Ir56f Form 2018-2026

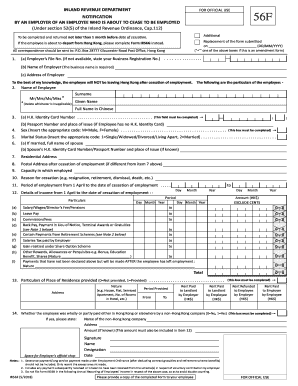

What is the Ir56f Form

The Ir56f form is a crucial document used in the United States for reporting employment and income details. It is primarily utilized by employers to provide information about their employees to the Internal Revenue Service (IRS). This form helps ensure compliance with tax regulations and facilitates accurate income reporting for tax purposes.

How to use the Ir56f Form

Using the Ir56f form involves several straightforward steps. First, employers need to gather all necessary information about the employee, including their name, Social Security number, and employment details. Next, the employer fills out the form with accurate data regarding wages, tax withholdings, and other relevant information. Once completed, the form must be submitted to the IRS by the specified deadline to avoid penalties.

Steps to complete the Ir56f Form

Completing the Ir56f form requires careful attention to detail. Follow these steps for accurate completion:

- Collect employee information: Ensure you have the employee's full name, Social Security number, and address.

- Fill in employment details: Include the start date, end date, and total wages paid during the reporting period.

- Report tax withholdings: Accurately indicate the amount of federal income tax withheld from the employee's paychecks.

- Review for accuracy: Double-check all entries to prevent errors that could lead to compliance issues.

- Submit the form: File the completed form with the IRS by the designated deadline.

Legal use of the Ir56f Form

The Ir56f form must be used in accordance with IRS regulations to maintain its legal validity. Employers are required to submit this form to report accurate income and tax information, ensuring compliance with federal tax laws. Failure to use the form correctly can result in penalties, including fines and additional scrutiny from tax authorities.

Filing Deadlines / Important Dates

Timely filing of the Ir56f form is essential to avoid penalties. The IRS typically sets specific deadlines for submission, which may vary based on the type of employer and employee circumstances. Employers should be aware of these important dates and ensure that the form is filed promptly to maintain compliance.

Penalties for Non-Compliance

Non-compliance with the requirements related to the Ir56f form can lead to significant penalties. Employers may face fines for late submissions, inaccuracies, or failure to file altogether. It is crucial to adhere to IRS guidelines to avoid these financial repercussions and ensure smooth operations within your business.

Quick guide on how to complete ird tax return 2018 2019 form

A concise handbook on how to assemble your Ir56f Form

Finding the appropriate template can pose a difficulty when you need to submit formal global documentation. Even if you possess the necessary form, swiftly filling it out in accordance with all the specifications can be tedious if you're using paper copies instead of managing everything digitally. airSlate SignNow is the web-based eSignature platform that aids you in navigating this. It allows you to choose your Ir56f Form and rapidly complete and sign it on-site without the need to reprint documents whenever an error occurs.

These are the steps you must follow to set up your Ir56f Form with airSlate SignNow:

- Hit the Get Form button to upload your document to our editor immediately.

- Begin with the first vacant field, input your information, and continue with the Next tool.

- Complete the empty fields using the Cross and Check features from the toolbar above.

- Choose the Highlight or Line options to emphasize the most critical information.

- Click on Image and upload one if your Ir56f Form necessitates it.

- Utilize the right-side panel to add additional areas for you or others to complete if needed.

- Review your responses and confirm the form by clicking Date, Initials, and Sign.

- Draw, type, upload your eSignature, or capture it using a camera or QR code.

- Complete the editing by clicking the Done button and choosing your file-sharing preferences.

Once your Ir56f Form is ready, you can distribute it as you wish—send it to your recipients via email, SMS, fax, or even print it directly from the editor. Additionally, you can securely keep all your finished documents in your account, organized in folders according to your choices. Don’t waste time on manual form filling; give airSlate SignNow a try!

Create this form in 5 minutes or less

Find and fill out the correct ird tax return 2018 2019 form

FAQs

-

How can I fill out the income tax return of the year 2016-17 in 2018?

There is no option to file online return but you can prepare an offline return and went to the officer of your jurisdiction income tax commissioner and after his permission you can file the return with his office.

-

I am filling income tax return for AY 2018–19. How do I download ITR-1 form?

You can fill it online ate-Filing Home Page, Income Tax Department, Government of IndiaCreate a user id and file all your returns from here only. No need to do offline

-

How the new Form 16 will change income tax return filing this FY 2018-19 (AY 2019-20)?

The new format of the Form 16 and the ITR for AY 2019–20 will allow the tax department to view a detailed break up of the salary and tax exemptions claimed by an employee. Any discrepancy in the Form 16 versus the ITR filed by the person will be easily traced by the tax department.Hence, the salary part of the ITR will need to be carefully filed to provide all details such that there is no mismatch with the Form 16 and the Form 26AS. Any discrepancy could result in a notice situation.

-

Is it okay to submit a Form 67 after filling out my tax return?

As per the law, Form 67 is required for claiming Foreign Tax Credits by an assessee and it should be done along with the return of income.It is possible to file Form 67 before filing the return.The question is whether the Form can be filed after filing the return of income. While the requirement is procedural, a return may be termed as incomplete if the form is not filed along with the returns and an officer can deny foreign tax credits.However, for all intents and purposes if you file Form 67 before the completion of assessment or even with an application u/s 154 once the assessment is completed, it cannot be denied if the facts have been already disclosed in the return and teh form in itself is only completing a process.However, to avoid adventures with the department and unwanted litigation, it is always prudent to file the form with the return of income so that it is not missed out or forgotten.

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How can you contact someone that is experienced in filling out a transcript of Tax Return Form 4506-T?

You can request a transcript online at Get Transcript. That should be easier and quicker than filling out the form. Otherwise any US tax professional should be able to help you.

-

What tax transcript form should I fill out to find my old W2 forms to file for a tax return? -I have not filed before and I'm 53.?

I guess this link answers to your question: Transcript or Copy of Form W-2

Create this form in 5 minutes!

How to create an eSignature for the ird tax return 2018 2019 form

How to create an eSignature for the Ird Tax Return 2018 2019 Form online

How to make an electronic signature for your Ird Tax Return 2018 2019 Form in Chrome

How to create an electronic signature for putting it on the Ird Tax Return 2018 2019 Form in Gmail

How to make an electronic signature for the Ird Tax Return 2018 2019 Form right from your mobile device

How to generate an electronic signature for the Ird Tax Return 2018 2019 Form on iOS devices

How to make an electronic signature for the Ird Tax Return 2018 2019 Form on Android devices

People also ask

-

What is the Ir56f Form and why do I need it?

The Ir56f Form is a crucial document used by employers in Hong Kong to report employee income and tax deductions. If you are managing payroll or employee records, understanding how to properly complete the Ir56f Form is essential for compliance with tax regulations. Using airSlate SignNow simplifies the process of sending and eSigning this form, ensuring timely submission.

-

How can airSlate SignNow help with the Ir56f Form?

airSlate SignNow provides an efficient platform for sending, signing, and managing the Ir56f Form digitally. Our solution allows for easy collaboration between employers and employees, making it simple to gather necessary signatures and maintain compliance. By using our service, you can streamline the process and minimize errors associated with manual paperwork.

-

Is there a cost associated with using airSlate SignNow for the Ir56f Form?

Yes, airSlate SignNow offers various pricing plans designed to fit different business needs and budgets. Our plans include features that specifically facilitate the management of documents like the Ir56f Form, ensuring you receive a cost-effective solution. You can choose a plan that suits your volume of use and the number of users you require.

-

Can I integrate airSlate SignNow with other software for handling the Ir56f Form?

Absolutely! airSlate SignNow seamlessly integrates with many popular software applications, allowing you to manage the Ir56f Form alongside your existing tools. This integration capability enhances your workflow, making it easier to collect signatures and track submissions directly from your preferred platforms.

-

What features does airSlate SignNow offer for the Ir56f Form?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage specifically for documents like the Ir56f Form. These features ensure that you can send, sign, and store your forms securely while having access to important data whenever you need it. Additionally, our user-friendly interface makes it easy for anyone to navigate the signing process.

-

How secure is my information when using airSlate SignNow for the Ir56f Form?

Security is a top priority at airSlate SignNow. When using our platform for the Ir56f Form, your data is protected through advanced encryption methods and secure servers. We comply with industry standards to ensure that all sensitive information remains confidential and secure throughout the signing process.

-

What are the benefits of using airSlate SignNow for the Ir56f Form compared to traditional methods?

Using airSlate SignNow for the Ir56f Form offers numerous benefits over traditional paper methods, including faster processing times, reduced paperwork, and enhanced accessibility. Our digital solution allows for immediate signature collection and tracking, which helps streamline your workflow and improve overall efficiency. Plus, you can access your documents from anywhere, making it convenient for remote teams.

Get more for Ir56f Form

- United states postal service application for delivery of mail through agent 1 form

- Llano logistics w2s form

- Health care provider certification family and medical leave pd 615a this form is used to provide certification per fmla and

- Aircraft specification sheet form

- Year 4 medical student excused absence request form ttuhsc

- Commercial triple net lease agreement template form

- Common lease agreement template form

- Company lease agreement template form

Find out other Ir56f Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors