If You Will Not Be Liable for Returns in the Future, Check Here Form

What is the If You Will Not Be Liable For Returns In The Future, Check Here

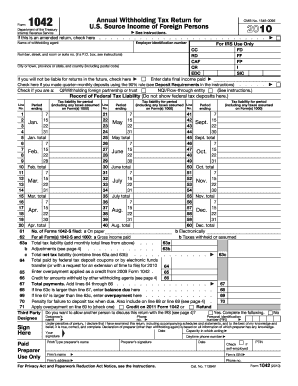

The form titled "If You Will Not Be Liable For Returns In The Future, Check Here" serves as a declaration for individuals or businesses indicating their intention to exempt themselves from future liabilities associated with returns. This form is particularly relevant in contexts such as tax filings or contractual agreements where liability for returns may arise. By completing this form, signers clarify their position regarding future responsibilities, ensuring that all parties involved understand the terms and conditions related to returns.

How to use the If You Will Not Be Liable For Returns In The Future, Check Here

Using the form involves a straightforward process. First, ensure that you have the correct version of the form, which can typically be obtained from relevant government or regulatory websites. Next, fill out the required fields, which usually include personal or business information and a clear statement of your intent regarding liability for returns. After completing the form, it should be signed and dated to validate the declaration. Depending on the context, you may need to submit the form to a specific agency or retain it for your records.

Key elements of the If You Will Not Be Liable For Returns In The Future, Check Here

Several key elements are essential when completing this form. These include:

- Personal or Business Information: This includes your name, address, and any relevant identification numbers.

- Declaration Statement: A clear statement indicating that you will not be liable for returns in the future.

- Signature and Date: Your signature is required to validate the form, along with the date of signing.

- Witness or Notary (if applicable): Some forms may require a witness or notary public to verify your identity.

Steps to complete the If You Will Not Be Liable For Returns In The Future, Check Here

Completing the form involves several steps:

- Obtain the correct form from an official source.

- Carefully read the instructions provided with the form.

- Fill in your personal or business details accurately.

- Provide a clear declaration of your intent regarding liability.

- Sign and date the form.

- If required, have the form witnessed or notarized.

- Submit the completed form as directed or keep it for your records.

Legal use of the If You Will Not Be Liable For Returns In The Future, Check Here

This form has legal implications, as it serves as a binding declaration regarding future liabilities. By signing this document, you are asserting that you will not be held responsible for any returns that may occur after the form is submitted. It is crucial to ensure that the form is completed accurately and in compliance with any relevant laws or regulations to avoid potential legal disputes.

Filing Deadlines / Important Dates

When using the "If You Will Not Be Liable For Returns In The Future, Check Here" form, it is important to be aware of any filing deadlines that may apply. These deadlines can vary based on the context in which the form is used, such as tax submissions or contractual obligations. Always check the specific guidelines related to your situation to ensure timely submission and compliance with all relevant timelines.

Quick guide on how to complete if you will not be liable for returns in the future check here

Complete [SKS] effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed records, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

The simplest way to modify and eSign [SKS] effortlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a customary wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you want to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Modify and eSign [SKS] and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to If You Will Not Be Liable For Returns In The Future, Check Here

Create this form in 5 minutes!

How to create an eSignature for the if you will not be liable for returns in the future check here

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how can it benefit my business?

airSlate SignNow is an easy-to-use, cost-effective solution that empowers businesses to send and eSign documents efficiently. If you will not be liable for returns in the future, check here to discover how our platform can streamline your document workflows and enhance productivity.

-

How does airSlate SignNow handle document security?

Security is a top priority for airSlate SignNow. Our platform employs advanced encryption and compliance measures to protect your documents. If you will not be liable for returns in the future, check here to learn more about our security features and how they safeguard your sensitive information.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. If you will not be liable for returns in the future, check here for detailed information on our pricing tiers and find the best option that fits your budget and needs.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing your workflow. If you will not be liable for returns in the future, check here to see the list of integrations available and how they can improve your document management processes.

-

What features does airSlate SignNow offer?

airSlate SignNow includes a range of features such as customizable templates, real-time tracking, and automated reminders. If you will not be liable for returns in the future, check here to explore all the features that can help you manage your documents more effectively.

-

Is airSlate SignNow suitable for small businesses?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small enterprises. If you will not be liable for returns in the future, check here to find out how our solution can support your growth and simplify your document processes.

-

How can I get started with airSlate SignNow?

Getting started with airSlate SignNow is simple. You can sign up for a free trial to explore our features and see how they fit your needs. If you will not be liable for returns in the future, check here for step-by-step instructions on how to begin using our platform.

Get more for If You Will Not Be Liable For Returns In The Future, Check Here

- Pre placement interview florida gulf coast university form

- Florida prepaid summer housing authorization florida gulf coast fgcu form

- Fgcu international services announces form

- Student health services health form florida gulf coast university fgcu

- Common data set a1 a1 a1 a1 a1 a1 a1 a1 a1 a1 a1 a1 a1 a1 a1 address information name of collegeuniversity mailing address

- Students are liable for all fees for courses in which they are enrolled at the end of the dropadd period fgcu form

- Rti handbook 20 21 form

- Kent hospital sleep lab form

Find out other If You Will Not Be Liable For Returns In The Future, Check Here

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors