Trust Agreement F&A Federal Credit Union Form

What is the Trust Agreement F&A Federal Credit Union

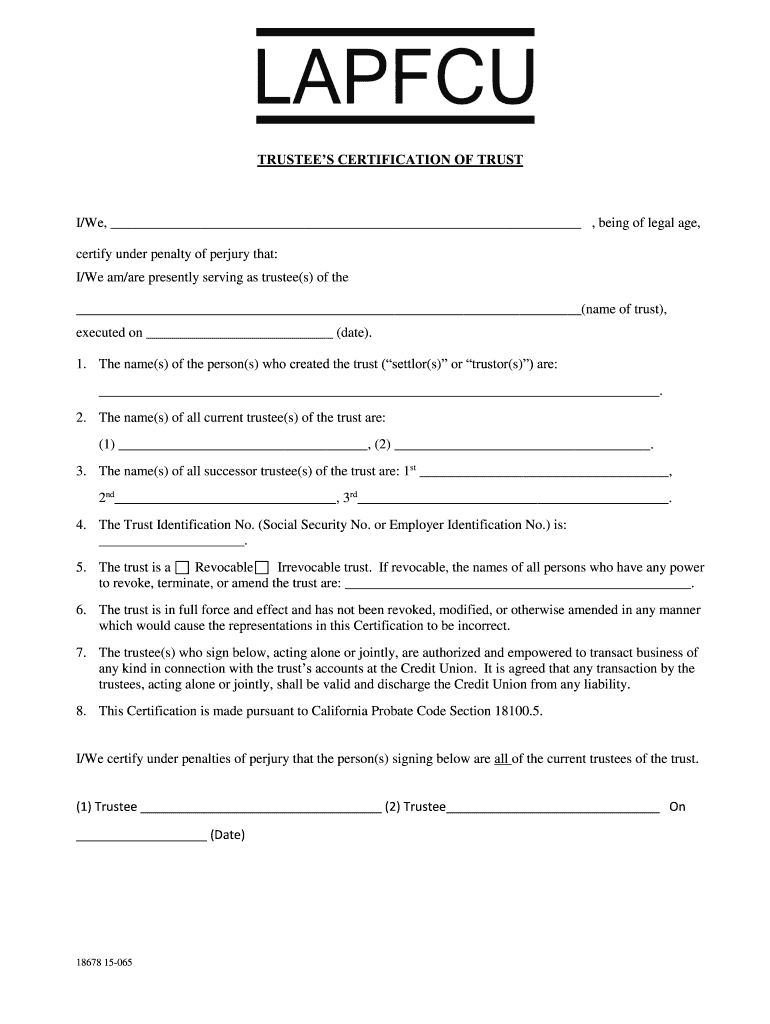

The Trust Agreement at F&A Federal Credit Union outlines the terms and conditions under which a trust is established and managed. It serves as a legal document that details the roles and responsibilities of the trustee, the rights of the beneficiaries, and the management of trust property. This agreement is essential for ensuring that the trust operates in accordance with the settlor's wishes and complies with applicable laws. Understanding the key components of the Trust Agreement can help individuals navigate their financial and estate planning needs effectively.

Steps to complete the Trust Agreement F&A Federal Credit Union

Completing the Trust Agreement involves several important steps to ensure that all necessary information is accurately provided. First, gather all required documents, including identification and any existing trust documents. Next, fill out the Trust Agreement form, ensuring that all fields are completed. It is crucial to specify the trust property and identify the beneficiaries clearly. Once the form is filled out, review it for accuracy before signing. Finally, submit the completed agreement to F&A Federal Credit Union for processing. This thorough approach will help in establishing a legally binding trust.

Key elements of the Trust Agreement F&A Federal Credit Union

Several key elements are fundamental to the Trust Agreement at F&A Federal Credit Union. These include the identification of the settlor, who creates the trust, and the designation of the trustee, who will manage the trust assets. The agreement should also specify the beneficiaries, detailing their rights to the trust property. Additionally, the terms of the trust, including how assets will be distributed and managed, must be clearly outlined. Understanding these elements is vital for ensuring that the trust functions as intended and meets legal requirements.

Legal use of the Trust Agreement F&A Federal Credit Union

The legal use of the Trust Agreement at F&A Federal Credit Union is governed by state and federal laws. It is essential that the agreement complies with relevant regulations to ensure its enforceability. The trust must be executed in accordance with the laws of the state where it is established, which may include specific requirements for signatures and notarization. Additionally, the agreement should align with IRS guidelines regarding taxation and reporting of trust income. Proper legal use of the Trust Agreement safeguards the interests of both the settlor and the beneficiaries.

How to obtain the Trust Agreement F&A Federal Credit Union

To obtain the Trust Agreement from F&A Federal Credit Union, individuals can visit their local branch or access the credit union's website. The agreement may be available as a downloadable form, or staff members can provide a physical copy upon request. It is advisable to review any accompanying instructions or guidelines to ensure that all necessary information is included when completing the form. For specific inquiries, contacting customer service can provide additional assistance in obtaining the Trust Agreement.

Examples of using the Trust Agreement F&A Federal Credit Union

Examples of using the Trust Agreement at F&A Federal Credit Union can illustrate its practical applications. For instance, a parent may establish a trust to manage assets for their minor children, ensuring that funds are available for education and other needs. Another example is a business owner creating a trust to manage company assets and provide for family members in the event of their passing. These scenarios demonstrate how the Trust Agreement can be tailored to meet individual needs while providing security and clarity regarding asset management.

Quick guide on how to complete trust agreement fampampa federal credit union

Effortlessly Prepare Trust Agreement F&A Federal Credit Union on Any Device

The management of online documents has gained traction among businesses and individuals. It offers an ideal eco-conscious substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents promptly without any hassle. Manage Trust Agreement F&A Federal Credit Union on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

Edit and eSign Trust Agreement F&A Federal Credit Union with Ease

- Locate Trust Agreement F&A Federal Credit Union and click Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight important sections of your documents or obscure sensitive information with the specific tools provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and hit the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, or an invitation link, or download it to your computer.

Put an end to misplaced or lost documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your preferred device. Edit and eSign Trust Agreement F&A Federal Credit Union to ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the trust agreement fampampa federal credit union

The way to make an electronic signature for your PDF document in the online mode

The way to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to make an eSignature from your mobile device

The way to generate an electronic signature for a PDF document on iOS devices

How to make an eSignature for a PDF file on Android devices

People also ask

-

What services does f7a federal credit union offer?

The f7a federal credit union provides a range of financial services, including savings accounts, loans, credit cards, and mortgage options. Members benefit from competitive rates and personalized customer service. It's designed to meet the financial needs of both individuals and businesses.

-

How can I become a member of f7a federal credit union?

To join f7a federal credit union, you need to meet specific membership eligibility criteria, which typically include living or working in certain areas or being part of affiliated organizations. Once eligible, you can apply online or visit a branch to set up your account. Membership grants access to a wide range of financial products.

-

What are the fees associated with f7a federal credit union accounts?

f7a federal credit union prides itself on low fees and competitive pricing for its accounts. Many services, like checking and savings accounts, often have minimal or no monthly maintenance fees. However, it's essential to review the fee schedule for specific services, as they can vary.

-

Does f7a federal credit union offer mobile banking?

Yes, f7a federal credit union offers a robust mobile banking app that allows members to manage their finances on-the-go. Through the app, you can check balances, transfer funds, and deposit checks conveniently. It enhances accessibility and provides a user-friendly experience.

-

What types of loans does f7a federal credit union provide?

f7a federal credit union provides various loans, including personal loans, auto loans, and home equity lines of credit. Their loan products come with competitive interest rates, making them an attractive option for borrowing. Members can apply online or in person to explore different financing options.

-

How can I ensure my personal information is secure with f7a federal credit union?

f7a federal credit union takes member security seriously and employs multiple layers of encryption and security protocols to protect your personal information. Regular security audits and updates are performed to maintain the highest security standards. Additionally, members are encouraged to practice safe online banking habits.

-

Can I use f7a federal credit union ATMs nationwide?

Yes, f7a federal credit union provides access to a nationwide ATM network, allowing members to withdraw cash without incurring fees at thousands of locations. It's beneficial for members who travel frequently or need cash while away from their home branch. You can find your nearest ATM using the credit union’s mobile app.

Get more for Trust Agreement F&A Federal Credit Union

- Real estate transaction make form

- Spouse no children form

- Louisiana commercial building or space lease form

- Louisiana sale vehicle form

- Louisiana special durable power of attorney for bank account matters form

- Massachusetts month form

- Massachusetts special or limited power of attorney for real estate sales transaction by seller form

- Real estate transaction 481378063 form

Find out other Trust Agreement F&A Federal Credit Union

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple