QUALIFIED DCAP EXPENSES Form

What are qualified DCAP expenses?

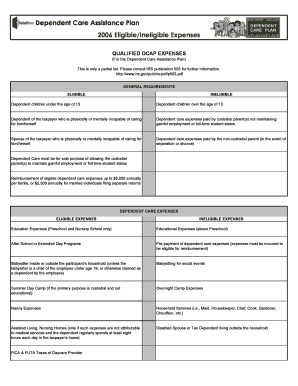

Qualified DCAP expenses refer to the costs associated with dependent care that can be reimbursed under a dependent care assistance program. These expenses typically include payments made for the care of a child or dependent while the parent or guardian is at work or seeking employment. Eligible expenses may cover daycare, preschool, and after-school programs for children under the age of thirteen, as well as care for a spouse or dependent who is unable to care for themselves due to physical or mental limitations.

Eligibility criteria for qualified DCAP expenses

To qualify for reimbursement under a dependent care assistance program, certain criteria must be met. The care must be necessary for the parent or guardian to work or look for work. Additionally, the care provider must not be a relative of the child or dependent, unless they are a licensed daycare provider. The expenses must also be incurred while the parent is working, and the total amount eligible for reimbursement is subject to annual limits set by the IRS.

Steps to complete the qualified DCAP expenses form

Completing the form for qualified DCAP expenses involves several important steps. First, gather all necessary documentation, including receipts and proof of payment for dependent care services. Next, fill out the required sections of the form, ensuring that all information is accurate and complete. Be sure to include the names and addresses of the care providers, as well as the total amount of expenses incurred. Finally, submit the form according to your employer's guidelines, which may include online submission or mailing the completed form to the HR department.

IRS guidelines for qualified DCAP expenses

The IRS provides specific guidelines regarding qualified DCAP expenses, including limits on the amount that can be claimed. For the tax year, the maximum amount that can be excluded from income is typically up to five thousand dollars for married couples filing jointly or two thousand five hundred dollars for single filers. It is important to track expenses accurately and retain all receipts, as the IRS may require documentation to substantiate claims made on tax returns.

Examples of qualified DCAP expenses

Examples of qualified DCAP expenses include payments made to daycare centers, nursery schools, and babysitters for children under the age of thirteen. Additionally, expenses for summer day camps, before and after school programs, and care for a disabled spouse or dependent are also considered qualified. It is essential to ensure that the care provided meets the IRS criteria to qualify for reimbursement.

Required documents for qualified DCAP expenses

To claim qualified DCAP expenses, specific documentation is required. This includes receipts from care providers, which should detail the services provided, the dates of care, and the total amount paid. Additionally, you may need to provide the care provider's tax identification number or Social Security number. Keeping organized records will help streamline the reimbursement process and ensure compliance with IRS regulations.

Quick guide on how to complete qualified dcap expenses

Prepare [SKS] effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals alike. It serves as a superb environmentally friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any platform using the airSlate SignNow Android or iOS applications and streamline any document-centric process today.

How to modify and electronically sign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize essential sections of the documents or redact sensitive information with tools that airSlate SignNow offers for this purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign [SKS] and guarantee exceptional communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to QUALIFIED DCAP EXPENSES

Create this form in 5 minutes!

How to create an eSignature for the qualified dcap expenses

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are QUALIFIED DCAP EXPENSES?

QUALIFIED DCAP EXPENSES refer to the eligible costs associated with dependent care assistance programs. These expenses can include daycare services, after-school programs, and other childcare-related costs. Understanding these expenses is crucial for maximizing your benefits and ensuring compliance with IRS regulations.

-

How can airSlate SignNow help manage QUALIFIED DCAP EXPENSES?

airSlate SignNow provides a streamlined platform for managing documents related to QUALIFIED DCAP EXPENSES. With our eSigning capabilities, you can easily sign and send necessary forms, ensuring that your dependent care claims are processed quickly and efficiently. This saves time and reduces the hassle of paperwork.

-

Are there any fees associated with using airSlate SignNow for QUALIFIED DCAP EXPENSES?

airSlate SignNow offers a cost-effective solution with transparent pricing plans. While there may be subscription fees, the savings from efficiently managing QUALIFIED DCAP EXPENSES can outweigh these costs. We provide various plans to suit different business needs, ensuring you find the right fit.

-

What features does airSlate SignNow offer for handling QUALIFIED DCAP EXPENSES?

Our platform includes features such as customizable templates, secure eSigning, and document tracking, all tailored for managing QUALIFIED DCAP EXPENSES. These tools help streamline the documentation process, making it easier for businesses to handle dependent care claims efficiently.

-

Can airSlate SignNow integrate with other software for managing QUALIFIED DCAP EXPENSES?

Yes, airSlate SignNow offers integrations with various HR and accounting software, enhancing your ability to manage QUALIFIED DCAP EXPENSES. This connectivity allows for seamless data transfer and ensures that all relevant information is easily accessible, improving overall efficiency.

-

What are the benefits of using airSlate SignNow for QUALIFIED DCAP EXPENSES?

Using airSlate SignNow for QUALIFIED DCAP EXPENSES provides numerous benefits, including reduced paperwork, faster processing times, and enhanced compliance. Our user-friendly interface ensures that both employees and administrators can navigate the system with ease, leading to a more efficient claims process.

-

Is airSlate SignNow secure for handling sensitive information related to QUALIFIED DCAP EXPENSES?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that all documents related to QUALIFIED DCAP EXPENSES are protected. We utilize advanced encryption and security protocols to safeguard sensitive information, giving you peace of mind while managing your dependent care claims.

Get more for QUALIFIED DCAP EXPENSES

- The motor trader proposal form tradex insurance

- Sadhu family benefit plan application formprincipa

- Ausfuhr und abnehmerbescheinigung fr umsatzsteuerzwecke bei form

- Behindt hewheel agreement cheap driving school keysdrivingschool form

- Tennis ball machinewaiver and release 01 form

- Psta disadvantaged transportation application careersource form

- Armenia visa application form

- Form 261 specification sheet for ashe section viii

Find out other QUALIFIED DCAP EXPENSES

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word