FORM MARYLAND Please Print Using Blue or Black Ink 500JR Job Creation and Recovery Tax Credit for Fiscal Year Beginning Ending T

Understanding the FORM MARYLAND 500JR Job Creation and Recovery Tax Credit

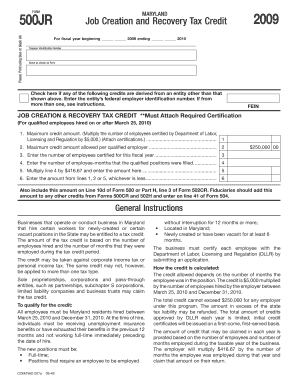

The FORM MARYLAND 500JR is designed for taxpayers seeking to claim the Job Creation and Recovery Tax Credit. This credit is available for businesses that create jobs or retain employees during specified fiscal years. The form requires essential information such as the taxpayer identification number and the name as shown on the form. It is crucial to provide accurate details to ensure eligibility for the tax credit. The form also includes a section where taxpayers can check if they qualify for any additional credits, which can further enhance their tax benefits.

Steps to Complete the FORM MARYLAND 500JR

Completing the FORM MARYLAND 500JR involves several key steps:

- Begin by downloading the form from the official Maryland state website or obtaining a physical copy.

- Fill in your taxpayer identification number accurately, ensuring it matches the records held by the IRS.

- Enter your name exactly as it appears on your tax documents.

- Indicate the fiscal year for which you are claiming the credit.

- Check the appropriate boxes to confirm any additional credits you may qualify for.

- Review the completed form for accuracy before submission.

Eligibility Criteria for the Job Creation and Recovery Tax Credit

To qualify for the Job Creation and Recovery Tax Credit, businesses must meet specific eligibility criteria. These include:

- Creating or retaining a minimum number of full-time jobs during the specified fiscal year.

- Maintaining compliance with all state and federal tax regulations.

- Filing the FORM MARYLAND 500JR within the designated timeframe.

It is essential for businesses to review these criteria thoroughly to ensure they meet all requirements before applying for the credit.

Form Submission Methods for the FORM MARYLAND 500JR

The FORM MARYLAND 500JR can be submitted through various methods:

- Online submission via the Maryland state tax portal, if available.

- Mailing the completed form to the appropriate tax office as indicated on the form.

- In-person submission at designated tax offices, which may provide immediate assistance.

Choosing the right submission method can help ensure timely processing of your tax credit application.

Required Documents for Filing the FORM MARYLAND 500JR

When filing the FORM MARYLAND 500JR, certain documents may be required to substantiate your claim. These documents typically include:

- Proof of employment for the jobs created or retained, such as payroll records.

- Tax returns from the fiscal year in question to verify income and tax obligations.

- Any additional documentation that supports your eligibility for the tax credit.

Gathering these documents in advance can streamline the filing process and help avoid delays.

Common Mistakes to Avoid When Filling Out the FORM MARYLAND 500JR

To ensure a successful application for the Job Creation and Recovery Tax Credit, it is important to avoid common mistakes, such as:

- Providing incorrect taxpayer identification numbers, which can lead to processing delays.

- Failing to check the boxes for additional credits, potentially missing out on benefits.

- Submitting the form after the deadline, which can result in disqualification.

By paying attention to these details, taxpayers can enhance their chances of a successful application.

Quick guide on how to complete form maryland please print using blue or black ink 500jr job creation and recovery tax credit for fiscal year beginning ending

Complete [SKS] effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign [SKS] with little effort

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the stress of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from a device of your preference. Edit and eSign [SKS] and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to FORM MARYLAND Please Print Using Blue Or Black Ink 500JR Job Creation And Recovery Tax Credit For Fiscal Year Beginning Ending T

Create this form in 5 minutes!

How to create an eSignature for the form maryland please print using blue or black ink 500jr job creation and recovery tax credit for fiscal year beginning ending

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the FORM MARYLAND Please Print Using Blue Or Black Ink 500JR Job Creation And Recovery Tax Credit?

The FORM MARYLAND Please Print Using Blue Or Black Ink 500JR Job Creation And Recovery Tax Credit is designed to provide tax relief to eligible businesses. It allows businesses to claim credits that can signNowly reduce their tax liabilities for the fiscal year. Understanding how to fill out this form correctly is crucial for maximizing your benefits.

-

How do I fill out the FORM MARYLAND Please Print Using Blue Or Black Ink 500JR?

To fill out the FORM MARYLAND Please Print Using Blue Or Black Ink 500JR, ensure you provide accurate information as shown on your taxpayer identification number. Use blue or black ink for clarity and legibility. Follow the instructions carefully to check any applicable credits that may apply to your situation.

-

What are the benefits of using airSlate SignNow for submitting the FORM MARYLAND?

Using airSlate SignNow to submit the FORM MARYLAND Please Print Using Blue Or Black Ink 500JR offers several benefits, including ease of use and secure eSigning capabilities. Our platform streamlines the document submission process, ensuring that your forms are completed accurately and submitted on time. This can help you avoid potential delays in receiving your tax credits.

-

Is there a cost associated with using airSlate SignNow for the FORM MARYLAND?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses. Our pricing plans are flexible and cater to various needs, ensuring that you get the best value for your investment. By using our service, you can save time and resources when handling the FORM MARYLAND Please Print Using Blue Or Black Ink 500JR.

-

Can I integrate airSlate SignNow with other software for managing the FORM MARYLAND?

Absolutely! airSlate SignNow offers integrations with various software solutions, allowing you to manage the FORM MARYLAND Please Print Using Blue Or Black Ink 500JR seamlessly. This integration capability enhances your workflow and ensures that all your documents are organized and easily accessible. Check our integration options to find the best fit for your business.

-

What features does airSlate SignNow provide for handling tax credit forms?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for handling tax credit forms like the FORM MARYLAND Please Print Using Blue Or Black Ink 500JR. These features help ensure that your forms are completed accurately and submitted efficiently, reducing the risk of errors and delays.

-

How can I ensure my FORM MARYLAND is submitted on time?

To ensure your FORM MARYLAND Please Print Using Blue Or Black Ink 500JR is submitted on time, utilize airSlate SignNow's reminders and tracking features. These tools help you stay organized and alert you to deadlines, ensuring that you complete and submit your forms promptly. Timely submission is crucial for receiving your tax credits without any issues.

Get more for FORM MARYLAND Please Print Using Blue Or Black Ink 500JR Job Creation And Recovery Tax Credit For Fiscal Year Beginning Ending T

- Nyu gi seminars broch2006 school of medicine new york med nyu form

- 3041 banff brochure nyu langone medical center new med nyu form

- Reservation form nyu radiology cme june 23 to july 2 med nyu

- Sagamore registration form doc med nyu

- Request for proposal consultant to provide a cost nj form

- Report annual report nj form

- Dr roman v yampolskiy computer science speed school university of form

- Scdhhs idea part c policy for early intervention services form

Find out other FORM MARYLAND Please Print Using Blue Or Black Ink 500JR Job Creation And Recovery Tax Credit For Fiscal Year Beginning Ending T

- How To Sign Iowa Christmas Bonus Letter

- How To Sign Nevada Christmas Bonus Letter

- Sign New Jersey Promotion Announcement Simple

- Sign Louisiana Company Bonus Letter Safe

- How To Sign Delaware Letter of Appreciation to Employee

- How To Sign Florida Letter of Appreciation to Employee

- How Do I Sign New Jersey Letter of Appreciation to Employee

- How Do I Sign Delaware Direct Deposit Enrollment Form

- How To Sign Alabama Employee Emergency Notification Form

- How To Sign Oklahoma Direct Deposit Enrollment Form

- Sign Wyoming Direct Deposit Enrollment Form Online

- Sign Nebraska Employee Suggestion Form Now

- How Can I Sign New Jersey Employee Suggestion Form

- Can I Sign New York Employee Suggestion Form

- Sign Michigan Overtime Authorization Form Mobile

- How To Sign Alabama Payroll Deduction Authorization

- How To Sign California Payroll Deduction Authorization

- How To Sign Utah Employee Emergency Notification Form

- Sign Maine Payroll Deduction Authorization Simple

- How To Sign Nebraska Payroll Deduction Authorization