Ancillary Bond Application IL Current1 Brokers' Risk Form

What is the Ancillary Bond Application IL current1 Brokers' Risk

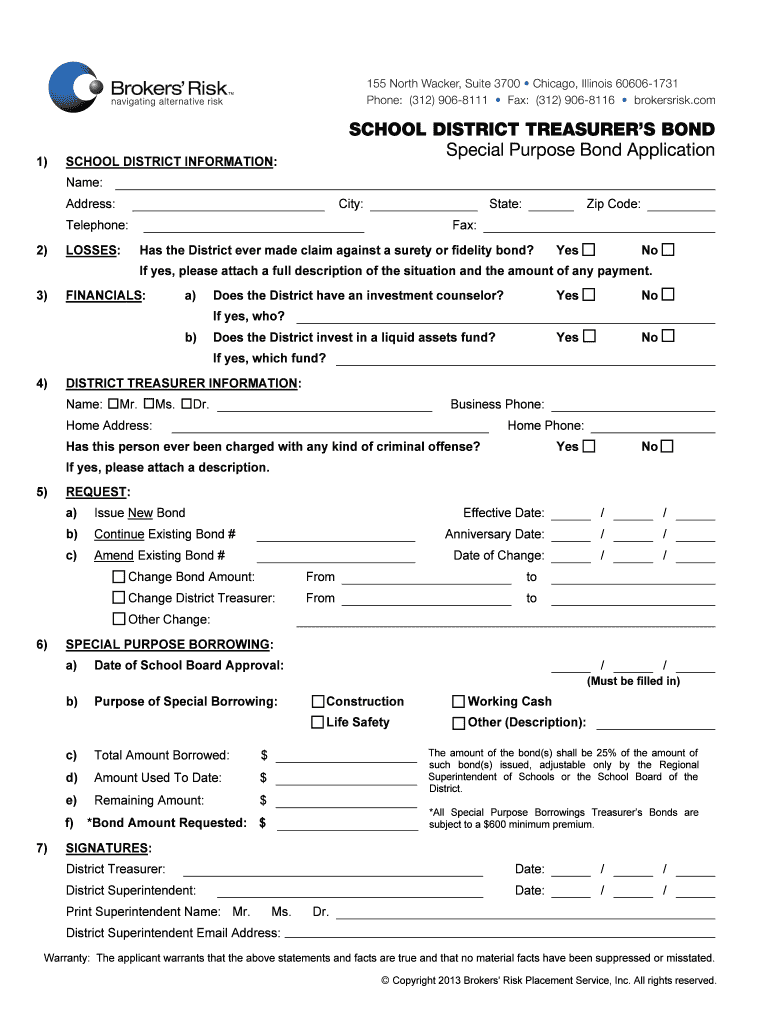

The Ancillary Bond Application IL current1 Brokers' Risk is a specialized form used by insurance brokers in Illinois to apply for ancillary bonds. These bonds are essential for brokers who need to meet specific regulatory requirements and ensure compliance with state laws. The application serves as a formal request to secure a bond that protects clients and the public from potential financial losses caused by the broker's actions or negligence. Understanding the purpose and importance of this application is crucial for brokers operating in Illinois.

Steps to complete the Ancillary Bond Application IL current1 Brokers' Risk

Completing the Ancillary Bond Application involves several key steps:

- Gather necessary information: Collect all required personal and business information, including your legal name, business address, and any relevant licensing details.

- Fill out the application: Carefully complete the application form, ensuring that all sections are filled out accurately to avoid delays.

- Review the application: Double-check all provided information for accuracy and completeness before submission.

- Submit the application: Follow the designated submission methods, which may include online, mail, or in-person options, depending on local regulations.

Legal use of the Ancillary Bond Application IL current1 Brokers' Risk

The legal use of the Ancillary Bond Application is governed by state regulations in Illinois. This application is essential for brokers to operate legally within the state. It ensures that brokers maintain a level of financial responsibility and accountability. By securing a bond through this application, brokers can demonstrate their commitment to ethical practices and compliance with state laws, thereby enhancing their credibility in the industry.

Required Documents

To successfully complete the Ancillary Bond Application, applicants typically need to provide several key documents:

- Proof of business registration in Illinois

- Personal identification, such as a driver's license or state ID

- Any relevant professional licenses or certifications

- Financial statements or proof of financial stability

Eligibility Criteria

Eligibility to apply for the Ancillary Bond Application IL current1 Brokers' Risk generally includes the following criteria:

- Applicants must be licensed insurance brokers in the state of Illinois.

- Businesses must be in good standing with state regulatory authorities.

- Applicants should demonstrate financial responsibility and stability.

Application Process & Approval Time

The application process for the Ancillary Bond Application typically involves submitting the completed form along with required documentation. Once submitted, the processing time can vary:

- Standard processing may take several weeks, depending on the volume of applications.

- Expedited processing options may be available for urgent requests.

It is advisable to check with the relevant authorities for specific timelines and any additional requirements that may apply.

Quick guide on how to complete ancillary bond application il current1 brokers39 risk

Effortlessly Prepare [SKS] on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can obtain the necessary form and securely store it digitally. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your documents promptly without interruptions. Manage [SKS] across any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Way to Edit and eSign [SKS] Effortlessly

- Obtain [SKS] and click on Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize signNow sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your changes.

- Select how you wish to share your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your preference. Modify and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ancillary bond application il current1 brokers39 risk

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ancillary Bond Application IL current1 Brokers' Risk?

The Ancillary Bond Application IL current1 Brokers' Risk is a specialized application designed for brokers to manage and mitigate risks associated with ancillary bonds. It provides a streamlined process for submitting applications and ensures compliance with state regulations. This application is essential for brokers looking to enhance their service offerings and protect their clients.

-

How does airSlate SignNow facilitate the Ancillary Bond Application IL current1 Brokers' Risk process?

airSlate SignNow simplifies the Ancillary Bond Application IL current1 Brokers' Risk process by allowing users to eSign and send documents quickly and securely. The platform's intuitive interface ensures that brokers can complete applications without unnecessary delays. Additionally, it offers features like document tracking and reminders to keep the process on schedule.

-

What are the pricing options for using airSlate SignNow for Ancillary Bond Application IL current1 Brokers' Risk?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of brokers handling the Ancillary Bond Application IL current1 Brokers' Risk. Pricing is based on the number of users and features required, ensuring that businesses of all sizes can find a suitable option. Contact our sales team for a customized quote that fits your specific requirements.

-

What features does airSlate SignNow provide for Ancillary Bond Application IL current1 Brokers' Risk?

airSlate SignNow includes a variety of features that enhance the Ancillary Bond Application IL current1 Brokers' Risk process, such as customizable templates, automated workflows, and secure cloud storage. These features help brokers streamline their operations and improve efficiency. Additionally, the platform supports multiple file formats, making it easy to work with various documents.

-

What are the benefits of using airSlate SignNow for Ancillary Bond Application IL current1 Brokers' Risk?

Using airSlate SignNow for the Ancillary Bond Application IL current1 Brokers' Risk offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Brokers can save time by automating repetitive tasks and ensuring that all documents are securely stored and easily accessible. This ultimately leads to improved client satisfaction and better business outcomes.

-

Can airSlate SignNow integrate with other tools for Ancillary Bond Application IL current1 Brokers' Risk?

Yes, airSlate SignNow can seamlessly integrate with various tools and platforms to enhance the Ancillary Bond Application IL current1 Brokers' Risk process. This includes CRM systems, project management tools, and accounting software. These integrations allow brokers to maintain a cohesive workflow and ensure that all aspects of their operations are connected.

-

Is airSlate SignNow compliant with regulations for Ancillary Bond Application IL current1 Brokers' Risk?

Absolutely, airSlate SignNow is designed to comply with all relevant regulations for the Ancillary Bond Application IL current1 Brokers' Risk. The platform adheres to industry standards for electronic signatures and data security, ensuring that brokers can operate confidently. Regular updates and audits help maintain compliance with changing regulations.

Get more for Ancillary Bond Application IL current1 Brokers' Risk

- 6 adolescent special education tws guideline doc adelphi form

- Teacher work sample handbook and rubrics adelphi university form

- 23c validation report doc form

- Form fda 3537a

- Va form 21p 0517 1 621515601

- Recurring ach debit authorization form template

- Directed study registration form hawaii pacific university hpu

- Gum disease risk factorsperio orgperiodontitis treatment home remedies and symptomsperiodontitis treatment home remedies and form

Find out other Ancillary Bond Application IL current1 Brokers' Risk

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy