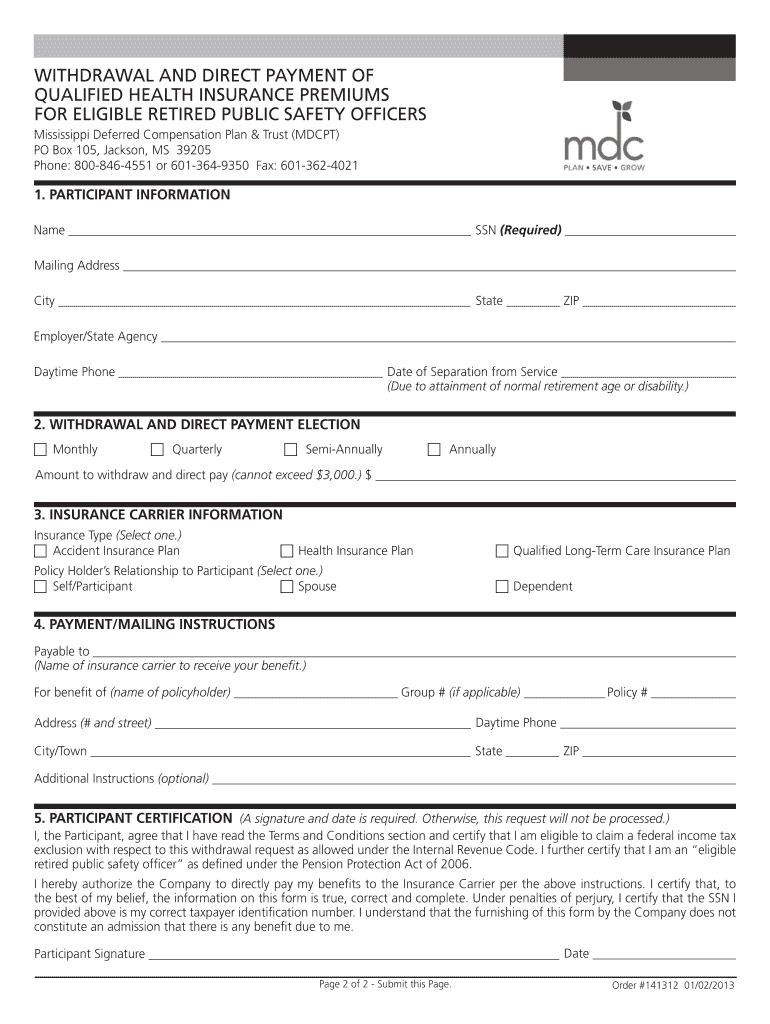

WITHDRAWAL and DIRECT PAYMENT of QUALIFIED HEALTH INSURANCE PREMIUMS for ELIGIBLE RETIRED PUBLIC SAFETY OFFICERS Form

Understanding the Withdrawal and Direct Payment of Qualified Health Insurance Premiums

The Withdrawal and Direct Payment of Qualified Health Insurance Premiums for Eligible Retired Public Safety Officers is a provision that allows retired public safety officers to withdraw funds from their retirement accounts to pay for health insurance premiums. This process is designed to ease the financial burden on retired officers, ensuring they can maintain their health coverage during retirement. Eligible individuals must meet specific criteria set forth by the IRS and their respective state laws.

Eligibility Criteria for Retired Public Safety Officers

To qualify for the withdrawal and direct payment of health insurance premiums, retired public safety officers must meet certain eligibility criteria. Generally, this includes being a retired officer from a state or local government agency and having a qualified health insurance plan. The officer must also have served in a capacity that qualifies them under the defined terms of public safety, which often includes roles such as police officers, firefighters, and emergency medical personnel.

Steps to Complete the Withdrawal Process

Completing the withdrawal process involves several key steps. First, eligible retired public safety officers must gather necessary documentation, such as proof of retirement and health insurance coverage. Next, they should fill out the appropriate withdrawal form, ensuring all information is accurate and complete. After completing the form, it should be submitted to the retirement plan administrator for processing. It is advisable to keep copies of all submitted documents for personal records.

Required Documents for Withdrawal

When applying for the withdrawal and direct payment of health insurance premiums, certain documents are typically required. These may include:

- Proof of retirement status

- Documentation of health insurance coverage

- Completed withdrawal form

- Identification verification, such as a driver's license or Social Security card

Having these documents prepared in advance can streamline the application process and reduce delays.

Legal Considerations for Withdrawals

Retired public safety officers should be aware of the legal implications of withdrawing funds for health insurance premiums. The IRS has specific guidelines regarding the tax treatment of these withdrawals. Generally, funds withdrawn for qualified health insurance premiums may not be subject to income tax, but it is essential to consult with a tax professional to understand individual circumstances. Additionally, state laws may impose further regulations that must be adhered to.

Submitting the Withdrawal Form

The withdrawal form can typically be submitted through various methods, including online submission, mailing, or in-person delivery to the retirement plan administrator. Each method has its own processing times and requirements, so it is important to choose the one that best fits individual needs. For online submissions, ensure that all digital forms are completed accurately and submitted through secure channels.

Quick guide on how to complete withdrawal and direct payment of qualified health insurance premiums for eligible retired public safety officers

Prepare [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed paperwork, as you can easily find the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly and without delays. Handle [SKS] on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign [SKS] without any hassle

- Find [SKS] and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize key sections of the documents or black out sensitive details with the tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to WITHDRAWAL AND DIRECT PAYMENT OF QUALIFIED HEALTH INSURANCE PREMIUMS FOR ELIGIBLE RETIRED PUBLIC SAFETY OFFICERS

Create this form in 5 minutes!

How to create an eSignature for the withdrawal and direct payment of qualified health insurance premiums for eligible retired public safety officers

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for WITHDRAWAL AND DIRECT PAYMENT OF QUALIFIED HEALTH INSURANCE PREMIUMS FOR ELIGIBLE RETIRED PUBLIC SAFETY OFFICERS?

The process for WITHDRAWAL AND DIRECT PAYMENT OF QUALIFIED HEALTH INSURANCE PREMIUMS FOR ELIGIBLE RETIRED PUBLIC SAFETY OFFICERS involves submitting the necessary documentation to your retirement system. Once approved, payments can be directly withdrawn from your pension or retirement account to cover your health insurance premiums, ensuring timely and hassle-free payments.

-

Are there any fees associated with the WITHDRAWAL AND DIRECT PAYMENT OF QUALIFIED HEALTH INSURANCE PREMIUMS?

Typically, there are no additional fees for the WITHDRAWAL AND DIRECT PAYMENT OF QUALIFIED HEALTH INSURANCE PREMIUMS FOR ELIGIBLE RETIRED PUBLIC SAFETY OFFICERS. However, it is advisable to check with your retirement system for any specific terms or conditions that may apply to your situation.

-

What benefits do I gain from using airSlate SignNow for my health insurance premium payments?

Using airSlate SignNow for the WITHDRAWAL AND DIRECT PAYMENT OF QUALIFIED HEALTH INSURANCE PREMIUMS FOR ELIGIBLE RETIRED PUBLIC SAFETY OFFICERS provides a streamlined and efficient way to manage your payments. Our platform ensures secure transactions, easy document management, and the ability to eSign necessary forms quickly, saving you time and reducing stress.

-

Can I integrate airSlate SignNow with other financial tools for managing my health insurance payments?

Yes, airSlate SignNow offers integrations with various financial tools and software, making it easier to manage the WITHDRAWAL AND DIRECT PAYMENT OF QUALIFIED HEALTH INSURANCE PREMIUMS FOR ELIGIBLE RETIRED PUBLIC SAFETY OFFICERS. This allows for seamless tracking and management of your payments alongside your other financial activities.

-

How can I ensure my payments are processed on time?

To ensure timely processing of the WITHDRAWAL AND DIRECT PAYMENT OF QUALIFIED HEALTH INSURANCE PREMIUMS FOR ELIGIBLE RETIRED PUBLIC SAFETY OFFICERS, it is important to submit your requests and documentation promptly. Setting up automatic withdrawals through airSlate SignNow can also help maintain consistency in your payment schedule.

-

What types of health insurance premiums are eligible for direct payment?

Eligible health insurance premiums for the WITHDRAWAL AND DIRECT PAYMENT OF QUALIFIED HEALTH INSURANCE PREMIUMS FOR ELIGIBLE RETIRED PUBLIC SAFETY OFFICERS typically include premiums for medical, dental, and vision insurance. It is essential to verify with your retirement system to confirm which specific premiums qualify under this program.

-

Is there customer support available for questions about my health insurance premium payments?

Yes, airSlate SignNow provides dedicated customer support to assist you with any inquiries regarding the WITHDRAWAL AND DIRECT PAYMENT OF QUALIFIED HEALTH INSURANCE PREMIUMS FOR ELIGIBLE RETIRED PUBLIC SAFETY OFFICERS. Our team is available to help you navigate the process and resolve any issues you may encounter.

Get more for WITHDRAWAL AND DIRECT PAYMENT OF QUALIFIED HEALTH INSURANCE PREMIUMS FOR ELIGIBLE RETIRED PUBLIC SAFETY OFFICERS

- Fort valley state fvsu form

- Quick select application this room selection option is open to all eligible room selection participants framingham form

- Summer housing application framingham state university form

- Application for admission framingham state university framingham form

- Fsu foundations peer mentor supplemental application form

- Framingham state university early childhoodelementary field study i application for field study i placement check one early form

- Information for international student applicants framingham

- Environmental science major application for senior thesis form

Find out other WITHDRAWAL AND DIRECT PAYMENT OF QUALIFIED HEALTH INSURANCE PREMIUMS FOR ELIGIBLE RETIRED PUBLIC SAFETY OFFICERS

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT