Credit for Prior Year Minimum Tax Form

What is the Credit For Prior Year Minimum Tax

The Credit For Prior Year Minimum Tax is a tax credit available to certain taxpayers who paid alternative minimum tax (AMT) in previous years. This credit allows eligible taxpayers to reduce their regular tax liability in future years by the amount of AMT they previously paid. It is designed to provide relief to those who may have been disproportionately impacted by the AMT system, ensuring that they do not face excessive tax burdens in subsequent years.

How to use the Credit For Prior Year Minimum Tax

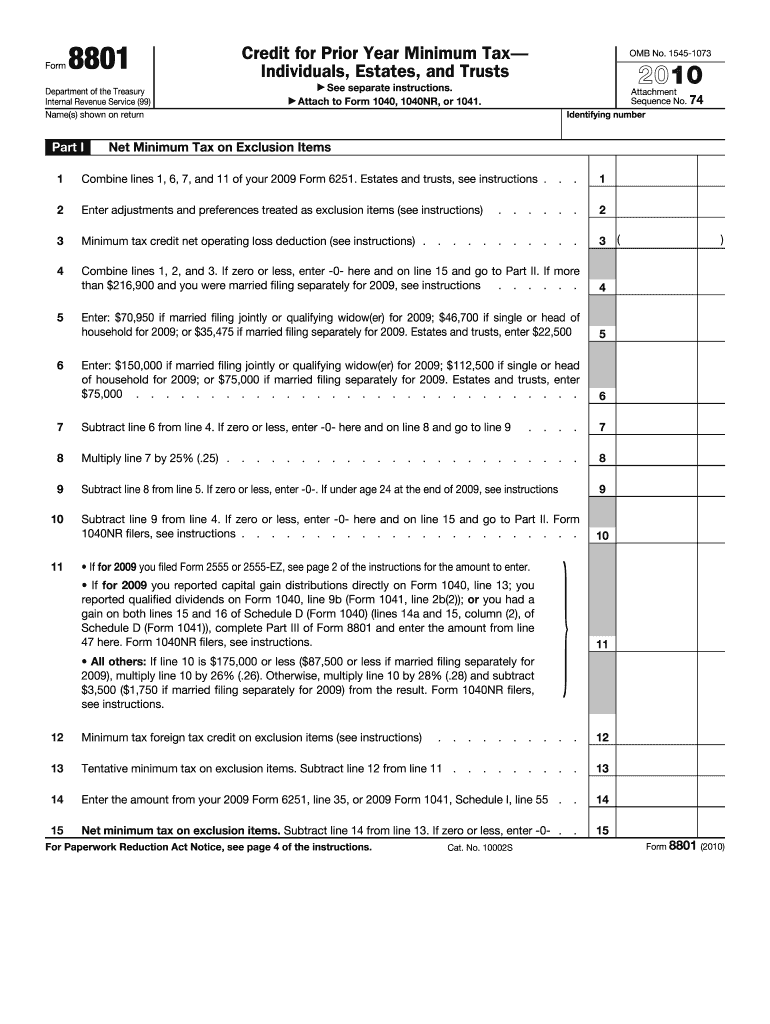

To utilize the Credit For Prior Year Minimum Tax, taxpayers must first determine their eligibility based on prior AMT payments. The credit can be claimed on Form 8801, which calculates the allowable credit based on the taxpayer's current tax situation. Taxpayers should ensure they have documentation of their prior AMT payments and any related tax returns to support their claim. Properly completing Form 8801 is essential to ensure the credit is accurately applied to their tax return.

Steps to complete the Credit For Prior Year Minimum Tax

Completing the Credit For Prior Year Minimum Tax involves several key steps:

- Gather documentation of prior AMT payments, including relevant tax returns.

- Obtain Form 8801 from the IRS website or a tax software program.

- Complete the form by entering your prior AMT amounts and current tax information.

- Calculate the allowable credit based on the instructions provided with Form 8801.

- Attach Form 8801 to your current year tax return when filing.

Eligibility Criteria

Eligibility for the Credit For Prior Year Minimum Tax typically requires that a taxpayer has paid AMT in a previous year and is subject to regular tax in the current year. Additionally, the credit is available to both individual and business taxpayers who meet specific income thresholds and tax filing requirements. It is important to review the IRS guidelines to confirm eligibility, as certain income limits and other factors may apply.

Required Documents

To successfully claim the Credit For Prior Year Minimum Tax, taxpayers should prepare the following documents:

- Copies of prior year tax returns showing AMT payments.

- Form 8801, which must be completed for the current tax year.

- Any supporting documentation that verifies income and deductions relevant to the AMT calculation.

IRS Guidelines

The IRS provides specific guidelines regarding the Credit For Prior Year Minimum Tax, detailing how to calculate the credit and the necessary forms to complete. Taxpayers should refer to the IRS instructions for Form 8801 to understand the eligibility requirements, calculation methods, and any changes to the tax code that may affect their claim. Staying informed about IRS updates ensures compliance and maximizes credit benefits.

Quick guide on how to complete credit for prior year minimum tax

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage [SKS] on any device with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign [SKS] seamlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiresome form searches, or errors that require the printing of new document copies. airSlate SignNow satisfies your document management needs with just a few clicks from any device of your choice. Modify and eSign [SKS] and guarantee outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Credit For Prior Year Minimum Tax

Create this form in 5 minutes!

How to create an eSignature for the credit for prior year minimum tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Credit For Prior Year Minimum Tax?

The Credit For Prior Year Minimum Tax is a tax credit that allows taxpayers to recover some of the minimum tax they paid in previous years. This credit can be beneficial for individuals who have faced alternative minimum tax (AMT) in prior tax years. Understanding this credit can help you maximize your tax benefits and reduce your overall tax liability.

-

How can airSlate SignNow help with the Credit For Prior Year Minimum Tax?

airSlate SignNow provides a streamlined solution for managing tax documents related to the Credit For Prior Year Minimum Tax. With our eSigning capabilities, you can quickly send and sign necessary forms, ensuring you meet all deadlines. This efficiency can save you time and reduce stress during tax season.

-

Is there a cost associated with using airSlate SignNow for tax documents?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Our cost-effective solutions ensure that you can manage your tax documents, including those related to the Credit For Prior Year Minimum Tax, without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking of document status. These features make it easier to manage tax documents related to the Credit For Prior Year Minimum Tax efficiently. Our platform is designed to simplify the eSigning process and enhance collaboration.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software. This integration allows you to manage documents related to the Credit For Prior Year Minimum Tax alongside your existing tools, streamlining your workflow and improving efficiency.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents offers numerous benefits, including increased efficiency, enhanced security, and reduced paper usage. By managing documents related to the Credit For Prior Year Minimum Tax electronically, you can ensure compliance and save valuable time during tax season. Our platform is user-friendly and designed for businesses of all sizes.

-

How secure is airSlate SignNow for handling sensitive tax documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your sensitive tax documents, including those related to the Credit For Prior Year Minimum Tax. You can trust that your information is safe and secure while using our platform.

Get more for Credit For Prior Year Minimum Tax

- Condition other than dishonorable gpo form

- Definition of qualified residential gpo form

- Proposed information collection should gpo

- Application is available at http gpo form

- Doe proposed rules u s government printing office gpo form

- Housing and urban development hud gpo form

- Except in the definition food stamp gpo form

- 35897 federal register vol form

Find out other Credit For Prior Year Minimum Tax

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement