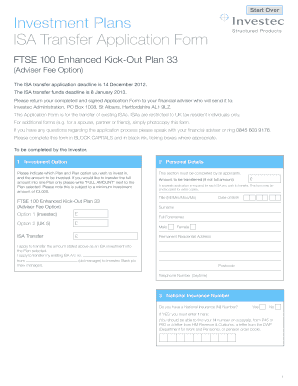

FTSE 100 Enhanced Kick Out Plan 33 Form

What is the FTSE 100 Enhanced Kick Out Plan 33

The FTSE 100 Enhanced Kick Out Plan 33 is a structured investment product designed to provide investors with potential returns linked to the performance of the FTSE 100 index. This plan typically offers a set maturity date and predefined conditions under which investors can receive their capital back along with potential interest payments. If the FTSE 100 index meets certain performance criteria at specified observation dates, investors may receive a return before the maturity date, hence the term "kick out." This product is aimed at those seeking a balance between risk and reward while investing in the stock market.

How to use the FTSE 100 Enhanced Kick Out Plan 33

Using the FTSE 100 Enhanced Kick Out Plan 33 involves several steps. First, investors should assess their financial goals and risk tolerance. Once they determine that this plan aligns with their investment strategy, they can proceed to purchase the plan through a financial advisor or directly from a financial institution offering it. After acquiring the plan, investors need to monitor the performance of the FTSE 100 index at the designated observation dates to see if the kick-out conditions are met. If the conditions are satisfied, the investment may mature early, allowing for potential returns.

Key elements of the FTSE 100 Enhanced Kick Out Plan 33

Several key elements define the FTSE 100 Enhanced Kick Out Plan 33. These include:

- Kick-out conditions: Specific performance metrics of the FTSE 100 index that determine if the investment matures early.

- Maturity date: The date when the investment is scheduled to mature if the kick-out conditions are not met.

- Potential returns: The interest payments or capital returns that investors may receive based on the plan's performance.

- Investment horizon: The timeframe for which the investment is made, usually spanning several years.

Steps to complete the FTSE 100 Enhanced Kick Out Plan 33

Completing the FTSE 100 Enhanced Kick Out Plan 33 involves a series of methodical steps:

- Evaluate your investment objectives and risk tolerance.

- Consult with a financial advisor to understand the product fully.

- Complete the necessary application forms provided by the financial institution.

- Submit the forms along with any required documentation.

- Monitor the performance of the FTSE 100 index at each observation date.

Eligibility Criteria

To invest in the FTSE 100 Enhanced Kick Out Plan 33, individuals must meet certain eligibility criteria. Generally, investors should be of legal age, typically eighteen years or older, and possess a valid identification document. Additionally, some financial institutions may require investors to demonstrate a certain level of financial literacy or investment experience. It is advisable to review specific eligibility requirements with the issuing institution before proceeding.

Legal use of the FTSE 100 Enhanced Kick Out Plan 33

The FTSE 100 Enhanced Kick Out Plan 33 is legally recognized as a structured investment product. Investors should ensure compliance with all applicable securities regulations and guidelines when purchasing and holding this investment. It is important to understand the legal implications, including tax obligations and reporting requirements, associated with the returns generated from this plan. Consulting with a financial or legal advisor can provide clarity on these matters.

Quick guide on how to complete ftse 100 enhanced kick out plan 33

Prepare [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources you need to produce, modify, and eSign your documents quickly and without hassle. Manage [SKS] on any device with the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method of delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to FTSE 100 Enhanced Kick Out Plan 33

Create this form in 5 minutes!

How to create an eSignature for the ftse 100 enhanced kick out plan 33

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FTSE 100 Enhanced Kick Out Plan 33?

The FTSE 100 Enhanced Kick Out Plan 33 is a structured investment product that offers potential returns linked to the performance of the FTSE 100 index. It is designed for investors seeking a balance between risk and reward, providing opportunities for capital growth while offering a level of protection against market downturns.

-

How does the FTSE 100 Enhanced Kick Out Plan 33 work?

The FTSE 100 Enhanced Kick Out Plan 33 works by allowing investors to benefit from the performance of the FTSE 100 index over a specified term. If the index performs well, investors may receive a fixed return at predetermined intervals, while also having the potential for early maturity if certain conditions are met.

-

What are the key benefits of investing in the FTSE 100 Enhanced Kick Out Plan 33?

Investing in the FTSE 100 Enhanced Kick Out Plan 33 offers several benefits, including the potential for higher returns compared to traditional savings accounts. Additionally, it provides a degree of capital protection, making it an attractive option for risk-averse investors looking to grow their wealth.

-

What is the pricing structure for the FTSE 100 Enhanced Kick Out Plan 33?

The pricing structure for the FTSE 100 Enhanced Kick Out Plan 33 typically includes an initial investment amount, which may vary based on the provider. It's important to review any associated fees or charges that may apply, as these can impact overall returns.

-

Are there any risks associated with the FTSE 100 Enhanced Kick Out Plan 33?

Yes, like any investment, the FTSE 100 Enhanced Kick Out Plan 33 carries risks, including market risk and the potential for loss of capital. Investors should carefully consider their risk tolerance and investment goals before participating in this plan.

-

Can the FTSE 100 Enhanced Kick Out Plan 33 be integrated with other investment strategies?

Yes, the FTSE 100 Enhanced Kick Out Plan 33 can be integrated with other investment strategies to create a diversified portfolio. By combining this plan with other asset classes, investors can potentially enhance their overall returns while managing risk.

-

How can I get started with the FTSE 100 Enhanced Kick Out Plan 33?

To get started with the FTSE 100 Enhanced Kick Out Plan 33, you should contact a financial advisor or investment provider that offers this product. They can guide you through the application process and help you understand the terms and conditions associated with the plan.

Get more for FTSE 100 Enhanced Kick Out Plan 33

Find out other FTSE 100 Enhanced Kick Out Plan 33

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed