Claim for Historic Barn Rehabilitation Credit and Employment Incentive Credit Names as Shown on Return New York State Department Form

Understanding the Claim For Historic Barn Rehabilitation Credit

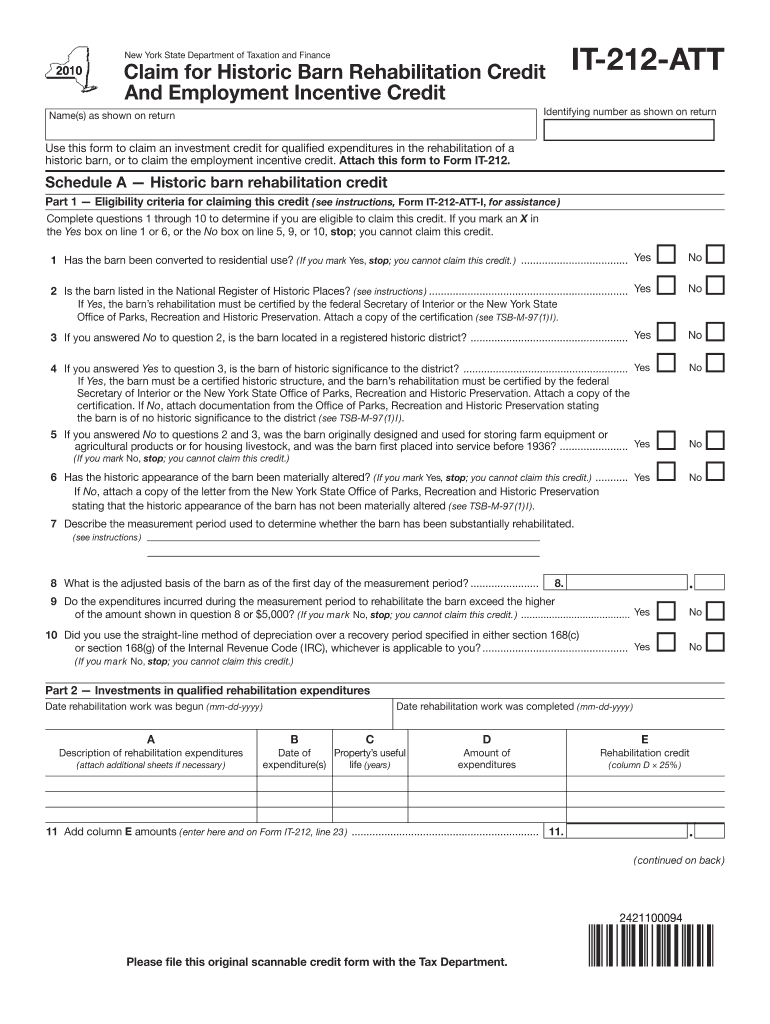

The Claim For Historic Barn Rehabilitation Credit and Employment Incentive Credit is a specific form issued by the New York State Department of Taxation and Finance. This form, known as IT-212 ATT, is designed for individuals and businesses seeking to claim tax credits related to the rehabilitation of historic barns and employment incentives. It is essential for taxpayers to accurately complete this form to ensure they receive the appropriate credits for their investments in historic properties and job creation efforts.

How to Use the Claim For Historic Barn Rehabilitation Credit

To effectively utilize the Claim For Historic Barn Rehabilitation Credit, individuals should first gather all necessary documentation related to their historic barn rehabilitation projects and employment incentives. This includes receipts, contracts, and any relevant tax identification numbers. Once all information is compiled, taxpayers can fill out the IT-212 ATT form, ensuring that each section is completed accurately to reflect the investments made. It is advisable to review the form for completeness before submission to avoid delays in processing.

Steps to Complete the Claim For Historic Barn Rehabilitation Credit

Completing the Claim For Historic Barn Rehabilitation Credit involves several key steps:

- Gather all relevant documents, including proof of expenses related to the rehabilitation and employment.

- Fill out the IT-212 ATT form, paying close attention to the identifying number and the names as shown on the return.

- Double-check all entries for accuracy and completeness.

- Submit the form either online, by mail, or in person, as per the guidelines provided by the New York State Department of Taxation and Finance.

Eligibility Criteria for the Claim For Historic Barn Rehabilitation Credit

Eligibility for the Claim For Historic Barn Rehabilitation Credit is determined by specific criteria set forth by the New York State Department of Taxation and Finance. Taxpayers must demonstrate that their barn rehabilitation projects meet the standards for historic preservation and that they have incurred eligible expenses. Additionally, businesses must show that they have created or retained jobs as part of their investment in the rehabilitation. Understanding these criteria is crucial for a successful claim.

Required Documents for Filing the Claim

When preparing to file the Claim For Historic Barn Rehabilitation Credit, it is important to gather the following documents:

- Receipts and invoices for all rehabilitation expenses.

- Documentation proving the historic status of the barn.

- Records of employment created or retained as a result of the rehabilitation.

- Tax identification numbers as required on the IT-212 ATT form.

Filing Deadlines for the Claim

Filing deadlines for the Claim For Historic Barn Rehabilitation Credit are critical to ensure that taxpayers do not miss out on potential credits. It is important to be aware of the specific dates set by the New York State Department of Taxation and Finance for submission of the IT-212 ATT form. Typically, these deadlines align with the annual tax filing season, so planning ahead is advisable to ensure timely submission.

Quick guide on how to complete claim for historic barn rehabilitation credit and employment incentive credit names as shown on return new york state

Effortlessly Prepare [SKS] on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary for you to create, modify, and electronically sign your documents swiftly without delays. Handle [SKS] across any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The Easiest Way to Edit and Electronically Sign [SKS] with Ease

- Find [SKS] and select Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of the documents or obscure confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to preserve your modifications.

- Choose your preferred method for delivering your form: via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements with just a few clicks from any device you prefer. Modify and eSign [SKS] while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Claim For Historic Barn Rehabilitation Credit And Employment Incentive Credit Names As Shown On Return New York State Department

Create this form in 5 minutes!

How to create an eSignature for the claim for historic barn rehabilitation credit and employment incentive credit names as shown on return new york state

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Claim For Historic Barn Rehabilitation Credit?

The Claim For Historic Barn Rehabilitation Credit is a tax incentive offered by the New York State Department of Taxation and Finance. It allows property owners to receive credits for rehabilitating historic barns, which can signNowly reduce tax liabilities. To claim this credit, you must use the IT 212 ATT form and provide the identifying number as shown on your return.

-

How can I apply for the Employment Incentive Credit?

To apply for the Employment Incentive Credit, you need to complete the Claim For Historic Barn Rehabilitation Credit And Employment Incentive Credit Names As Shown On Return New York State Department Of Taxation And Finance IT 212 ATT. This form requires specific information about your business and the employees you are claiming credits for, ensuring you maximize your potential benefits.

-

What information is required on the IT 212 ATT form?

The IT 212 ATT form requires detailed information including your identifying number as shown on your return, the nature of the investment, and the specific credits you are claiming. Accurate completion of this form is crucial to ensure your claim for the Historic Barn Rehabilitation Credit and Employment Incentive Credit is processed smoothly.

-

Are there any costs associated with filing the IT 212 ATT form?

Filing the IT 212 ATT form itself does not incur a fee; however, you may want to consider any costs associated with preparing your tax documents or hiring a tax professional. Utilizing airSlate SignNow can streamline the document signing process, making it a cost-effective solution for managing your claims and investments.

-

What are the benefits of using airSlate SignNow for my claims?

Using airSlate SignNow allows you to efficiently manage and eSign your documents related to the Claim For Historic Barn Rehabilitation Credit And Employment Incentive Credit. The platform is user-friendly and cost-effective, ensuring that you can complete your claims quickly and securely, enhancing your overall experience with the New York State Department of Taxation and Finance.

-

Can I integrate airSlate SignNow with other software for tax management?

Yes, airSlate SignNow offers integrations with various tax management and accounting software. This allows you to streamline your workflow when preparing to claim the Historic Barn Rehabilitation Credit and Employment Incentive Credit, ensuring all necessary documents are easily accessible and securely signed.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking. These features are particularly beneficial when preparing to submit your Claim For Historic Barn Rehabilitation Credit And Employment Incentive Credit, as they help ensure that all necessary documentation is in order and submitted on time.

Get more for Claim For Historic Barn Rehabilitation Credit And Employment Incentive Credit Names As Shown On Return New York State Department

- Oct03coverpages doc blm form

- Certain lands in the states of wyoming and nebraska for federal oil and gas leasing blm form

- 1004coverpages doc blm form

- Describes the time and place of the sale blm form

- We wish to announce that in accordance blm form

- How to file a noncompetitive offer after the sale blm form

- Describes blm form

- How the sale will be conducted blm form

Find out other Claim For Historic Barn Rehabilitation Credit And Employment Incentive Credit Names As Shown On Return New York State Department

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form