MICHIGAN 1ST MORTGAGE BROKERLENDERSERVICER Mortgage Nationwidelicensingsystem Form

Understanding the MICHIGAN 1ST MORTGAGE BROKERLENDERSERVICER Mortgage Nationwidelicensingsystem

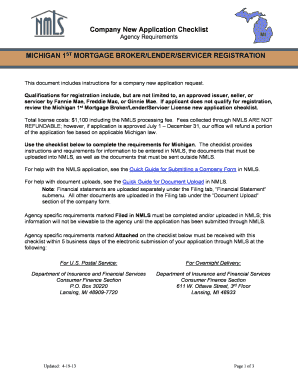

The MICHIGAN 1ST MORTGAGE BROKERLENDERSERVICER Mortgage Nationwidelicensingsystem is a regulatory framework designed to oversee mortgage brokers, lenders, and servicers operating within Michigan. This system ensures that all entities involved in mortgage transactions adhere to state and federal laws, promoting transparency and consumer protection. It encompasses licensing requirements, compliance standards, and operational guidelines that must be followed to maintain legal standing in the mortgage industry.

Steps to Complete the MICHIGAN 1ST MORTGAGE BROKERLENDERSERVICER Mortgage Nationwidelicensingsystem

Completing the MICHIGAN 1ST MORTGAGE BROKERLENDERSERVICER Mortgage Nationwidelicensingsystem involves several critical steps:

- Gather necessary documentation, including proof of identity, financial statements, and business licenses.

- Submit an application through the Nationwide Multistate Licensing System (NMLS), ensuring all information is accurate and complete.

- Pay applicable fees associated with the licensing process.

- Complete any required pre-licensing education courses, if applicable.

- Pass background checks, including credit history and criminal background checks.

- Maintain compliance with ongoing education and renewal requirements to keep the license active.

Legal Use of the MICHIGAN 1ST MORTGAGE BROKERLENDERSERVICER Mortgage Nationwidelicensingsystem

Legal use of the MICHIGAN 1ST MORTGAGE BROKERLENDERSERVICER Mortgage Nationwidelicensingsystem is essential for all mortgage professionals. This system establishes the legal framework that governs how mortgage brokers, lenders, and servicers operate. Adhering to these regulations helps prevent fraud, ensures fair lending practices, and protects consumers' rights. Entities must remain informed about changes in legislation and compliance requirements to avoid penalties and maintain their licenses.

Eligibility Criteria for the MICHIGAN 1ST MORTGAGE BROKERLENDERSERVICER Mortgage Nationwidelicensingsystem

Eligibility for the MICHIGAN 1ST MORTGAGE BROKERLENDERSERVICER Mortgage Nationwidelicensingsystem requires applicants to meet specific criteria:

- Applicants must be at least eighteen years old and possess a high school diploma or equivalent.

- Demonstrated financial responsibility, including a satisfactory credit history, is required.

- Completion of pre-licensing education courses is mandatory, covering topics relevant to mortgage lending and servicing.

- Applicants must not have any felony convictions or certain misdemeanors that could impact their ability to operate in the mortgage industry.

Key Elements of the MICHIGAN 1ST MORTGAGE BROKERLENDERSERVICER Mortgage Nationwidelicensingsystem

Key elements of the MICHIGAN 1ST MORTGAGE BROKERLENDERSERVICER Mortgage Nationwidelicensingsystem include:

- Licensing requirements that ensure all mortgage professionals are qualified and adhere to industry standards.

- Consumer protection measures that promote transparency and fair practices in mortgage transactions.

- Compliance monitoring to ensure ongoing adherence to state and federal regulations.

- Continuing education requirements to keep professionals updated on industry changes and best practices.

How to Obtain the MICHIGAN 1ST MORTGAGE BROKERLENDERSERVICER Mortgage Nationwidelicensingsystem

Obtaining the MICHIGAN 1ST MORTGAGE BROKERLENDERSERVICER Mortgage Nationwidelicensingsystem involves a systematic approach:

- Register on the NMLS website and create an account to begin the application process.

- Complete the application form, providing all required personal and business information.

- Submit necessary documentation, including proof of education and financial responsibility.

- Pay the required fees associated with the licensing application.

- Complete any additional requirements, such as background checks and pre-licensing education.

Quick guide on how to complete michigan 1st mortgage brokerlenderservicer mortgage nationwidelicensingsystem

Complete [SKS] seamlessly on any device

Online document management has become widely embraced by companies and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, enabling you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to adjust and eSign [SKS] effortlessly

- Obtain [SKS] and click Get Form to begin.

- Use the tools at your disposal to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, text message (SMS), invitation link, or by downloading it to your computer.

Say goodbye to lost or misplaced files, daunting form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign [SKS] and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the michigan 1st mortgage brokerlenderservicer mortgage nationwidelicensingsystem

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MICHIGAN 1ST MORTGAGE BROKERLENDERSERVICER Mortgage Nationwidelicensingsystem?

The MICHIGAN 1ST MORTGAGE BROKERLENDERSERVICER Mortgage Nationwidelicensingsystem is a regulatory framework that ensures mortgage brokers and lenders in Michigan operate under specific licensing requirements. This system helps maintain industry standards and protects consumers during the mortgage process.

-

How can airSlate SignNow assist with the MICHIGAN 1ST MORTGAGE BROKERLENDERSERVICER Mortgage Nationwidelicensingsystem?

airSlate SignNow provides a streamlined platform for mortgage professionals to manage documents efficiently while complying with the MICHIGAN 1ST MORTGAGE BROKERLENDERSERVICER Mortgage Nationwidelicensingsystem. Our eSigning solution ensures that all documents are securely signed and stored, facilitating compliance with state regulations.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses in the mortgage industry, including those operating under the MICHIGAN 1ST MORTGAGE BROKERLENDERSERVICER Mortgage Nationwidelicensingsystem. Our plans are designed to be cost-effective, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for mortgage professionals?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which are essential for mortgage professionals. These features help streamline workflows and ensure compliance with the MICHIGAN 1ST MORTGAGE BROKERLENDERSERVICER Mortgage Nationwidelicensingsystem.

-

How does airSlate SignNow enhance collaboration among mortgage teams?

With airSlate SignNow, mortgage teams can collaborate in real-time, sharing documents and obtaining signatures quickly. This collaborative approach is particularly beneficial for those adhering to the MICHIGAN 1ST MORTGAGE BROKERLENDERSERVICER Mortgage Nationwidelicensingsystem, as it speeds up the mortgage process and improves efficiency.

-

Can airSlate SignNow integrate with other tools used in the mortgage industry?

Yes, airSlate SignNow seamlessly integrates with various CRM and document management systems commonly used in the mortgage industry. This integration is crucial for professionals working under the MICHIGAN 1ST MORTGAGE BROKERLENDERSERVICER Mortgage Nationwidelicensingsystem, as it enhances overall productivity and compliance.

-

What benefits does airSlate SignNow provide for compliance with state regulations?

airSlate SignNow helps mortgage professionals maintain compliance with state regulations, including the MICHIGAN 1ST MORTGAGE BROKERLENDERSERVICER Mortgage Nationwidelicensingsystem, by providing secure document management and eSigning capabilities. This ensures that all transactions are legally binding and properly documented.

Get more for MICHIGAN 1ST MORTGAGE BROKERLENDERSERVICER Mortgage Nationwidelicensingsystem

- This agreement made and entered into this date by and form

- Employment agreement general templateword ampamp pdfby form

- How to write an executive summary for your proposal bidsketch form

- 7 steps to create a powerful sales presentation form

- Cover letter essays examples topics titles ampamp outlines form

- How do you correctly write your address in one line answers form

- Due to the fact that form

- How to develop and write a grant proposal fasorg form

Find out other MICHIGAN 1ST MORTGAGE BROKERLENDERSERVICER Mortgage Nationwidelicensingsystem

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors