85A Third Quarter Gasoline Form Kansas Department of Revenue Ksrevenue

What is the 85A Third Quarter Gasoline Form?

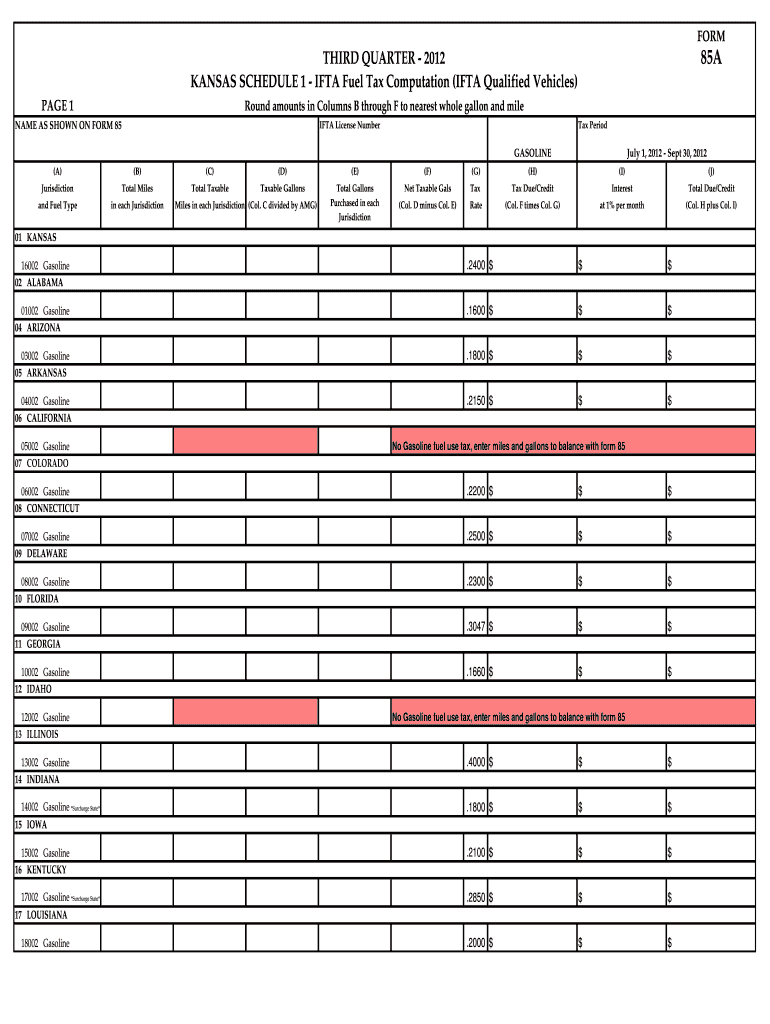

The 85A Third Quarter Gasoline Form is a document issued by the Kansas Department of Revenue that is specifically designed for reporting gasoline sales and usage for the third quarter of the fiscal year. This form is essential for businesses involved in the sale or distribution of gasoline within Kansas, as it helps ensure compliance with state tax regulations. The information collected through this form is used to calculate the appropriate taxes owed on gasoline sales and to monitor fuel consumption patterns within the state.

How to Use the 85A Third Quarter Gasoline Form

Using the 85A Third Quarter Gasoline Form requires careful attention to detail. Businesses must accurately report their gasoline sales and any applicable exemptions. Each section of the form corresponds to specific data points, such as total gallons sold, tax rates, and any credits claimed. It is important to follow the instructions provided with the form to ensure all information is submitted correctly. Accurate completion of the form helps prevent potential penalties and ensures compliance with Kansas tax laws.

Steps to Complete the 85A Third Quarter Gasoline Form

Completing the 85A Third Quarter Gasoline Form involves several key steps:

- Gather all relevant sales records for the third quarter, including invoices and receipts.

- Calculate the total gallons of gasoline sold during the reporting period.

- Determine the applicable tax rates and any exemptions that may apply.

- Fill out the form, ensuring that all sections are completed accurately.

- Review the completed form for any errors or omissions before submission.

Filing Deadlines / Important Dates

It is crucial for businesses to be aware of the filing deadlines associated with the 85A Third Quarter Gasoline Form. Typically, the form must be submitted by a specific date following the end of the third quarter. Missing this deadline can result in penalties or interest charges on any taxes owed. Businesses should check the Kansas Department of Revenue's website or contact their office for the exact dates and any updates regarding filing requirements.

Required Documents

When completing the 85A Third Quarter Gasoline Form, businesses should have several documents on hand to support their claims. These may include:

- Invoices and receipts for gasoline purchases and sales.

- Records of any tax-exempt sales.

- Previous filings, if applicable, for reference.

Having these documents ready can streamline the process of completing the form and ensure that all information provided is accurate and verifiable.

Penalties for Non-Compliance

Failure to comply with the requirements of the 85A Third Quarter Gasoline Form can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential for businesses to understand their obligations and ensure timely and accurate submissions to avoid these consequences. Regular training and updates on compliance can help mitigate risks associated with non-compliance.

Quick guide on how to complete 85a third quarter gasoline form kansas department of revenue ksrevenue

Complete [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitution for traditional printed and signed documents, as you can easily find the correct template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without any holdups. Manage [SKS] on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The easiest way to edit and eSign [SKS] without hassle

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that require printing new copies of documents. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] and ensure exceptional communication throughout your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 85A Third Quarter Gasoline Form Kansas Department Of Revenue Ksrevenue

Create this form in 5 minutes!

How to create an eSignature for the 85a third quarter gasoline form kansas department of revenue ksrevenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 85A Third Quarter Gasoline Form Kansas Department Of Revenue Ksrevenue?

The 85A Third Quarter Gasoline Form Kansas Department Of Revenue Ksrevenue is a document required for reporting gasoline sales and usage in Kansas. It helps businesses comply with state regulations and ensures accurate tax reporting. Completing this form is essential for maintaining good standing with the Kansas Department of Revenue.

-

How can airSlate SignNow help with the 85A Third Quarter Gasoline Form Kansas Department Of Revenue Ksrevenue?

airSlate SignNow provides an easy-to-use platform for businesses to complete and eSign the 85A Third Quarter Gasoline Form Kansas Department Of Revenue Ksrevenue. Our solution streamlines the document management process, making it faster and more efficient. You can easily send, sign, and store your forms securely.

-

What are the pricing options for using airSlate SignNow for the 85A Third Quarter Gasoline Form Kansas Department Of Revenue Ksrevenue?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. You can choose from monthly or annual subscriptions, with options that provide access to features specifically designed for managing forms like the 85A Third Quarter Gasoline Form Kansas Department Of Revenue Ksrevenue. Visit our pricing page for detailed information.

-

Are there any integrations available for the 85A Third Quarter Gasoline Form Kansas Department Of Revenue Ksrevenue?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance your workflow. You can connect with popular tools like Google Drive, Dropbox, and CRM systems to manage the 85A Third Quarter Gasoline Form Kansas Department Of Revenue Ksrevenue more effectively. These integrations help streamline your document processes.

-

What features does airSlate SignNow offer for the 85A Third Quarter Gasoline Form Kansas Department Of Revenue Ksrevenue?

airSlate SignNow offers a range of features tailored for the 85A Third Quarter Gasoline Form Kansas Department Of Revenue Ksrevenue, including customizable templates, secure eSigning, and real-time tracking. These features ensure that your documents are completed accurately and efficiently. Additionally, our platform provides audit trails for compliance purposes.

-

How secure is the airSlate SignNow platform for handling the 85A Third Quarter Gasoline Form Kansas Department Of Revenue Ksrevenue?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and security protocols to protect your data while handling the 85A Third Quarter Gasoline Form Kansas Department Of Revenue Ksrevenue. You can trust that your sensitive information is safe and compliant with industry standards.

-

Can I access the 85A Third Quarter Gasoline Form Kansas Department Of Revenue Ksrevenue on mobile devices?

Absolutely! airSlate SignNow is designed to be mobile-friendly, allowing you to access and manage the 85A Third Quarter Gasoline Form Kansas Department Of Revenue Ksrevenue from your smartphone or tablet. This flexibility ensures that you can complete your documents anytime, anywhere, enhancing your productivity.

Get more for 85A Third Quarter Gasoline Form Kansas Department Of Revenue Ksrevenue

- Dsscd travel policy missouri department of social services form

- Missouri task force on chilren39s justice missouri department of dss mo form

- Cd06 97 child care services for childrens division cases form

- Cd06 95 new termination of parental rights forms dss mo

- Application for agency eligibility verification missouri department form

- Cd memo 32 revised and new child care subsidy forms dss mo

- Dear you are eligible for temporary mo healthnet based upon your form

- Pregnancy resource center tax credit form

Find out other 85A Third Quarter Gasoline Form Kansas Department Of Revenue Ksrevenue

- How Do I Electronic signature Nevada Stock Transfer Form Template

- Electronic signature Virginia Stock Transfer Form Template Secure

- How Do I Electronic signature Colorado Promissory Note Template

- Can I Electronic signature Florida Promissory Note Template

- How To Electronic signature Hawaii Promissory Note Template

- Electronic signature Indiana Promissory Note Template Now

- Electronic signature Kansas Promissory Note Template Online

- Can I Electronic signature Louisiana Promissory Note Template

- Electronic signature Rhode Island Promissory Note Template Safe

- How To Electronic signature Texas Promissory Note Template

- Electronic signature Wyoming Indemnity Agreement Template Free

- Electronic signature Iowa Bookkeeping Contract Safe

- Electronic signature New York Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Computer

- Electronic signature South Carolina Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Easy

- How To Electronic signature South Carolina Bookkeeping Contract

- How Do I eSignature Arkansas Medical Records Release

- How Do I eSignature Iowa Medical Records Release

- Electronic signature Texas Internship Contract Safe