Form 4255 Rev December Fill in Capable Recapture of Investment Credit

What is the Form 4255 Rev December Fill In Capable Recapture Of Investment Credit

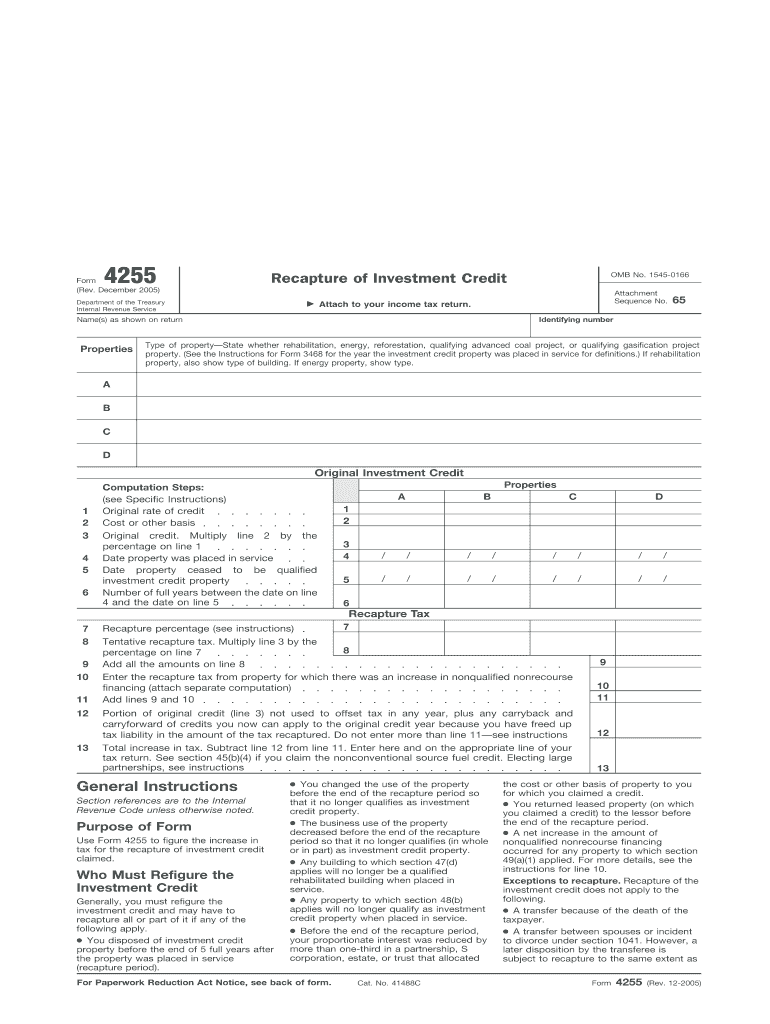

The Form 4255 Rev December is a tax form used by businesses and individuals in the United States to report the recapture of the investment credit. This form is essential for taxpayers who have previously claimed an investment credit and are now required to recapture that credit due to changes in the use of the property or other qualifying factors. The recapture can occur when the property is disposed of, or its use changes, leading to a reduction in the originally claimed credit. Understanding the purpose and requirements of this form is crucial for compliance with IRS regulations.

How to use the Form 4255 Rev December Fill In Capable Recapture Of Investment Credit

Using the Form 4255 Rev December involves several steps to ensure accurate reporting of the investment credit recapture. Taxpayers must first determine if they are required to recapture the credit based on their property usage. After confirming the need for recapture, the form should be filled out with the appropriate details, including the type of property, the original credit claimed, and the reason for recapture. It is important to follow the IRS instructions carefully to avoid errors that could lead to penalties or delays in processing.

Steps to complete the Form 4255 Rev December Fill In Capable Recapture Of Investment Credit

Completing the Form 4255 Rev December involves a systematic approach:

- Gather all relevant information regarding the property for which the investment credit was claimed.

- Review the IRS guidelines to determine the specific circumstances that require recapture.

- Fill in the form with accurate details, including the original credit amount and the date of property disposition or change in use.

- Calculate the recapture amount based on the IRS instructions provided with the form.

- Sign and date the form before submission.

Key elements of the Form 4255 Rev December Fill In Capable Recapture Of Investment Credit

Several key elements are critical when filling out the Form 4255 Rev December. These include:

- Identification of the taxpayer: Ensure that the taxpayer's name, address, and identification number are correctly entered.

- Property details: Provide comprehensive information about the property associated with the investment credit.

- Recapture calculation: Accurately calculate the recapture amount based on the guidelines provided by the IRS.

- Signature and date: The form must be signed and dated by the taxpayer or an authorized representative.

Filing Deadlines / Important Dates

Filing deadlines for the Form 4255 Rev December are crucial for compliance. Taxpayers must submit the form by the due date of their tax return for the year in which the recapture event occurred. If the form is not filed on time, taxpayers may face penalties or interest on unpaid taxes. It is advisable to check the IRS calendar for specific filing dates and ensure timely submission to avoid complications.

Penalties for Non-Compliance

Failure to comply with the requirements of the Form 4255 Rev December can result in significant penalties. Taxpayers who do not report the recapture of the investment credit may face fines and interest on any unpaid taxes. Additionally, the IRS may impose further penalties for inaccuracies or late submissions. Understanding these potential consequences emphasizes the importance of timely and accurate filing of this form.

Quick guide on how to complete form 4255 rev december fill in capable recapture of investment credit

Prepare [SKS] effortlessly on any device

Digital document management has surged in popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

The simplest method to modify and electronically sign [SKS] with ease

- Locate [SKS] and then click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Choose how you wish to deliver your form, whether by email, text message (SMS), invite link, or download it to your computer.

Put aside concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and electronically sign [SKS] and guarantee excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 4255 Rev December Fill In Capable Recapture Of Investment Credit

Create this form in 5 minutes!

How to create an eSignature for the form 4255 rev december fill in capable recapture of investment credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 4255 Rev December Fill In Capable Recapture Of Investment Credit?

The Form 4255 Rev December Fill In Capable Recapture Of Investment Credit is a tax form used by businesses to report the recapture of investment credits. This form is essential for ensuring compliance with IRS regulations when claiming investment credits. Understanding this form can help businesses avoid penalties and ensure accurate tax filings.

-

How can airSlate SignNow assist with the Form 4255 Rev December Fill In Capable Recapture Of Investment Credit?

airSlate SignNow provides an easy-to-use platform for businesses to fill out and eSign the Form 4255 Rev December Fill In Capable Recapture Of Investment Credit. Our solution streamlines the document management process, making it simple to complete and submit tax forms electronically. This efficiency can save time and reduce errors in your tax submissions.

-

What are the pricing options for using airSlate SignNow for Form 4255 Rev December Fill In Capable Recapture Of Investment Credit?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, including those requiring the Form 4255 Rev December Fill In Capable Recapture Of Investment Credit. Our plans are designed to be cost-effective, ensuring that businesses can access essential features without breaking the bank. You can choose a plan that best fits your volume of document management.

-

What features does airSlate SignNow offer for managing the Form 4255 Rev December Fill In Capable Recapture Of Investment Credit?

With airSlate SignNow, you can easily create, fill in, and eSign the Form 4255 Rev December Fill In Capable Recapture Of Investment Credit. Our platform includes features like templates, automated workflows, and secure storage, ensuring that your documents are handled efficiently. These features enhance productivity and ensure compliance with tax regulations.

-

Is airSlate SignNow secure for handling sensitive documents like the Form 4255 Rev December Fill In Capable Recapture Of Investment Credit?

Yes, airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive documents, including the Form 4255 Rev December Fill In Capable Recapture Of Investment Credit. Our platform is designed to keep your data safe while allowing for seamless document management. You can trust us to handle your important tax forms securely.

-

Can I integrate airSlate SignNow with other software for managing the Form 4255 Rev December Fill In Capable Recapture Of Investment Credit?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage the Form 4255 Rev December Fill In Capable Recapture Of Investment Credit alongside your existing tools. This integration capability enhances your workflow and ensures that all your documents are synchronized across platforms. You can streamline your processes effectively.

-

What benefits does airSlate SignNow provide for businesses needing the Form 4255 Rev December Fill In Capable Recapture Of Investment Credit?

Using airSlate SignNow for the Form 4255 Rev December Fill In Capable Recapture Of Investment Credit offers numerous benefits, including increased efficiency, reduced paperwork, and improved accuracy. Our platform simplifies the eSigning process, allowing for faster turnaround times on important documents. This can signNowly enhance your business operations and compliance efforts.

Get more for Form 4255 Rev December Fill In Capable Recapture Of Investment Credit

- Usaarl 02 u s army aeromedical research laboratory form

- Contrast sensitivity in army aviator candldates form

- Circadian rhythm desynchronosis jet lag form

- Age specific medical and nonmedical attrition rates form

- A comparison form

- Anvis objective lens depth of field form

- Air warrior aircrew restraint tether system ufdc image array 2 form

- Corneal hypoxia secondary to contact lenses the effect of form

Find out other Form 4255 Rev December Fill In Capable Recapture Of Investment Credit

- Sign Colorado Independent Contractor Agreement Template Simple

- How Can I Sign Florida Independent Contractor Agreement Template

- Sign Georgia Independent Contractor Agreement Template Fast

- Help Me With Sign Nevada Termination Letter Template

- How Can I Sign Michigan Independent Contractor Agreement Template

- Sign Montana Independent Contractor Agreement Template Simple

- Sign Vermont Independent Contractor Agreement Template Free

- Sign Wisconsin Termination Letter Template Free

- How To Sign Rhode Island Emergency Contact Form

- Can I Sign Utah Executive Summary Template

- Sign Washington Executive Summary Template Free

- Sign Connecticut New Hire Onboarding Mobile

- Help Me With Sign Wyoming CV Form Template

- Sign Mississippi New Hire Onboarding Simple

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now