for the PT 701PU Annual Return vary by state, but it is typically due on or before April 15 each year. It is important to check with your state tax authority for specific deadlines and any potential extensions. Missing the deadline can result in penalties or interest charges, so timely submission is crucial for compliance.

Penalties for Non-Compliance

Failure to file the PT 701PU Annual Return can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action from state tax authorities. Additionally, non-compliance can affect the company's reputation and financial standing. It is essential to adhere to all filing requirements to avoid these repercussions.

Who Issues the Form

The PT 701PU Annual Return is issued by state tax authorities responsible for assessing property taxes on railroad equipment. Each state may have its own version of the form, tailored to meet local regulations and requirements. It is important for businesses to use the correct form as designated by their respective state to ensure compliance.

Quick guide on how to complete pt 701pu annual return for taxation railroad equipment car

Prepare PT 701PU Annual Return For Taxation Railroad Equipment Car effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers a perfect eco-friendly substitute to conventional printed and signed files, as you can acquire the correct format and securely save it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents quickly without delays. Manage PT 701PU Annual Return For Taxation Railroad Equipment Car on any device using airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign PT 701PU Annual Return For Taxation Railroad Equipment Car without breaking a sweat

- Locate PT 701PU Annual Return For Taxation Railroad Equipment Car and click on Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and eSign PT 701PU Annual Return For Taxation Railroad Equipment Car and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pt 701pu annual return for taxation railroad equipment car

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PT 701PU Annual Return For Taxation Railroad Equipment Car?

The PT 701PU Annual Return For Taxation Railroad Equipment Car is a tax form specifically designed for reporting the value of railroad equipment for taxation purposes. This form helps businesses ensure compliance with state tax regulations while accurately reporting their assets. Understanding this form is crucial for railroad companies to avoid penalties and optimize their tax obligations.

-

How can airSlate SignNow assist with the PT 701PU Annual Return For Taxation Railroad Equipment Car?

airSlate SignNow streamlines the process of completing and submitting the PT 701PU Annual Return For Taxation Railroad Equipment Car by providing an easy-to-use eSignature platform. Users can fill out the form digitally, sign it, and send it securely, ensuring a hassle-free experience. This efficiency helps businesses save time and reduce errors in their tax submissions.

-

What are the pricing options for using airSlate SignNow for the PT 701PU Annual Return For Taxation Railroad Equipment Car?

airSlate SignNow offers flexible pricing plans that cater to various business needs, making it cost-effective for handling the PT 701PU Annual Return For Taxation Railroad Equipment Car. Plans typically include features like unlimited eSignatures and document storage. You can choose a plan that best fits your volume of transactions and budget.

-

What features does airSlate SignNow provide for managing the PT 701PU Annual Return For Taxation Railroad Equipment Car?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage, all of which enhance the management of the PT 701PU Annual Return For Taxation Railroad Equipment Car. These features allow users to create, edit, and store their tax documents efficiently. Additionally, the platform ensures compliance with legal standards for electronic signatures.

-

Are there any integrations available with airSlate SignNow for the PT 701PU Annual Return For Taxation Railroad Equipment Car?

Yes, airSlate SignNow integrates seamlessly with various business applications, enhancing the workflow for the PT 701PU Annual Return For Taxation Railroad Equipment Car. Integrations with tools like CRM systems and accounting software allow for a more streamlined process. This connectivity ensures that all relevant data is easily accessible and manageable.

-

What are the benefits of using airSlate SignNow for the PT 701PU Annual Return For Taxation Railroad Equipment Car?

Using airSlate SignNow for the PT 701PU Annual Return For Taxation Railroad Equipment Car offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick document turnaround times, which is essential during tax season. Additionally, the secure eSignature feature ensures that your documents are legally binding and protected.

-

Is airSlate SignNow user-friendly for completing the PT 701PU Annual Return For Taxation Railroad Equipment Car?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete the PT 701PU Annual Return For Taxation Railroad Equipment Car. The intuitive interface guides users through the process, ensuring that even those with minimal technical skills can navigate the platform effectively. This accessibility helps businesses focus on their core operations without getting bogged down by paperwork.

Get more for PT 701PU Annual Return For Taxation Railroad Equipment Car

Find out other PT 701PU Annual Return For Taxation Railroad Equipment Car

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe