Bank Validation Letter Form

What is the bank account verification letter?

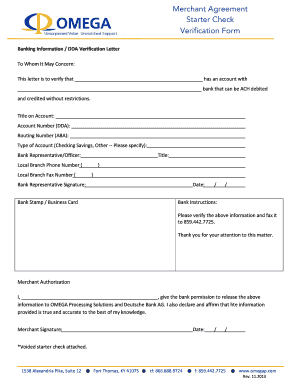

A bank account verification letter is an official document provided by a financial institution to confirm the existence and status of a bank account. This letter typically includes details such as the account holder's name, account number, and the date the account was opened. It serves as proof for various purposes, including loan applications, rental agreements, and identity verification. The letter is often required by businesses or organizations to ensure that the account information provided by an individual or entity is accurate and legitimate.

How to obtain the bank account verification letter

To obtain a bank account verification letter, account holders should follow these steps:

- Contact the bank: Reach out to the customer service department of your bank, either by phone or in person.

- Request the letter: Clearly state that you need a bank account verification letter and provide any necessary information, such as your account number and personal identification.

- Provide identification: Be prepared to present valid identification to verify your identity, such as a driver's license or passport.

- Receive the letter: The bank will process your request and provide the letter, either immediately or within a few business days.

Key elements of the bank account verification letter

A well-structured bank account verification letter should include several key elements to ensure its validity and usefulness:

- Bank's letterhead: The letter should be printed on official bank stationery, including the bank's name, logo, and contact information.

- Account holder's details: It must contain the full name of the account holder and any relevant account numbers.

- Account status: The letter should state whether the account is active, closed, or in good standing.

- Date of issuance: Include the date when the letter is issued to establish its timeliness.

- Bank representative's signature: A signature from an authorized bank representative adds authenticity to the document.

Steps to complete the bank account verification letter

Completing a bank account verification letter involves a few straightforward steps:

- Gather necessary information: Collect your personal details, including your full name, account number, and any other required identifiers.

- Contact your bank: Reach out to your bank to request the letter, specifying that it is for verification purposes.

- Provide identification: Present valid identification to confirm your identity and account ownership.

- Review the letter: Once you receive the letter, check it for accuracy and completeness before using it for your intended purpose.

Legal use of the bank account verification letter

The bank account verification letter is legally recognized as a formal document that can be used in various situations. It is often required for:

- Loan applications: Lenders may request this letter to verify your financial status.

- Rental agreements: Landlords may require proof of income or financial stability.

- Employment verification: Employers might ask for this document to confirm your financial reliability.

Using this letter appropriately can help ensure compliance with legal and financial requirements.

Examples of using the bank account verification letter

There are several scenarios where a bank account verification letter may be necessary:

- Applying for a mortgage: Lenders often require this letter to confirm your financial standing.

- Setting up utility services: Utility companies may request proof of your bank account for payment purposes.

- Opening a new account: Some banks require verification of existing accounts to assess your financial history.

These examples illustrate the importance of having a bank account verification letter readily available for various financial transactions.

Quick guide on how to complete bank validation letter

Effortlessly Prepare Bank Validation Letter on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers a wonderful eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the required format and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without hindrances. Manage Bank Validation Letter on any device using airSlate SignNow’s Android or iOS applications and enhance your document-related processes today.

How to Edit and Electronically Sign Bank Validation Letter with Ease

- Obtain Bank Validation Letter and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which only takes seconds and has the same legal validity as a standard ink signature.

- Review the information and hit the Done button to save your changes.

- Choose your preferred method for sending your document, whether by email, SMS, invite link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow simplifies your document management needs in just a few clicks from your chosen device. Edit and electronically sign Bank Validation Letter to ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bank validation letter

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a bank account verification letter?

A bank account verification letter is a document provided by a bank that confirms the existence of an account and its details. This letter is often required for various financial transactions, such as loan applications or account openings. Using airSlate SignNow, you can easily create and send this letter electronically, ensuring a quick and secure process.

-

How can airSlate SignNow help with bank account verification letters?

airSlate SignNow streamlines the process of creating and signing bank account verification letters. With our platform, you can customize templates, add necessary details, and send them for eSignature in just a few clicks. This not only saves time but also enhances the security of your documents.

-

Is there a cost associated with using airSlate SignNow for bank account verification letters?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our plans are designed to be cost-effective, allowing you to manage your document signing processes, including bank account verification letters, without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing bank account verification letters?

airSlate SignNow provides features such as customizable templates, automated workflows, and secure eSignature capabilities for bank account verification letters. You can track the status of your documents in real-time and receive notifications when they are signed. This ensures a smooth and efficient document management experience.

-

Can I integrate airSlate SignNow with other applications for bank account verification letters?

Absolutely! airSlate SignNow offers integrations with various applications, including CRM systems and cloud storage services. This allows you to seamlessly manage your bank account verification letters alongside other business processes, enhancing productivity and collaboration across your team.

-

What are the benefits of using airSlate SignNow for bank account verification letters?

Using airSlate SignNow for bank account verification letters provides numerous benefits, including increased efficiency, enhanced security, and reduced paper usage. Our platform allows for quick document turnaround times, ensuring that your verification letters are processed promptly. Additionally, the eSignature feature adds a layer of authenticity to your documents.

-

How secure is the process of sending bank account verification letters with airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure storage protocols to protect your bank account verification letters and other sensitive documents. Our platform complies with industry standards, ensuring that your information remains confidential and secure throughout the signing process.

Get more for Bank Validation Letter

Find out other Bank Validation Letter

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe