Historical Conventional Loan Limits Form

Understanding Historical Conventional Loan Limits

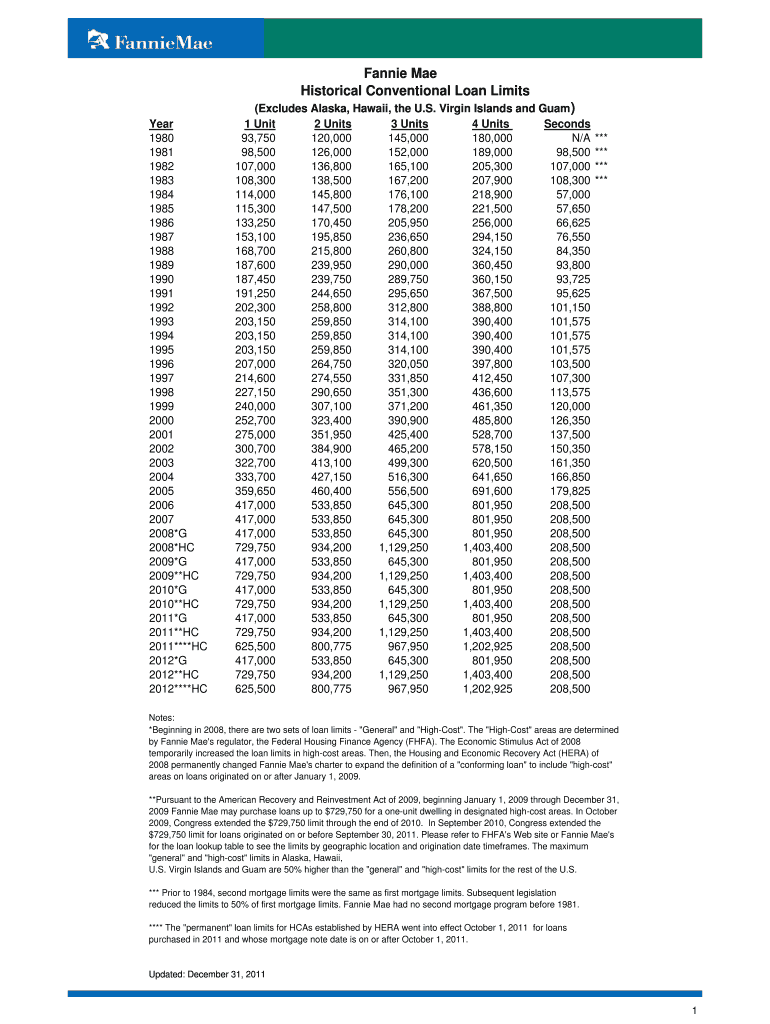

The Historical Conventional Loan Limits refer to the maximum amount of money that can be borrowed through conventional loans, which are not insured or guaranteed by the federal government. These limits vary by location and are influenced by factors such as the median home prices in different areas. Understanding these limits is crucial for potential homebuyers and real estate professionals, as they dictate the financing options available for purchasing homes.

How to Utilize Historical Conventional Loan Limits

To effectively use the Historical Conventional Loan Limits, individuals should first identify the limits specific to their area. This can typically be done through local housing authorities or financial institutions. Once the limits are established, potential borrowers can assess their purchasing power and determine what types of properties they can afford. It is also important to stay informed about any changes to these limits, as they can affect loan eligibility and terms.

Obtaining Historical Conventional Loan Limits Information

Information regarding Historical Conventional Loan Limits can be obtained from various sources. The Federal Housing Finance Agency (FHFA) publishes annual updates on conforming loan limits. Local banks and mortgage lenders also provide information tailored to specific regions. Additionally, real estate websites and local government resources can offer insights into historical trends and current limits, helping buyers make informed decisions.

Key Elements of Historical Conventional Loan Limits

Several key elements define Historical Conventional Loan Limits. These include:

- Geographic Variability: Limits differ by county and are often higher in metropolitan areas.

- Loan Type: There are distinctions between conforming and non-conforming loans.

- Annual Adjustments: Limits are reviewed and adjusted annually based on housing market conditions.

Understanding these elements helps borrowers navigate the lending landscape more effectively.

State-Specific Rules for Historical Conventional Loan Limits

Each state may have unique rules and regulations regarding Historical Conventional Loan Limits. These rules can affect how limits are set and adjusted, as well as the types of loans available to borrowers. It is essential for potential homebuyers to familiarize themselves with their state's specific guidelines, which can often be found on state housing authority websites or through local mortgage lenders.

Examples of Historical Conventional Loan Limits in Practice

For example, in 2023, the conforming loan limit for a single-family home in most parts of the United States was set at $726,200. However, in high-cost areas like San Francisco or New York City, the limit can exceed $1 million. These examples illustrate the importance of understanding local limits when considering home financing options.

Quick guide on how to complete historical conventional loan limits

Complete Historical Conventional Loan Limits effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Handle Historical Conventional Loan Limits on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Historical Conventional Loan Limits with ease

- Find Historical Conventional Loan Limits and then click Get Form to initiate the process.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal significance as a conventional ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Select how you would like to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Historical Conventional Loan Limits and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the historical conventional loan limits

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Historical Conventional Loan Limits?

Historical Conventional Loan Limits refer to the maximum loan amounts set by government-sponsored enterprises for conventional loans over the years. Understanding these limits is crucial for borrowers as they can impact loan eligibility and terms. By knowing the Historical Conventional Loan Limits, you can make informed decisions about your mortgage options.

-

How do Historical Conventional Loan Limits affect my mortgage application?

Historical Conventional Loan Limits play a signNow role in determining the amount you can borrow for a mortgage. If your desired loan amount exceeds these limits, you may need to consider alternative financing options. It's essential to review these limits to ensure your application aligns with current lending standards.

-

Where can I find the latest Historical Conventional Loan Limits?

You can find the latest Historical Conventional Loan Limits on the official websites of Fannie Mae and Freddie Mac, as they regularly update these figures. Additionally, mortgage lenders often provide this information to help you understand your borrowing capacity. Staying informed about these limits can help you plan your home purchase effectively.

-

How do Historical Conventional Loan Limits vary by location?

Historical Conventional Loan Limits can vary signNowly based on geographic location, reflecting local housing market conditions. High-cost areas typically have higher limits to accommodate the increased property values. It's important to check the specific limits for your area to understand your borrowing potential.

-

What benefits do Historical Conventional Loan Limits provide to borrowers?

Historical Conventional Loan Limits provide borrowers with a clear framework for understanding their mortgage options. By knowing these limits, you can better assess your financial situation and choose a loan that fits your needs. This knowledge can also help you avoid overextending your budget when purchasing a home.

-

Can Historical Conventional Loan Limits change over time?

Yes, Historical Conventional Loan Limits can change annually based on market conditions and housing prices. These adjustments are made to ensure that the limits remain relevant and accessible for borrowers. Keeping track of these changes is essential for anyone considering a conventional loan.

-

How does airSlate SignNow assist with understanding Historical Conventional Loan Limits?

While airSlate SignNow primarily focuses on document management and eSigning, it can help streamline the process of obtaining mortgage documents related to Historical Conventional Loan Limits. By using our platform, you can efficiently manage and sign necessary paperwork, ensuring a smoother mortgage application experience.

Get more for Historical Conventional Loan Limits

Find out other Historical Conventional Loan Limits

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure