OHIO ESTATE TAX RETURN and Allen County Auditor's Form

What is the Ohio Estate Tax Return and Allen County Auditor's?

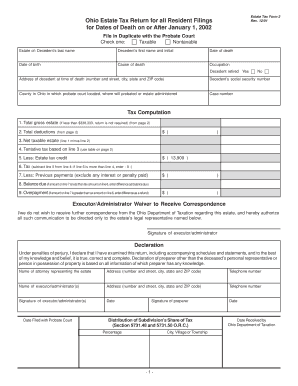

The Ohio Estate Tax Return is a legal document required for the assessment of estate taxes in the state of Ohio. This form is essential for individuals who have passed away and whose estates exceed the taxable threshold set by the state. The Allen County Auditor's Office is responsible for administering the estate tax process within Allen County, ensuring compliance with state laws and regulations.

This return provides detailed information about the deceased's assets, liabilities, and the overall value of the estate. It is crucial for heirs and executors to understand the implications of this form, as it directly affects the distribution of the estate and any taxes owed.

Steps to Complete the Ohio Estate Tax Return and Allen County Auditor's

Completing the Ohio Estate Tax Return involves several key steps:

- Gather necessary documentation, including the deceased's will, asset valuations, and any outstanding debts.

- Determine the total value of the estate, which includes real estate, personal property, and financial accounts.

- Complete the Ohio Estate Tax Return form accurately, ensuring all required fields are filled out.

- Submit the completed form to the Allen County Auditor's Office, along with any required supporting documents.

- Pay any estate taxes due by the specified deadline to avoid penalties.

Required Documents for the Ohio Estate Tax Return

To successfully file the Ohio Estate Tax Return, several documents are necessary:

- The deceased's death certificate.

- A copy of the will, if applicable.

- Documentation of all assets, including appraisals for real estate and personal property.

- Records of any debts or liabilities owed by the estate.

- Proof of any previous tax payments related to the estate.

Filing Deadlines for the Ohio Estate Tax Return

Filing deadlines for the Ohio Estate Tax Return are critical to ensure compliance and avoid penalties. Generally, the return must be filed within nine months of the date of death. If the deadline is missed, the estate may incur additional interest and penalties. It is advisable to check with the Allen County Auditor's Office for any specific local deadlines or extensions that may apply.

Legal Use of the Ohio Estate Tax Return

The Ohio Estate Tax Return serves a legal purpose in the administration of an estate. It ensures that estate taxes are calculated and paid in accordance with state laws. Failure to file this return can result in legal consequences for the executor or administrator of the estate, including potential fines or personal liability for unpaid taxes. Understanding the legal implications of this form is essential for those managing an estate.

Who Issues the Ohio Estate Tax Return?

The Ohio Estate Tax Return is issued by the Ohio Department of Taxation. However, the Allen County Auditor's Office plays a crucial role in the local administration of the estate tax process. They provide guidance on completing the return, offer resources for estate valuation, and ensure that all filings comply with state regulations. Executors and administrators should reach out to the Auditor's Office for assistance and clarification on any aspects of the process.

Quick guide on how to complete ohio estate tax return and allen county auditor39s

Complete [SKS] effortlessly on any device

Digital document management has become widespread among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the appropriate paperwork and securely keep it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents rapidly without delays. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The easiest way to modify and eSign [SKS] seamlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight essential sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced files, exhausting form searches, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure exceptional communication at any point of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ohio estate tax return and allen county auditor39s

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for filing an OHIO ESTATE TAX RETURN AND Allen County Auditor's?

Filing an OHIO ESTATE TAX RETURN AND Allen County Auditor's involves gathering necessary documentation, completing the required forms, and submitting them to the appropriate county office. It's essential to ensure all information is accurate to avoid delays. Utilizing airSlate SignNow can streamline this process by allowing you to eSign and send documents securely.

-

How much does it cost to file an OHIO ESTATE TAX RETURN AND Allen County Auditor's?

The cost of filing an OHIO ESTATE TAX RETURN AND Allen County Auditor's can vary based on the estate's value and any applicable fees. However, using airSlate SignNow provides a cost-effective solution for managing your documents, ensuring you can file efficiently without incurring unnecessary expenses.

-

What features does airSlate SignNow offer for OHIO ESTATE TAX RETURN AND Allen County Auditor's?

airSlate SignNow offers features such as document templates, eSignature capabilities, and secure cloud storage, all tailored to assist with your OHIO ESTATE TAX RETURN AND Allen County Auditor's needs. These tools simplify the document management process, making it easier to stay organized and compliant.

-

How can airSlate SignNow benefit my OHIO ESTATE TAX RETURN AND Allen County Auditor's filing?

Using airSlate SignNow can signNowly benefit your OHIO ESTATE TAX RETURN AND Allen County Auditor's filing by providing a user-friendly platform for document preparation and signing. This not only saves time but also enhances accuracy, reducing the likelihood of errors that could lead to complications.

-

Is airSlate SignNow compliant with Ohio state regulations for estate tax returns?

Yes, airSlate SignNow is designed to comply with Ohio state regulations, including those related to the OHIO ESTATE TAX RETURN AND Allen County Auditor's. Our platform ensures that all documents meet legal standards, providing peace of mind as you navigate the filing process.

-

Can I integrate airSlate SignNow with other tools for my OHIO ESTATE TAX RETURN AND Allen County Auditor's?

Absolutely! airSlate SignNow offers integrations with various tools and software that can enhance your workflow for the OHIO ESTATE TAX RETURN AND Allen County Auditor's. This allows you to connect your existing systems and streamline your document management processes.

-

What support does airSlate SignNow provide for OHIO ESTATE TAX RETURN AND Allen County Auditor's users?

airSlate SignNow provides comprehensive support for users dealing with OHIO ESTATE TAX RETURN AND Allen County Auditor's. Our customer service team is available to assist with any questions or issues you may encounter, ensuring you have the resources needed for a smooth filing experience.

Get more for OHIO ESTATE TAX RETURN AND Allen County Auditor's

- Influenza pediatric death nc dph epidemiology epi publichealth nc form

- Leptospirosis nc dph epidemiology epi publichealth nc form

- Listeriosis epidemiology in north carolina epi publichealth nc form

- Lyme disease nc dph epidemiology epi publichealth nc form

- Meningococcal disease invasive epi publichealth nc form

- Meningitis pneumococcal nc dph epidemiology epi publichealth nc form

- Monkeypox nc dph epidemiology epi publichealth nc form

- Plague nc dph epidemiology epi publichealth nc form

Find out other OHIO ESTATE TAX RETURN AND Allen County Auditor's

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple