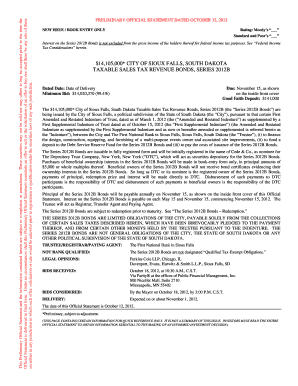

14105000* City of Sioux Falls, South Dakota Taxable Sales Tax PFM Form

Understanding the 14105000* City Of Sioux Falls, South Dakota Taxable Sales Tax PFM

The 14105000* City Of Sioux Falls, South Dakota Taxable Sales Tax PFM is a specific form used by businesses operating within the city to report taxable sales. This form is essential for compliance with local tax regulations and helps ensure that businesses contribute their fair share to municipal revenue. It encompasses various sales transactions, including goods and services sold within city limits, and is crucial for maintaining accurate tax records.

Steps to Complete the 14105000* City Of Sioux Falls, South Dakota Taxable Sales Tax PFM

Completing the 14105000* form involves several key steps:

- Gather all relevant sales records for the reporting period.

- Calculate the total taxable sales by summing all applicable transactions.

- Fill out the form with accurate figures, ensuring all sections are completed.

- Review the form for accuracy before submission.

- Submit the form by the designated deadline to avoid penalties.

Legal Use of the 14105000* City Of Sioux Falls, South Dakota Taxable Sales Tax PFM

The legal use of the 14105000* form is mandated by the city’s tax laws. Businesses must file this form to report their taxable sales accurately. Failure to do so can result in fines or other legal repercussions. It is important for businesses to understand their obligations under local tax law to ensure compliance and avoid any legal issues.

Required Documents for the 14105000* City Of Sioux Falls, South Dakota Taxable Sales Tax PFM

To complete the 14105000* form, businesses should have the following documents ready:

- Sales records for the reporting period.

- Invoices and receipts for all taxable sales.

- Any previous tax filings for reference.

- Records of exempt sales, if applicable.

Filing Deadlines for the 14105000* City Of Sioux Falls, South Dakota Taxable Sales Tax PFM

Timely filing of the 14105000* form is critical. The city typically sets specific deadlines for submission, often aligned with quarterly or annual reporting periods. Businesses should mark these dates on their calendars to ensure they submit their forms on time and avoid late fees or penalties.

Examples of Using the 14105000* City Of Sioux Falls, South Dakota Taxable Sales Tax PFM

Businesses may use the 14105000* form in various scenarios, such as:

- A retail store reporting sales of clothing and accessories sold within Sioux Falls.

- A service provider, such as a landscaping company, reporting income from services rendered in the city.

- Restaurants reporting sales from food and beverage services offered to customers.

Quick guide on how to complete 14105000 city of sioux falls south dakota taxable sales tax pfm

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents quickly without delays. Manage [SKS] on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related task today.

How to edit and eSign [SKS] with ease

- Locate [SKS] and then click Get Form to begin.

- Use the tools available to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to apply your changes.

- Choose how you want to submit your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your needs in document management with just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 14105000* City Of Sioux Falls, South Dakota Taxable Sales Tax PFM

Create this form in 5 minutes!

How to create an eSignature for the 14105000 city of sioux falls south dakota taxable sales tax pfm

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 14105000* City Of Sioux Falls, South Dakota Taxable Sales Tax PFM?

The 14105000* City Of Sioux Falls, South Dakota Taxable Sales Tax PFM refers to the specific taxable sales tax applicable in Sioux Falls. This tax is crucial for businesses operating in the area to understand for compliance and financial planning. Utilizing airSlate SignNow can help streamline the documentation process related to this tax.

-

How can airSlate SignNow assist with managing the 14105000* City Of Sioux Falls, South Dakota Taxable Sales Tax PFM?

airSlate SignNow provides an efficient platform for businesses to manage their documents related to the 14105000* City Of Sioux Falls, South Dakota Taxable Sales Tax PFM. With features like eSigning and document tracking, businesses can ensure timely compliance and reduce the risk of errors in tax documentation.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for small businesses and larger enterprises. Each plan provides access to essential features that can help manage documents related to the 14105000* City Of Sioux Falls, South Dakota Taxable Sales Tax PFM efficiently. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for tax-related documents?

airSlate SignNow includes features such as customizable templates, secure eSigning, and automated workflows that are particularly beneficial for handling tax-related documents like the 14105000* City Of Sioux Falls, South Dakota Taxable Sales Tax PFM. These features enhance productivity and ensure that all necessary documentation is completed accurately and on time.

-

Can airSlate SignNow integrate with other software for tax management?

Yes, airSlate SignNow offers integrations with various accounting and tax management software, making it easier to manage the 14105000* City Of Sioux Falls, South Dakota Taxable Sales Tax PFM. This seamless integration allows for better data synchronization and reduces the manual effort required in document handling.

-

What are the benefits of using airSlate SignNow for tax documentation?

Using airSlate SignNow for tax documentation, including the 14105000* City Of Sioux Falls, South Dakota Taxable Sales Tax PFM, provides numerous benefits such as increased efficiency, reduced paperwork, and enhanced security. The platform simplifies the eSigning process, ensuring that all parties can sign documents quickly and securely, which is vital for tax compliance.

-

Is airSlate SignNow user-friendly for businesses new to eSigning?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible for businesses new to eSigning. The intuitive interface allows users to easily navigate the platform and manage documents related to the 14105000* City Of Sioux Falls, South Dakota Taxable Sales Tax PFM without extensive training.

Get more for 14105000* City Of Sioux Falls, South Dakota Taxable Sales Tax PFM

- Gift annuity application dallas theological seminary dts form

- Unsubsidized federal direct loan request form

- Sample learning planning document dallas theological seminary dts form

- Ss residence hall reservation form dallas theological seminary dts

- Subsidized and unsubsidized federal stafford loan form

- Faith enrichment student registration dallas theological seminary dts form

- Request for academic transcript dallas theological seminary dts form

- Before completing this form please verify that you currently meet all

Find out other 14105000* City Of Sioux Falls, South Dakota Taxable Sales Tax PFM

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online