Schedule D 2018

What is the Schedule D

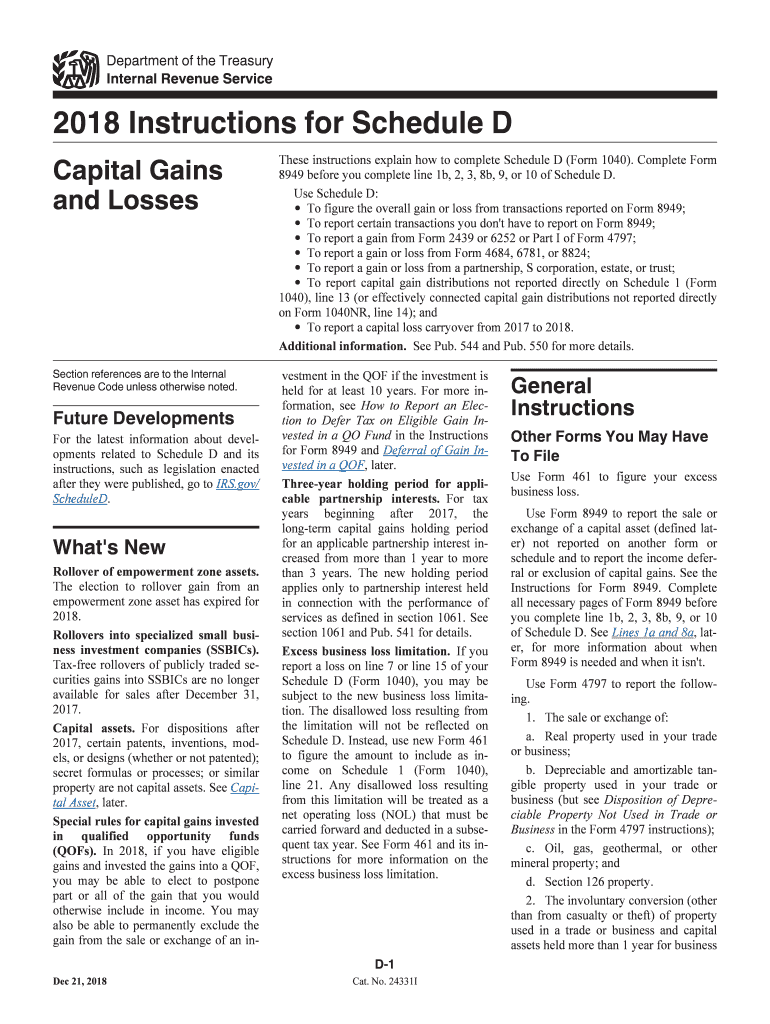

The IRS Schedule D form is a critical document used for reporting capital gains and losses from the sale of securities, real estate, and other assets. It is typically filed alongside Form 1040, the individual income tax return. The information provided on Schedule D helps the IRS assess the taxpayer's overall tax liability by summarizing transactions involving capital assets. Understanding this form is essential for individuals and businesses engaged in investment activities, as it directly impacts tax obligations.

How to use the Schedule D

To effectively use the Schedule D form, taxpayers must first gather all relevant information regarding their capital gains and losses. This includes details about the purchase and sale of assets, such as dates, amounts, and any associated costs. The form consists of two main sections: one for reporting short-term capital gains and losses, and another for long-term capital gains and losses. Taxpayers must complete both sections accurately to ensure correct reporting to the IRS.

Steps to complete the Schedule D

Completing the Schedule D form involves several key steps:

- Gather all necessary documents, including transaction records for assets sold during the tax year.

- Determine whether each transaction results in a short-term or long-term gain or loss based on the holding period of the asset.

- Fill out the short-term section first, listing each transaction and calculating total gains and losses.

- Proceed to the long-term section, repeating the process for those transactions.

- Transfer the totals from both sections to the appropriate lines on Form 1040.

Legal use of the Schedule D

The Schedule D form is legally recognized as a means for taxpayers to report capital gains and losses to the IRS. To ensure compliance, it is essential to provide accurate information and maintain proper documentation for all reported transactions. Failure to do so may result in penalties or audits. Utilizing digital tools for completing and submitting the form can enhance accuracy and security, helping to meet legal requirements effectively.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Schedule D form. Typically, the deadline for submitting Form 1040, along with Schedule D, is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers should consider any applicable extensions, which can provide additional time for filing but do not extend the time for payment of taxes owed.

Required Documents

To complete the Schedule D form accurately, taxpayers need several key documents, including:

- Transaction records for all capital assets sold during the tax year.

- Brokerage statements that detail sales and purchases of securities.

- Any documentation related to the cost basis of assets, including purchase receipts and records of improvements made to real estate.

Form Submission Methods (Online / Mail / In-Person)

The Schedule D form can be submitted in various ways, depending on the taxpayer's preference. Options include:

- Online filing through tax preparation software, which often simplifies the process and ensures accuracy.

- Mailing a paper copy of the completed form along with Form 1040 to the appropriate IRS address.

- In-person submission at designated IRS offices, although this method may require an appointment.

Quick guide on how to complete d instructions 2018 2019 form

Effortlessly Prepare Schedule D on Any Device

The management of online documents has become increasingly favored by businesses and individuals alike. It serves as a perfect eco-friendly alternative to traditional printed and signed contracts, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary for you to create, modify, and electronically sign your documents quickly without delays. Manage Schedule D on any device using the airSlate SignNow apps for Android or iOS, and simplify any document-related workflow today.

How to Modify and Electronically Sign Schedule D with Ease

- Locate Schedule D and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all details and click on the Done button to preserve your modifications.

- Select your preferred method to submit your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Alter and electronically sign Schedule D and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct d instructions 2018 2019 form

Create this form in 5 minutes!

How to create an eSignature for the d instructions 2018 2019 form

How to generate an electronic signature for the D Instructions 2018 2019 Form in the online mode

How to generate an electronic signature for your D Instructions 2018 2019 Form in Chrome

How to generate an electronic signature for signing the D Instructions 2018 2019 Form in Gmail

How to generate an electronic signature for the D Instructions 2018 2019 Form straight from your smart phone

How to create an eSignature for the D Instructions 2018 2019 Form on iOS devices

How to generate an eSignature for the D Instructions 2018 2019 Form on Android OS

People also ask

-

What is Schedule D and how does it relate to airSlate SignNow?

Schedule D is a tax form used to report capital gains and losses. With airSlate SignNow, you can easily eSign and securely send your Schedule D documents, streamlining your tax filing process. Our platform ensures that your important documents are handled efficiently and securely.

-

How can airSlate SignNow help me complete my Schedule D?

airSlate SignNow simplifies the process of completing your Schedule D by allowing you to fill out and eSign the form online. Our user-friendly interface makes it easy to input your financial data, ensuring that your Schedule D is accurate and ready for submission.

-

What features does airSlate SignNow offer for managing Schedule D documents?

airSlate SignNow offers a range of features for managing Schedule D documents, including customizable templates, cloud storage, and real-time tracking of eSigned documents. These features help you stay organized and ensure that your Schedule D is processed smoothly.

-

Is airSlate SignNow cost-effective for filing Schedule D?

Yes, airSlate SignNow is a cost-effective solution for filing your Schedule D. Our subscription plans are designed to fit various budgets, allowing you to manage your eSigning needs without breaking the bank. Plus, the time saved in document handling can lead to additional financial benefits.

-

Can I integrate airSlate SignNow with my accounting software for Schedule D?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, allowing you to manage your Schedule D alongside your financial records. This integration helps streamline your workflow and ensures consistency across your documents.

-

What security measures does airSlate SignNow have for Schedule D documents?

airSlate SignNow takes security seriously, especially for sensitive documents like your Schedule D. Our platform employs advanced encryption and secure cloud storage, ensuring that your information remains confidential and protected from unauthorized access.

-

How do I get started with airSlate SignNow for my Schedule D needs?

Getting started with airSlate SignNow for your Schedule D is easy! Simply sign up for an account, choose the plan that suits your needs, and start uploading your documents. Our intuitive platform will guide you through the process of eSigning and managing your Schedule D.

Get more for Schedule D

- Basketball scouting report template form

- Basketball player evaluation form

- Changes customer address form

- Ukc duplicate papers form

- Form 168 proof of eligible service form omers

- John wayne airport badge application form

- Contracting request form medical provider bluecross blueshield of arizona 2013

- Bcbsaz contract application submitter form

Find out other Schedule D

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later