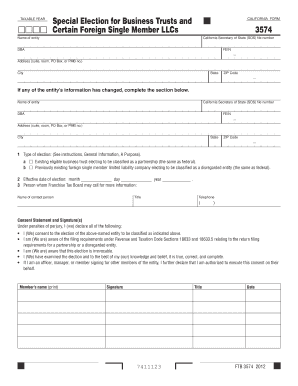

Form 3574 Special Election for Business Trusts and Certain Foreign Single Member LLCs

What is the Form 3574 Special Election For Business Trusts And Certain Foreign Single Member LLCs

The Form 3574 is a tax form used to make a special election for business trusts and certain foreign single member limited liability companies (LLCs). This form allows these entities to be treated as disregarded entities for federal tax purposes, simplifying their tax reporting obligations. By filing this form, eligible business trusts and foreign single member LLCs can avoid the complexities of corporate taxation, allowing income, deductions, and credits to flow through to the owner’s personal tax return.

How to use the Form 3574 Special Election For Business Trusts And Certain Foreign Single Member LLCs

Using Form 3574 involves a straightforward process. First, ensure that your business trust or foreign single member LLC meets the eligibility criteria. Once confirmed, complete the form by providing the necessary information, including the entity's name, address, and identification number. After filling out the form, submit it to the appropriate IRS office. It is essential to keep a copy for your records, as this will serve as proof of your election for future reference.

Steps to complete the Form 3574 Special Election For Business Trusts And Certain Foreign Single Member LLCs

Completing Form 3574 requires careful attention to detail. Follow these steps:

- Gather necessary information, including the entity's legal name, address, and Employer Identification Number (EIN).

- Fill out the form accurately, ensuring all sections are completed.

- Review the form for any errors or omissions.

- Sign and date the form to validate it.

- Submit the completed form to the IRS by the specified deadline.

Eligibility Criteria

To qualify for the special election using Form 3574, the entity must be either a business trust or a foreign single member LLC. The business trust must be recognized under state law, and the foreign single member LLC must be owned by a single individual or entity. Additionally, the election must be made timely, typically by the due date of the tax return for the year in which the election is to take effect.

Filing Deadlines / Important Dates

Filing deadlines for Form 3574 are crucial to ensure compliance. Generally, the form must be filed by the due date of the tax return for the year in which the election is to be effective. If the return is filed on extension, the election must also be made by the extended due date. It is advisable to mark these dates on your calendar to avoid missing the opportunity to make the election.

Required Documents

When preparing to file Form 3574, certain documents may be required to support your application. These typically include:

- The entity's formation documents, such as articles of incorporation or organization.

- Proof of the entity's status as a business trust or foreign single member LLC.

- Any prior tax returns that may provide context for the election.

Penalties for Non-Compliance

Failure to file Form 3574 correctly or on time can result in penalties. The IRS may impose fines for late submissions, and the election may not be recognized, leading to unintended tax consequences. It is important to adhere to all filing requirements and deadlines to avoid these penalties and ensure that your entity is treated as intended for tax purposes.

Quick guide on how to complete form 3574 special election for business trusts and certain foreign single member llcs

Manage [SKS] seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as a perfect environmentally friendly alternative to traditional printed and signed papers, allowing you to access the correct forms and securely store them online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents quickly and without holdups. Handle [SKS] on any device using airSlate SignNow for Android or iOS and streamline any document-related procedure today.

The easiest way to modify and eSign [SKS] effortlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of your documents or redact sensitive information using features specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries over lost or misplaced files, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign [SKS] while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3574 special election for business trusts and certain foreign single member llcs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 3574 Special Election For Business Trusts And Certain Foreign Single Member LLCs?

Form 3574 Special Election For Business Trusts And Certain Foreign Single Member LLCs is a tax form that allows eligible entities to elect to be treated as a corporation for federal tax purposes. This election can provide various tax benefits and simplify compliance for businesses. Understanding this form is crucial for business trusts and foreign LLCs to optimize their tax strategy.

-

How can airSlate SignNow help with Form 3574 Special Election For Business Trusts And Certain Foreign Single Member LLCs?

airSlate SignNow offers a streamlined platform for businesses to prepare, send, and eSign Form 3574 Special Election For Business Trusts And Certain Foreign Single Member LLCs. Our user-friendly interface ensures that you can complete the form accurately and efficiently. This saves time and reduces the risk of errors in your submission.

-

What are the pricing options for using airSlate SignNow for Form 3574?

airSlate SignNow provides flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans include features that support the completion and eSigning of Form 3574 Special Election For Business Trusts And Certain Foreign Single Member LLCs. You can choose a plan that fits your budget while ensuring compliance and efficiency.

-

What features does airSlate SignNow offer for managing Form 3574?

With airSlate SignNow, you can access features such as document templates, real-time collaboration, and secure eSigning for Form 3574 Special Election For Business Trusts And Certain Foreign Single Member LLCs. These features enhance your workflow and ensure that all parties can easily review and sign the document. Additionally, our platform provides tracking and reminders to keep your process on schedule.

-

Are there any integrations available with airSlate SignNow for Form 3574?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms to enhance your experience with Form 3574 Special Election For Business Trusts And Certain Foreign Single Member LLCs. You can connect with popular tools like Google Drive, Dropbox, and CRM systems to streamline your document management process. This integration helps you maintain a cohesive workflow across your business operations.

-

What are the benefits of using airSlate SignNow for Form 3574?

Using airSlate SignNow for Form 3574 Special Election For Business Trusts And Certain Foreign Single Member LLCs offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete and sign documents electronically, which speeds up the process and minimizes the risk of lost paperwork. Additionally, our security measures ensure that your sensitive information is protected.

-

Is airSlate SignNow compliant with legal standards for Form 3574?

Absolutely! airSlate SignNow is designed to comply with all legal standards for electronic signatures and document management, including those relevant to Form 3574 Special Election For Business Trusts And Certain Foreign Single Member LLCs. Our platform adheres to the ESIGN Act and UETA, ensuring that your electronically signed documents are legally binding and enforceable.

Get more for Form 3574 Special Election For Business Trusts And Certain Foreign Single Member LLCs

Find out other Form 3574 Special Election For Business Trusts And Certain Foreign Single Member LLCs

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself