Form 941 M Rev July Internal Revenue Service

What is the Form 941 M Rev July Internal Revenue Service

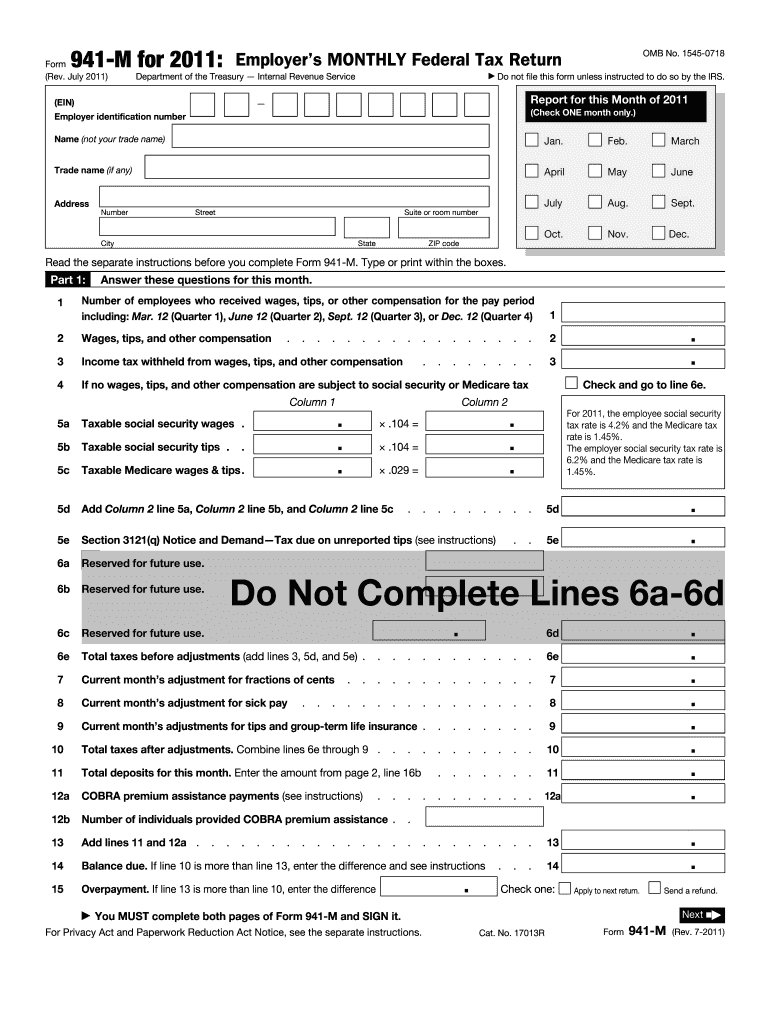

The Form 941 M Rev July is a tax form issued by the Internal Revenue Service (IRS) that employers use to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is essential for businesses to ensure compliance with federal tax regulations. It provides a detailed account of the taxes owed and helps the IRS track employment tax liabilities. Employers must file this form quarterly, making it a crucial part of their tax responsibilities.

How to use the Form 941 M Rev July Internal Revenue Service

To effectively use the Form 941 M Rev July, employers should first gather all necessary payroll information, including total wages paid, tips, and other compensation. The form requires specific details about the number of employees, the amount of federal income tax withheld, and the total Social Security and Medicare taxes. Once the data is compiled, employers can fill out the form accurately, ensuring all calculations are correct to avoid penalties. After completing the form, it must be submitted to the IRS by the designated deadlines.

Steps to complete the Form 941 M Rev July Internal Revenue Service

Completing the Form 941 M Rev July involves several key steps:

- Gather payroll records for the reporting period, including wages, tips, and compensation.

- Calculate the total federal income tax withheld from employees' paychecks.

- Determine the total Social Security and Medicare taxes owed based on employee wages.

- Complete all sections of the form, ensuring accuracy in reporting numbers.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the IRS by the applicable deadline.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing the Form 941 M Rev July. The form is due on the last day of the month following the end of each quarter. For example, the deadlines are typically April 30 for the first quarter, July 31 for the second quarter, October 31 for the third quarter, and January 31 for the fourth quarter. It is crucial for employers to file on time to avoid penalties and interest on any unpaid taxes.

Penalties for Non-Compliance

Failure to file the Form 941 M Rev July on time or inaccuracies in reporting can lead to significant penalties. The IRS may impose a failure-to-file penalty, which is typically five percent of the unpaid taxes for each month the return is late, up to a maximum of 25 percent. Additionally, there may be penalties for failing to pay the taxes owed. Employers should ensure timely and accurate filing to avoid these financial repercussions.

Form Submission Methods

The Form 941 M Rev July can be submitted to the IRS through various methods. Employers may choose to file electronically using the IRS e-file system, which is a convenient and efficient option. Alternatively, the form can be mailed to the appropriate IRS address based on the employer's location. Employers should ensure they follow the correct submission method to facilitate timely processing of their tax returns.

Quick guide on how to complete form 941 m rev july internal revenue service

Complete [SKS] effortlessly on any device

Digital document management has gained popularity among companies and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed papers, as you can locate the appropriate form and securely save it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents swiftly without any holdups. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to alter and eSign [SKS] without difficulty

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to preserve your modifications.

- Select how you wish to share your form, by email, text message (SMS), or invite link, or download it to your PC.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Edit and eSign [SKS] and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 941 M Rev July Internal Revenue Service

Create this form in 5 minutes!

How to create an eSignature for the form 941 m rev july internal revenue service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 941 M Rev July from the Internal Revenue Service?

Form 941 M Rev July is a tax form used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is essential for compliance with the Internal Revenue Service regulations and helps businesses accurately report their payroll taxes.

-

How can airSlate SignNow help with Form 941 M Rev July submissions?

airSlate SignNow provides a streamlined solution for electronically signing and sending Form 941 M Rev July to the Internal Revenue Service. Our platform ensures that your documents are securely signed and submitted, reducing the risk of errors and improving compliance with IRS requirements.

-

What are the pricing options for using airSlate SignNow for Form 941 M Rev July?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Our cost-effective solution allows you to manage and eSign documents like Form 941 M Rev July without breaking the bank, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for managing Form 941 M Rev July?

With airSlate SignNow, you can easily create, edit, and eSign Form 941 M Rev July. Our platform includes features like templates, automated workflows, and secure storage, making it easier for businesses to manage their tax documents efficiently.

-

Are there any integrations available with airSlate SignNow for Form 941 M Rev July?

Yes, airSlate SignNow integrates seamlessly with various applications, allowing you to manage Form 941 M Rev July alongside your existing tools. This integration capability enhances your workflow and ensures that all your documents are easily accessible and organized.

-

What are the benefits of using airSlate SignNow for Form 941 M Rev July?

Using airSlate SignNow for Form 941 M Rev July offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the signing process, allowing you to focus on your business while ensuring compliance with the Internal Revenue Service.

-

Is airSlate SignNow secure for handling Form 941 M Rev July?

Absolutely! airSlate SignNow employs advanced security measures to protect your documents, including Form 941 M Rev July. Our platform is designed to ensure that your sensitive information is kept safe and secure throughout the signing and submission process.

Get more for Form 941 M Rev July Internal Revenue Service

- Tattoo apprenticeship checklist form

- Sex offender safety plan example 467356333 form

- Crowd photo release form slr lounge

- Prescription pickup authorization form hotel pharmacy

- 0116 ust c009kdhe reference no form

- Family code chapter 162 adoption texasoklahoma child adoption laws and statutes family code chapter 162 adoption texasoklahoma form

- West virginia adoption forms

- Merchant pre qualification form fx 800 278 6713

Find out other Form 941 M Rev July Internal Revenue Service

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document