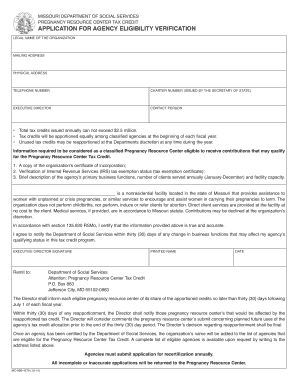

PRegnAnCy ReSOuRCe CenTeR TAx CReDiT Form

Understanding the Pregnancy Resource Center Tax Credit

The Pregnancy Resource Center Tax Credit is a financial incentive designed to support organizations that provide essential services to pregnant women and families. This credit aims to encourage donations and contributions to these centers, which often offer counseling, medical assistance, and educational resources. By providing this tax credit, the government seeks to promote the well-being of mothers and their children, ensuring they have access to necessary support during pregnancy and beyond.

Eligibility Criteria for the Pregnancy Resource Center Tax Credit

To qualify for the Pregnancy Resource Center Tax Credit, both the donor and the organization must meet specific criteria. Donors must be individuals or businesses that contribute to a qualified pregnancy resource center recognized by the state. The centers themselves must provide services that align with the objectives of the tax credit, such as pregnancy testing, counseling, and parenting classes. Additionally, the centers must be registered and compliant with state regulations to ensure they are operating within the legal framework.

Steps to Claim the Pregnancy Resource Center Tax Credit

Claiming the Pregnancy Resource Center Tax Credit involves several straightforward steps. First, donors should ensure their contributions are made to a qualified center. Next, they must obtain a receipt or acknowledgment from the center confirming the donation amount. When filing taxes, donors can then complete the appropriate tax forms, including any necessary schedules that detail the contributions made. It is essential to keep all documentation for future reference and potential audits.

Required Documents for the Pregnancy Resource Center Tax Credit

When applying for the Pregnancy Resource Center Tax Credit, certain documents are necessary to substantiate the claim. Donors should retain the following:

- A receipt or acknowledgment letter from the pregnancy resource center.

- Tax forms that reflect the donation, such as the state tax return.

- Any additional documentation that may be required by state tax authorities.

Having these documents organized will facilitate a smoother filing process and help ensure compliance with tax regulations.

Filing Deadlines for the Pregnancy Resource Center Tax Credit

Filing deadlines for claiming the Pregnancy Resource Center Tax Credit coincide with standard tax filing dates. Typically, individual and business tax returns are due by April fifteenth of each year. However, it is crucial to verify specific state deadlines, as they may vary. Taxpayers should plan ahead to ensure all necessary documentation is gathered and submitted on time to avoid penalties or missed opportunities for claiming the credit.

IRS Guidelines for the Pregnancy Resource Center Tax Credit

The Internal Revenue Service (IRS) provides guidelines for claiming tax credits, including the Pregnancy Resource Center Tax Credit. Taxpayers should refer to the IRS publications relevant to charitable contributions and tax credits. These guidelines outline eligibility, documentation requirements, and how to report the credit on tax returns. Staying informed about IRS regulations helps ensure compliance and maximizes the benefits of available tax credits.

Quick guide on how to complete pregnancy resource center tax credit

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, enabling you to access the necessary forms and securely save them online. airSlate SignNow provides all the tools you need to swiftly create, modify, and electronically sign your documents without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to Modify and eSign [SKS] with Ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or obscure confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes requiring the printing of new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your preferred device. Modify and eSign [SKS] to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to PRegnAnCy ReSOuRCe CenTeR TAx CReDiT

Create this form in 5 minutes!

How to create an eSignature for the pregnancy resource center tax credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PRegnAnCy ReSOuRCe CenTeR TAx CReDiT?

The PRegnAnCy ReSOuRCe CenTeR TAx CReDiT is a financial benefit designed to support families during pregnancy. It provides eligible individuals with tax credits that can help alleviate some of the costs associated with pregnancy and childbirth. Understanding this credit can signNowly ease financial burdens for expecting parents.

-

How can I apply for the PRegnAnCy ReSOuRCe CenTeR TAx CReDiT?

To apply for the PRegnAnCy ReSOuRCe CenTeR TAx CReDiT, you need to complete the necessary tax forms during your tax filing process. Ensure you have all required documentation, such as proof of pregnancy and income statements. Consulting a tax professional can also help streamline your application.

-

What are the eligibility requirements for the PRegnAnCy ReSOuRCe CenTeR TAx CReDiT?

Eligibility for the PRegnAnCy ReSOuRCe CenTeR TAx CReDiT typically includes being a resident of the state offering the credit and meeting specific income thresholds. Additionally, you must provide documentation proving your pregnancy status. It's essential to check local regulations for detailed requirements.

-

What benefits does the PRegnAnCy ReSOuRCe CenTeR TAx CReDiT offer?

The PRegnAnCy ReSOuRCe CenTeR TAx CReDiT offers signNow financial relief by reducing your overall tax liability. This credit can help cover medical expenses, prenatal care, and other costs associated with pregnancy. Utilizing this credit can lead to substantial savings for expecting families.

-

Is the PRegnAnCy ReSOuRCe CenTeR TAx CReDiT available in all states?

The availability of the PRegnAnCy ReSOuRCe CenTeR TAx CReDiT varies by state, as each state has its own tax laws and credits. It's important to check with your state's tax authority to determine if this credit is offered and what the specific requirements are. Some states may have similar programs with different names.

-

How does the PRegnAnCy ReSOuRCe CenTeR TAx CReDiT impact my overall tax return?

Claiming the PRegnAnCy ReSOuRCe CenTeR TAx CReDiT can positively impact your overall tax return by lowering your taxable income. This reduction can lead to a larger refund or a smaller tax bill. It's a valuable resource for families looking to maximize their tax benefits during pregnancy.

-

Can I combine the PRegnAnCy ReSOuRCe CenTeR TAx CReDiT with other tax credits?

Yes, you can often combine the PRegnAnCy ReSOuRCe CenTeR TAx CReDiT with other tax credits, depending on your eligibility. This can enhance your overall tax savings and provide additional financial support. Always consult a tax professional to ensure compliance and maximize your benefits.

Get more for PRegnAnCy ReSOuRCe CenTeR TAx CReDiT

- Job application for township of edison edison new jersey edisonnj form

- P3 network vessel sharing agreement www2 fmc form

- Bapplicationb for residential hydro service lakeland power lakelandpower on form

- Special needs reg bakercountyfl form

- Florida form 2 2015 2019

- Motheramp39s birth certificate worksheet mylearningpointe form

- Poc approval form

- 1240 catering notification form 201108 agco on

Find out other PRegnAnCy ReSOuRCe CenTeR TAx CReDiT

- How Do I Sign California Stock Transfer Form Template

- How Can I Sign North Carolina Indemnity Agreement Template

- How Do I Sign Delaware Stock Transfer Form Template

- Help Me With Sign Texas Stock Purchase Agreement Template

- Help Me With Sign Nevada Stock Transfer Form Template

- Can I Sign South Carolina Stock Transfer Form Template

- How Can I Sign Michigan Promissory Note Template

- Sign New Mexico Promissory Note Template Now

- Sign Indiana Basketball Registration Form Now

- Sign Iowa Gym Membership Agreement Later

- Can I Sign Michigan Gym Membership Agreement

- Sign Colorado Safety Contract Safe

- Sign North Carolina Safety Contract Later

- Sign Arkansas Application for University Free

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template