Form W 4 W 4 Finezi

What is the Form W-4 Finezi

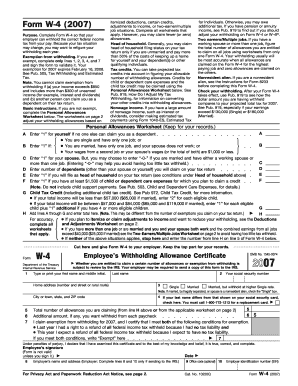

The Form W-4 Finezi is a crucial document used by employees in the United States to indicate their tax withholding preferences to their employer. This form allows individuals to specify the amount of federal income tax that should be withheld from their paychecks. By accurately completing the W-4, employees can ensure that they are not over- or under-withheld, which can significantly affect their tax obligations at the end of the year.

How to use the Form W-4 Finezi

Using the Form W-4 Finezi involves a few straightforward steps. First, employees need to obtain the form from their employer or download it from the IRS website. After acquiring the form, individuals should fill it out by providing their personal information, including name, address, and Social Security number. Next, they will indicate their filing status and any additional allowances or deductions they wish to claim. Once completed, the form should be submitted to the employer to update the tax withholding settings.

Steps to complete the Form W-4 Finezi

Completing the Form W-4 Finezi requires careful attention to detail. Follow these steps for accurate completion:

- Enter your personal information, including your full name, address, and Social Security number.

- Select your filing status: single, married filing jointly, married filing separately, or head of household.

- Claim any dependents you have and indicate any additional amount you want withheld from each paycheck.

- Sign and date the form to certify that the information provided is accurate.

Legal use of the Form W-4 Finezi

The Form W-4 Finezi is legally binding once submitted to an employer. It is essential for employees to provide accurate information, as incorrect details can lead to improper tax withholding. The IRS requires employers to keep the W-4 on file for at least four years. Employees can update their W-4 at any time, especially after significant life changes, such as marriage or the birth of a child, which may affect their tax situation.

Filing Deadlines / Important Dates

While there is no specific deadline for submitting the Form W-4 Finezi, it is advisable to complete it as soon as employment begins or when there are changes in personal circumstances. Employers are required to implement the new withholding instructions within a reasonable time frame. Additionally, employees should review and potentially update their W-4 at the beginning of each tax year or after major life events to ensure accurate withholding throughout the year.

Examples of using the Form W-4 Finezi

There are various scenarios in which the Form W-4 Finezi is utilized. For instance, a newly married individual may choose to adjust their withholding to reflect their new filing status, potentially lowering their tax burden. Similarly, a parent may complete the form to claim additional allowances for dependents, which can increase their take-home pay. Each of these examples highlights the importance of the W-4 in managing tax liabilities effectively.

Quick guide on how to complete form w 4 w 4 finezi

Complete [SKS] effortlessly on any device

Online document management has become prevalent among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed papers, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow Android or iOS applications and enhance any document-centered workflow today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign [SKS] and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form W 4 W 4 Finezi

Create this form in 5 minutes!

How to create an eSignature for the form w 4 w 4 finezi

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form W 4 W 4 Finezi and how does it work?

The Form W 4 W 4 Finezi is a tax form used by employees to indicate their tax withholding preferences. By utilizing airSlate SignNow, users can easily fill out, sign, and send this form electronically, streamlining the process and ensuring accuracy.

-

How can airSlate SignNow help with the Form W 4 W 4 Finezi?

airSlate SignNow simplifies the completion and submission of the Form W 4 W 4 Finezi by providing an intuitive interface for electronic signatures and document management. This ensures that your tax forms are processed quickly and securely.

-

What are the pricing options for using airSlate SignNow for the Form W 4 W 4 Finezi?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for individuals and teams. Each plan provides access to features that enhance the management of documents like the Form W 4 W 4 Finezi.

-

Are there any integrations available for the Form W 4 W 4 Finezi with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications, allowing users to manage the Form W 4 W 4 Finezi alongside other business tools. This integration enhances workflow efficiency and document accessibility.

-

What are the benefits of using airSlate SignNow for the Form W 4 W 4 Finezi?

Using airSlate SignNow for the Form W 4 W 4 Finezi offers numerous benefits, including reduced processing time, enhanced security, and improved accuracy. The platform's user-friendly design makes it easy for anyone to navigate and complete their forms.

-

Is airSlate SignNow secure for handling the Form W 4 W 4 Finezi?

Absolutely! airSlate SignNow employs advanced security measures to protect sensitive information, including the Form W 4 W 4 Finezi. Users can trust that their data is safe and compliant with industry standards.

-

Can I track the status of my Form W 4 W 4 Finezi submissions with airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow users to monitor the status of their Form W 4 W 4 Finezi submissions. This transparency helps ensure that all documents are processed in a timely manner.

Get more for Form W 4 W 4 Finezi

- Request to transfer cpe credit university of dallas form

- Special event set up diagram worksheet form

- Health insurance affidavit university of dallas udallas form

- The university of dallas udallas form

- Resident assistant application questions udayton form

- Urban teacher academy udayton form

- Nmif scholarship application national military form

- Www cla amsterdam com form

Find out other Form W 4 W 4 Finezi

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online