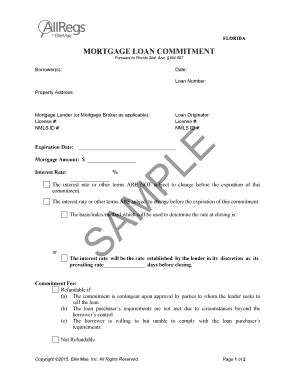

MORTGAGE LOAN COMMITMENT Form

Understanding the Mortgage Loan Commitment

A mortgage loan commitment is a formal document issued by a lender that indicates a borrower's eligibility for a mortgage loan. This commitment outlines the terms of the loan, including the amount, interest rate, and repayment schedule. It serves as a guarantee that the lender is willing to provide the funds necessary for the purchase of a property, provided that all conditions outlined in the commitment are met. This document is crucial in the home buying process, as it assures sellers that the buyer is financially capable of completing the transaction.

How to Obtain a Mortgage Loan Commitment

To obtain a mortgage loan commitment, a borrower must first complete a mortgage application with a lender. This process typically involves the following steps:

- Gather necessary documentation, such as income statements, tax returns, and credit history.

- Submit the application along with the required documents to the lender.

- Undergo a credit check and property appraisal, as these are essential for the lender's evaluation.

- Receive a conditional approval, which outlines any additional requirements that must be met before the commitment is issued.

- Once all conditions are satisfied, the lender will issue the mortgage loan commitment.

Key Elements of the Mortgage Loan Commitment

The mortgage loan commitment includes several key elements that are important for both the borrower and the lender. These elements typically consist of:

- Loan Amount: The total amount of money the lender agrees to loan the borrower.

- Interest Rate: The cost of borrowing the money, expressed as a percentage.

- Loan Term: The duration over which the loan must be repaid, usually ranging from fifteen to thirty years.

- Conditions: Specific requirements that must be met before the loan can be finalized, such as additional documentation or repairs to the property.

- Expiration Date: The date by which the loan must close, or the commitment may become void.

Steps to Complete the Mortgage Loan Commitment

Completing the mortgage loan commitment involves several important steps that ensure all conditions are met and the loan can be finalized. These steps generally include:

- Reviewing the commitment document thoroughly to understand all terms and conditions.

- Providing any additional documentation requested by the lender.

- Addressing any conditions outlined in the commitment, such as property repairs or obtaining insurance.

- Confirming the closing date and ensuring all parties are prepared for the transaction.

- Finalizing the loan by signing the necessary documents at closing.

Legal Use of the Mortgage Loan Commitment

The mortgage loan commitment is a legally binding document that protects both the borrower and the lender. It outlines the terms of the loan and the obligations of each party. Borrowers should ensure they understand their rights and responsibilities as outlined in the commitment. Additionally, lenders must adhere to the terms specified in the commitment to avoid potential legal issues. It is advisable for borrowers to consult with a legal professional if they have questions regarding the implications of the commitment.

Examples of Using the Mortgage Loan Commitment

There are various scenarios in which a mortgage loan commitment is utilized. For instance:

- A first-time homebuyer may present their mortgage loan commitment to a seller to demonstrate their financial readiness to purchase a property.

- A homeowner looking to refinance may use their existing commitment to negotiate better terms with a new lender.

- Real estate agents often rely on mortgage loan commitments to ensure that buyers are serious and capable of completing a purchase.

Quick guide on how to complete mortgage loan commitment

Complete MORTGAGE LOAN COMMITMENT effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as it's possible to locate the right form and securely keep it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents quickly and without interruptions. Manage MORTGAGE LOAN COMMITMENT on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and electronically sign MORTGAGE LOAN COMMITMENT effortlessly

- Obtain MORTGAGE LOAN COMMITMENT and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure confidential information with the tools that airSlate SignNow specifically provides for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Verify all details and click on the Done button to save your adjustments.

- Choose your preferred method of sharing your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and electronically sign MORTGAGE LOAN COMMITMENT and ensure effective communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mortgage loan commitment

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a MORTGAGE LOAN COMMITMENT?

A MORTGAGE LOAN COMMITMENT is a formal agreement from a lender to provide a mortgage loan to a borrower, outlining the terms and conditions of the loan. This document is crucial as it indicates that the lender has reviewed the borrower's financial information and is willing to proceed with the loan process. Understanding your MORTGAGE LOAN COMMITMENT can help you navigate your home buying journey more effectively.

-

How does airSlate SignNow facilitate the MORTGAGE LOAN COMMITMENT process?

airSlate SignNow streamlines the MORTGAGE LOAN COMMITMENT process by allowing users to send and eSign documents quickly and securely. With our easy-to-use platform, you can manage all your mortgage documents in one place, reducing the time it takes to finalize your loan. This efficiency can signNowly enhance your overall mortgage experience.

-

What are the benefits of using airSlate SignNow for MORTGAGE LOAN COMMITMENT?

Using airSlate SignNow for your MORTGAGE LOAN COMMITMENT offers several benefits, including faster document turnaround times and enhanced security features. Our platform ensures that your sensitive information is protected while allowing for seamless collaboration between all parties involved. Additionally, our cost-effective solution helps you save on administrative costs.

-

Are there any costs associated with obtaining a MORTGAGE LOAN COMMITMENT through airSlate SignNow?

While airSlate SignNow itself does not charge for obtaining a MORTGAGE LOAN COMMITMENT, there may be associated fees from lenders or third-party services. It's essential to review all potential costs with your lender to understand the full financial picture. Our platform, however, offers competitive pricing for document management and eSigning services.

-

Can I integrate airSlate SignNow with other mortgage software for MORTGAGE LOAN COMMITMENT?

Yes, airSlate SignNow offers integrations with various mortgage software solutions to enhance your MORTGAGE LOAN COMMITMENT process. These integrations allow for seamless data transfer and improved workflow efficiency. By connecting our platform with your existing tools, you can streamline your mortgage operations.

-

What features does airSlate SignNow provide for managing MORTGAGE LOAN COMMITMENT documents?

airSlate SignNow provides features such as customizable templates, real-time tracking, and secure cloud storage for managing MORTGAGE LOAN COMMITMENT documents. These tools help you keep your documents organized and accessible, ensuring that you can easily find and manage your mortgage paperwork. Our user-friendly interface makes it simple to navigate through your documents.

-

How secure is the MORTGAGE LOAN COMMITMENT process with airSlate SignNow?

The MORTGAGE LOAN COMMITMENT process with airSlate SignNow is highly secure, utilizing advanced encryption and authentication measures to protect your sensitive information. We prioritize data security to ensure that your mortgage documents are safe from unauthorized access. Trust in our platform to handle your MORTGAGE LOAN COMMITMENT with the utmost care.

Get more for MORTGAGE LOAN COMMITMENT

- Dss ea 240 form

- Wwwmichigangovtaxes 2368 principal residence exemption pre affidavit michigan form

- Form i 765ws worksheet form i 765ws worksheet

- Form i 765 application for employment authorization uscis fill

- Form i 485 application to register permanent residenceor adjust status i 485pdf

- Form i 129 petition for nonimmigrant worker petition for nonimmigrant worker

- Sc dmv form 400

- Mv 619 form

Find out other MORTGAGE LOAN COMMITMENT

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF