Et 141 2015-2026

What is the ET 141?

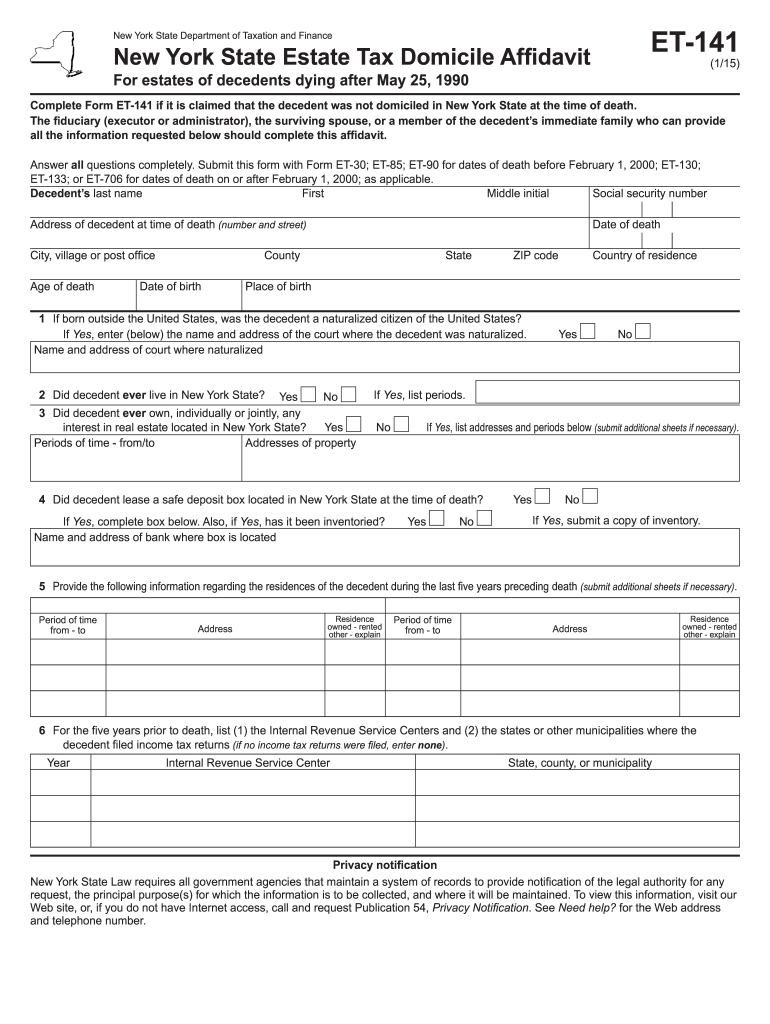

The ET 141 is a New York State form used for estate tax purposes. It serves as a declaration of the domicile of the decedent and is essential for determining the estate's tax obligations. This form helps establish whether the estate is subject to New York State estate tax based on the decedent's residence at the time of death. Understanding the ET 141 is crucial for executors and administrators managing the estate, as it outlines the necessary information regarding the decedent's residency and estate valuation.

Steps to Complete the ET 141

Completing the ET 141 involves several key steps to ensure accuracy and compliance with state regulations. Begin by gathering all necessary information about the decedent, including their full name, date of birth, and date of death. Next, provide details regarding the decedent's residency, including the address of their primary residence and any other locations where they maintained a presence. Ensure that all sections of the form are filled out completely, and double-check for any required signatures. Once completed, the form should be submitted as part of the estate tax filing process.

How to Obtain the ET 141

The ET 141 form can be obtained through the New York State Department of Taxation and Finance website. It is available for download in PDF format, allowing individuals to print and fill it out manually. Alternatively, some tax preparation software may offer the ET 141 as part of their estate tax filing packages. It is important to ensure that you are using the most current version of the form to comply with state requirements.

Legal Use of the ET 141

The legal use of the ET 141 is critical for ensuring that estates comply with New York State tax laws. The form is legally binding and must be accurately completed to avoid penalties or delays in the estate tax process. Executors and administrators should be aware that submitting an incomplete or incorrect form can lead to complications, including audits or additional tax liabilities. It is advisable to consult with a tax professional or attorney specializing in estate matters to ensure proper use of the ET 141.

Required Documents

When completing the ET 141, several documents may be required to support the information provided. Key documents include the decedent's death certificate, proof of residency, and any relevant estate planning documents, such as wills or trusts. Additionally, financial statements and property deeds may be necessary to substantiate the estate's value and the decedent's assets. Having these documents on hand will facilitate a smoother completion process and ensure compliance with state requirements.

Filing Deadlines / Important Dates

Filing deadlines for the ET 141 are crucial for estate administrators to keep in mind. Typically, the form must be submitted within nine months of the decedent's date of death to avoid penalties. However, extensions may be available under certain circumstances. It is important to stay informed about any changes in deadlines or requirements, especially in light of evolving tax laws and regulations. Marking important dates on a calendar can help ensure timely submission of the form.

Quick guide on how to complete ny et 141 2015 2019 form

Your assistance manual on how to organize your Et 141

If you’re curious about how to generate and dispatch your Et 141, here are some straightforward recommendations on how to simplify tax submission.

Firstly, you simply need to create your airSlate SignNow account to change how you manage documents online. airSlate SignNow is an extremely user-friendly and effective document solution that enables you to modify, draft, and finish your income tax documents with ease. With its editor, you can alternate between text, checkboxes, and eSignatures while being able to edit information as necessary. Optimize your tax handling with sophisticated PDF editing, eSigning, and intuitive sharing options.

Follow the instructions below to finalize your Et 141 in just a few minutes:

- Set up your account and begin editing PDFs within moments.

- Utilize our directory to find any IRS tax document; browse through formats and schedules.

- Click Obtain form to access your Et 141 in our editor.

- Complete the required fillable fields with your information (text, figures, checkmarks).

- Employ the Sign Tool to insert your legally-binding eSignature (if necessary).

- Review your document and correct any mistakes.

- Store changes, print your copy, send it to your recipient, and save it to your device.

Utilize this manual to electronically file your taxes using airSlate SignNow. Keep in mind that submitting in paper form can lead to increased errors and delays in refunds. Of course, before e-filing your taxes, verify the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ny et 141 2015 2019 form

How to make an eSignature for your Ny Et 141 2015 2019 Form in the online mode

How to create an electronic signature for the Ny Et 141 2015 2019 Form in Chrome

How to create an eSignature for putting it on the Ny Et 141 2015 2019 Form in Gmail

How to create an electronic signature for the Ny Et 141 2015 2019 Form straight from your smartphone

How to make an eSignature for the Ny Et 141 2015 2019 Form on iOS devices

How to make an electronic signature for the Ny Et 141 2015 2019 Form on Android OS

People also ask

-

What is the NYS ET 85 Form?

The NYS ET 85 Form is a document required for New York State taxpayers to provide information about the eligibility for certain benefits and credits. Understanding how to correctly fill out this form can help streamline your tax process and ensure compliance with state regulations.

-

How does airSlate SignNow help with the NYS ET 85 Form?

airSlate SignNow simplifies the process of completing the NYS ET 85 Form by allowing users to easily fill, sign, and send documents online. Our platform provides a user-friendly interface and the ability to integrate templates, making it easier to manage your tax forms efficiently.

-

Is there a cost associated with using airSlate SignNow for the NYS ET 85 Form?

Yes, airSlate SignNow offers a variety of pricing plans depending on the features you need. Our cost-effective solution ensures that you can manage documents like the NYS ET 85 Form without breaking the bank, providing excellent value for businesses of all sizes.

-

What are the benefits of using airSlate SignNow for the NYS ET 85 Form?

Using airSlate SignNow for the NYS ET 85 Form provides numerous advantages, including increased accuracy, reduced processing time, and enhanced compliance with state requirements. Our eSignature solution helps eliminate paper forms, making the entire process more streamlined.

-

Can I integrate airSlate SignNow with other software to manage the NYS ET 85 Form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage the NYS ET 85 Form and other documents efficiently. These integrations help automate workflows, making it easier to track and manage all your tax-related documentation.

-

How secure is the information I provide on the NYS ET 85 Form with airSlate SignNow?

Security is a top priority for us at airSlate SignNow. We utilize advanced encryption and data protection measures to ensure that the information provided on the NYS ET 85 Form is fully secure, giving our users peace of mind when handling sensitive documents.

-

Is it easy to use airSlate SignNow for someone unfamiliar with the NYS ET 85 Form?

Yes, airSlate SignNow is designed to be user-friendly, catering to individuals unfamiliar with the NYS ET 85 Form. Our intuitive interface provides step-by-step guidance to help users complete their forms easily, regardless of their previous experience with eSigning or document management.

Get more for Et 141

- Tricare other health insurance form express scripts

- Po1 application form

- Individual application for license to own and possess firearms form

- Pharmacy technician skills competency checklist collin form

- Revenue affidavit disposal at death jamaicataxgovjm form

- Application for employment paychex form

- 2014 irs form 8917 2015

- Fringe benefit statement alliant consulting inc form

Find out other Et 141

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile