One Time Payee B10 Form

What is the One Time Payee B10

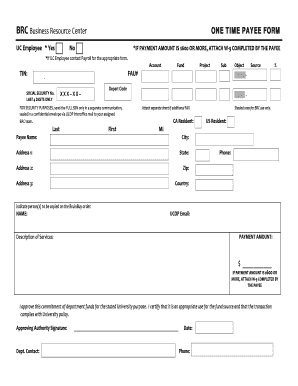

The One Time Payee B10 is a specific form used primarily for reporting payments made to individuals or entities that are not regular payees. This form is essential for ensuring compliance with IRS regulations regarding tax reporting. It typically applies to one-time payments made for services rendered or goods provided, where the recipient does not have an established business relationship with the payer.

How to use the One Time Payee B10

To use the One Time Payee B10, you must first gather the necessary information about the payee, including their name, address, and taxpayer identification number (TIN). The form requires details about the payment amount and the purpose of the payment. Once completed, the form should be submitted to the appropriate tax authority to ensure proper reporting of the transaction.

Steps to complete the One Time Payee B10

Completing the One Time Payee B10 involves several key steps:

- Obtain the form from the IRS website or your tax professional.

- Fill in the payee's information, including their name, address, and TIN.

- Specify the payment amount and the reason for the payment.

- Review the form for accuracy and completeness.

- Submit the form to the IRS or state tax authority as required.

Legal use of the One Time Payee B10

The One Time Payee B10 must be used in accordance with IRS guidelines to ensure that all payments are reported correctly. Failure to use the form properly can result in penalties for both the payer and the payee. It is important to maintain accurate records of all transactions reported on this form for future reference and compliance checks.

Key elements of the One Time Payee B10

Key elements of the One Time Payee B10 include:

- The payee's full legal name and address.

- The payee's TIN, which is essential for tax reporting.

- The total amount of payment made.

- The purpose of the payment, which helps clarify the nature of the transaction.

Filing Deadlines / Important Dates

Filing deadlines for the One Time Payee B10 are critical to avoid penalties. Generally, the form must be filed by January thirty-first of the year following the payment. It is advisable to check for any updates or specific state requirements that may affect these deadlines.

Examples of using the One Time Payee B10

Examples of situations where the One Time Payee B10 may be applicable include:

- Payment to a contractor for a one-time service.

- Reimbursement to an individual for a specific expense.

- Payment for a prize or award to a non-employee.

Quick guide on how to complete one time payee b10

Accomplish [SKS] seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Handle [SKS] on any platform using airSlate SignNow Android or iOS applications and enhance any document-based task today.

How to update and eSign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant parts of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you prefer to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you choose. Revise and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to One Time Payee B10

Create this form in 5 minutes!

How to create an eSignature for the one time payee b10

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the One Time Payee B10 feature in airSlate SignNow?

The One Time Payee B10 feature in airSlate SignNow allows businesses to streamline their payment processes by enabling one-time payments to specific payees. This feature simplifies transactions, ensuring that payments are processed quickly and securely. With this functionality, users can easily manage and track their one-time payments without hassle.

-

How does the One Time Payee B10 feature benefit my business?

Utilizing the One Time Payee B10 feature can signNowly enhance your business's efficiency by reducing the time spent on payment processing. It allows for quick and secure transactions, minimizing the risk of errors. Additionally, this feature helps maintain accurate records of payments, which is essential for financial tracking and reporting.

-

What are the pricing options for using the One Time Payee B10 feature?

airSlate SignNow offers competitive pricing for the One Time Payee B10 feature, which is included in various subscription plans. Depending on your business needs, you can choose a plan that best fits your budget while still providing access to this valuable feature. For detailed pricing information, visit our pricing page or contact our sales team.

-

Can I integrate the One Time Payee B10 feature with other software?

Yes, the One Time Payee B10 feature can be seamlessly integrated with various third-party applications and software. This integration allows for a more streamlined workflow, enabling businesses to manage payments alongside other operational tasks. Check our integrations page for a list of compatible applications.

-

Is the One Time Payee B10 feature secure?

Absolutely! The One Time Payee B10 feature in airSlate SignNow is designed with security in mind. We utilize advanced encryption and security protocols to ensure that all transactions are safe and confidential. Your business can trust that sensitive payment information is protected at all times.

-

How can I get started with the One Time Payee B10 feature?

Getting started with the One Time Payee B10 feature is easy! Simply sign up for an airSlate SignNow account and choose a plan that includes this feature. Once your account is set up, you can begin sending and managing one-time payments effortlessly.

-

What types of documents can I use with the One Time Payee B10 feature?

The One Time Payee B10 feature can be used with various types of documents, including invoices, contracts, and payment authorizations. This versatility allows businesses to handle different payment scenarios efficiently. You can customize documents to suit your specific needs while utilizing the One Time Payee B10 functionality.

Get more for One Time Payee B10

Find out other One Time Payee B10

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors