Non IRIS Travel Expense Report Form

What is the Non IRIS Travel Expense Report

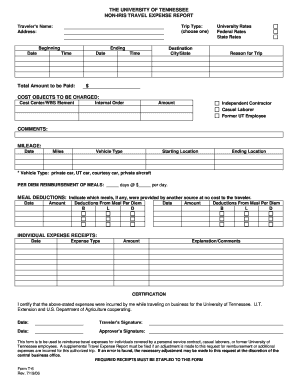

The Non IRIS Travel Expense Report is a document used by employees to report travel-related expenses incurred while conducting business on behalf of their organization. This report is essential for ensuring that employees are reimbursed for eligible expenses, such as transportation, lodging, meals, and other travel costs. It serves as a formal record that helps organizations manage their travel budgets and maintain accurate financial records.

How to use the Non IRIS Travel Expense Report

Using the Non IRIS Travel Expense Report involves several straightforward steps. First, gather all relevant receipts and documentation related to your travel expenses. Next, fill out the report by entering details such as the purpose of travel, dates, locations, and specific expenses incurred. Ensure that each expense is supported by a corresponding receipt. Once completed, submit the report to your supervisor or the finance department for review and approval. Following approval, the report will be processed for reimbursement.

Steps to complete the Non IRIS Travel Expense Report

Completing the Non IRIS Travel Expense Report requires careful attention to detail. Start by entering your personal information, including your name, employee ID, and department. Then, list each expense in the designated sections, categorizing them by type, such as transportation or lodging. Include the date of each expense, the amount, and a brief description of the purpose. Attach all relevant receipts to support your claims. Finally, review the report for accuracy before submitting it for approval.

Key elements of the Non IRIS Travel Expense Report

The Non IRIS Travel Expense Report includes several key elements that are crucial for proper documentation. These elements typically consist of:

- Employee Information: Name, employee ID, and department.

- Travel Details: Dates of travel, destinations, and purpose.

- Expense Categories: Breakdown of expenses such as transportation, lodging, meals, and incidentals.

- Receipts: Attachments of original receipts for verification.

- Approval Signatures: Required signatures from supervisors or finance personnel.

Legal use of the Non IRIS Travel Expense Report

The Non IRIS Travel Expense Report must be used in compliance with both company policies and applicable laws. Organizations often set specific guidelines regarding what constitutes reimbursable expenses. It is important for employees to familiarize themselves with these policies to ensure that their claims are valid. Additionally, proper documentation is essential for tax purposes, as businesses may need to report these expenses as part of their financial statements.

Examples of using the Non IRIS Travel Expense Report

Examples of using the Non IRIS Travel Expense Report can vary based on the nature of travel. For instance, an employee attending a conference may claim expenses for airfare, hotel accommodations, and meals during the event. Another example could involve a sales representative traveling to meet clients, where expenses might include transportation costs, meals, and lodging. Each scenario highlights the importance of accurately documenting and reporting expenses to facilitate timely reimbursement.

Quick guide on how to complete non iris travel expense report

Complete [SKS] effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents rapidly without delays. Manage [SKS] on any device using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign [SKS] effortlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your needs in document management with just a few clicks from any device of your choosing. Modify and eSign [SKS] and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Non IRIS Travel Expense Report

Create this form in 5 minutes!

How to create an eSignature for the non iris travel expense report

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Non IRIS Travel Expense Report?

A Non IRIS Travel Expense Report is a document used to track and report travel expenses incurred by employees that are not processed through the IRIS system. This report helps businesses maintain accurate records of travel-related expenditures, ensuring compliance and facilitating reimbursement. By utilizing airSlate SignNow, you can easily create and manage these reports.

-

How does airSlate SignNow simplify the Non IRIS Travel Expense Report process?

airSlate SignNow streamlines the creation and submission of Non IRIS Travel Expense Reports by providing an intuitive platform for document management. Users can easily fill out, sign, and send reports electronically, reducing paperwork and saving time. This efficiency helps businesses focus on their core operations while ensuring accurate expense tracking.

-

What features does airSlate SignNow offer for managing Non IRIS Travel Expense Reports?

airSlate SignNow offers features such as customizable templates, electronic signatures, and real-time tracking for Non IRIS Travel Expense Reports. These tools allow users to create tailored reports that meet their specific needs while ensuring compliance with company policies. Additionally, the platform provides secure storage and easy access to all submitted documents.

-

Is there a cost associated with using airSlate SignNow for Non IRIS Travel Expense Reports?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be a cost-effective solution for businesses. Pricing plans vary based on the features and number of users, allowing companies to choose a plan that fits their budget. Investing in airSlate SignNow can lead to signNow savings in time and resources when managing Non IRIS Travel Expense Reports.

-

Can airSlate SignNow integrate with other software for Non IRIS Travel Expense Reports?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing the management of Non IRIS Travel Expense Reports. This includes popular accounting and expense management tools, allowing for seamless data transfer and improved workflow. Integrating these systems can help businesses maintain accurate financial records and streamline their reporting processes.

-

What are the benefits of using airSlate SignNow for Non IRIS Travel Expense Reports?

Using airSlate SignNow for Non IRIS Travel Expense Reports provides numerous benefits, including increased efficiency, reduced paperwork, and improved accuracy. The platform's electronic signature feature ensures that reports are signed and submitted quickly, while customizable templates save time on document creation. Overall, it enhances the expense reporting process for both employees and management.

-

How secure is airSlate SignNow for handling Non IRIS Travel Expense Reports?

airSlate SignNow prioritizes security, ensuring that all Non IRIS Travel Expense Reports are handled with the utmost care. The platform employs advanced encryption and secure storage solutions to protect sensitive information. Businesses can trust that their data is safe while using airSlate SignNow for their expense reporting needs.

Get more for Non IRIS Travel Expense Report

- Select one of the following two options form

- Justia application for transfer of partnership name form

- Change name andor address complete form

- Free ucc5 correction statement the filing o findformscom

- Something that was not their intent form

- Be named as your personal representative or form

- Have a life estate in the property form

- Executor to administer your estate and who will form

Find out other Non IRIS Travel Expense Report

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online