Gst523 1 2018-2026

What is the Gst523 1

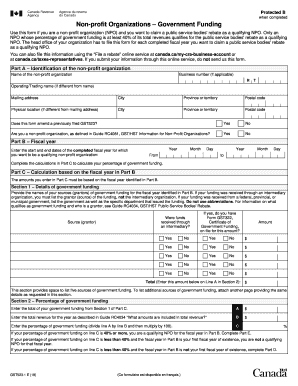

The Gst523 1 form is a crucial document used for various purposes, primarily related to government funding and financial reporting. It is designed to collect essential information from organizations applying for grants or financial assistance. The form ensures that applicants provide accurate and complete data, which is vital for the assessment and approval process. Understanding the purpose of the Gst523 1 is essential for organizations seeking to navigate the funding landscape effectively.

How to use the Gst523 1

Using the Gst523 1 form involves several steps to ensure that all required information is accurately captured. First, organizations should review the guidelines provided for the form to understand the necessary details. Next, gather all relevant documents and data that will be needed to complete the form. This may include financial statements, organizational information, and any supporting documentation required for the application. Once all information is ready, fill out the form carefully, ensuring that every section is completed accurately to avoid delays in processing.

Steps to complete the Gst523 1

Completing the Gst523 1 form can be streamlined by following these steps:

- Review the form instructions thoroughly.

- Gather all necessary documents, including financial records and organizational details.

- Fill out the form, ensuring all fields are completed accurately.

- Double-check the information for any errors or omissions.

- Submit the completed form through the designated method, whether online, by mail, or in person.

Legal use of the Gst523 1

The Gst523 1 form is legally binding, provided it is filled out correctly and submitted according to the relevant regulations. Organizations must ensure compliance with all applicable laws when using this form. This includes providing truthful and accurate information, as any discrepancies can lead to penalties or disqualification from funding opportunities. It is advisable to consult legal counsel or compliance experts when preparing the form to ensure all legal requirements are met.

Who Issues the Form

The Gst523 1 form is typically issued by government agencies or organizations responsible for administering grants and funding programs. These entities set the guidelines for the use of the form and oversee the application process. Understanding the issuing authority can help organizations stay informed about any changes to the form or the application process, ensuring they are always using the most current version.

Filing Deadlines / Important Dates

Filing deadlines for the Gst523 1 form can vary depending on the specific program or funding opportunity. It is crucial for organizations to be aware of these deadlines to ensure timely submission. Missing a deadline can result in the rejection of the application or loss of funding opportunities. Organizations should regularly check for updates from the issuing authority regarding important dates related to the Gst523 1 form.

Quick guide on how to complete gst523 1 non profit organizations government funding canadaca

A concise manual on how to prepare your Gst523 1

Finding the appropriate template can be difficult when you have to provide formal international paperwork. Even if you possess the necessary form, it can be tedious to quickly prepare it according to all specifications if you rely on printed versions rather than handling everything digitally. airSlate SignNow is the online electronic signature platform that assists you in overcoming these challenges. It allows you to select your Gst523 1 and rapidly fill it out and sign it on the spot without the need to reprint documents if you make an error.

Follow these steps to prepare your Gst523 1 with airSlate SignNow:

- Click the Get Form button to upload your document into our editor instantly.

- Begin with the first vacant field, input your information, and proceed with the Next tool.

- Complete the empty fields using the Cross and Check tools from the toolbar above.

- Choose the Highlight or Line options to emphasize the most important details.

- Select Image and upload one if your Gst523 1 requires it.

- Use the right-side panel to add more fields for yourself or others to fill out if needed.

- Review your responses and confirm the template by clicking Date, Initials, and Sign.

- Draw, type, upload your eSignature, or capture it with a camera or QR code.

- Complete your modifications by clicking the Done button and selecting your file-sharing options.

Once your Gst523 1 is prepared, you can share it as you prefer - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely store all your completed documents in your account, organized in folders according to your preferences. Avoid wasting time on manual form completion; explore airSlate SignNow!

Create this form in 5 minutes or less

Find and fill out the correct gst523 1 non profit organizations government funding canadaca

FAQs

-

How can I get a government grant to fund a non-profit organization?

By applying for a grant exactly as the guidelines state. Your local library can help you research government grants. However, note that nonprofits are not sustained by government grants; they are sustained by a variety of funding sources.

-

What is the best way to get your non-profit out there and secure funding to start it? Also, how can you find volunteers to work for you? Are news stations a good strategy to promote your organization?

Those are some big questions: hopefully you are doing this homework before you start a nonprofit. Its a big, competitive space, and requires lots of hard work.I don’t agree that start up funds come from the board, they may pay annual dues but I have rarely seen a board that will work for start up funds. That you will have to figure out.Funding and finding funding will take up a large part of your time and energy. All the good work in the world needs money to operate.The volunteer recruitment will need to come from your supporters and organizing and managing them needs to be dialed in to keep them. It depends on what kind of tasks you will want them to perform.News is tough, you get a split second of air time and it generally requires something happening that is newsworthy. It would be smarter to sit down and map out a communications strategy that uses other channels that target those you want to signNow.Think long and hard about starting a nonprofit, I don’t want to rain on your parade but it is a huuuuuge job.

-

I want to start an American non-profit organization in Brazil. I have the business plan and model laid out, including an idea for how to raise funds. What steps do I need to take to become a legitimate 501(c), and should I file to be a 501(c) 1, 2, or 3?

Nonprofits for charitable or educational purposes fall under 501(c)(3). To start one:Form the appropriate entity by filing the entity's charter with the appropriate state agency. In Arizona, this would be filing the Articles of Incorporation for a Nonprofit Corporation with the Arizona Corporation Commission.Prepare bylaws and policies for your organization.Hold an organizational meetinf for directors to adopt bylaws, ratify actions and approve going for 501c3.Complete Form 1023 or 1023-EZ and file it with the IRS.Cross your fingers and hope the IRS says OK.You should be aware that this answer addresses what needs to be done in the US, but not what may need to be done in Brazil. For the latter, you will need to consult with a Brazilian lawyer.

Create this form in 5 minutes!

How to create an eSignature for the gst523 1 non profit organizations government funding canadaca

How to create an electronic signature for your Gst523 1 Non Profit Organizations Government Funding Canadaca online

How to make an eSignature for the Gst523 1 Non Profit Organizations Government Funding Canadaca in Google Chrome

How to create an eSignature for putting it on the Gst523 1 Non Profit Organizations Government Funding Canadaca in Gmail

How to make an electronic signature for the Gst523 1 Non Profit Organizations Government Funding Canadaca straight from your mobile device

How to create an electronic signature for the Gst523 1 Non Profit Organizations Government Funding Canadaca on iOS devices

How to create an eSignature for the Gst523 1 Non Profit Organizations Government Funding Canadaca on Android devices

People also ask

-

What is gst523 1 and how does it relate to airSlate SignNow?

The gst523 1 is a specific form utilized for tax purposes, and airSlate SignNow provides an efficient solution for signing and sending such documents electronically. With airSlate SignNow, businesses can streamline their processes related to gst523 1 forms, ensuring compliance and ease of use.

-

How much does it cost to use airSlate SignNow for gst523 1 documents?

airSlate SignNow offers flexible pricing plans that cater to various business needs, whether you're managing few or numerous gst523 1 documents. Potential customers can select from monthly or annual subscription options, allowing for cost-effective solutions.

-

What features does airSlate SignNow offer for managing gst523 1 forms?

airSlate SignNow includes features such as document templates, audit trails, and secure storage, making it ideal for handling gst523 1 forms. These tools enhance productivity while ensuring that all documents comply with legal standards and regulations.

-

Can airSlate SignNow help with compliance for gst523 1 electronically signed documents?

Yes, airSlate SignNow ensures that all electronically signed documents, including gst523 1 forms, comply with relevant legal standards. The platform utilizes secure encryption and provides an audit trail to verify the integrity of all transactions.

-

What are the benefits of using airSlate SignNow for gst523 1 compared to traditional methods?

Using airSlate SignNow for gst523 1 provides numerous advantages, including faster turnaround times, reduced paper waste, and enhanced security. This electronic signing solution signNowly simplifies the process, allowing businesses to focus on core activities while ensuring document accuracy.

-

Does airSlate SignNow integrate with other tools for managing gst523 1 documents?

Absolutely, airSlate SignNow integrates seamlessly with various business applications, enabling a smooth workflow for managing gst523 1 documents. These integrations facilitate data transfer and streamline operations, making it easier for businesses to manage their documentation.

-

Is airSlate SignNow user-friendly for signing gst523 1 forms?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for anyone to sign gst523 1 forms without technical training. The intuitive interface ensures that both senders and recipients can navigate the platform effortlessly.

Get more for Gst523 1

Find out other Gst523 1

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement