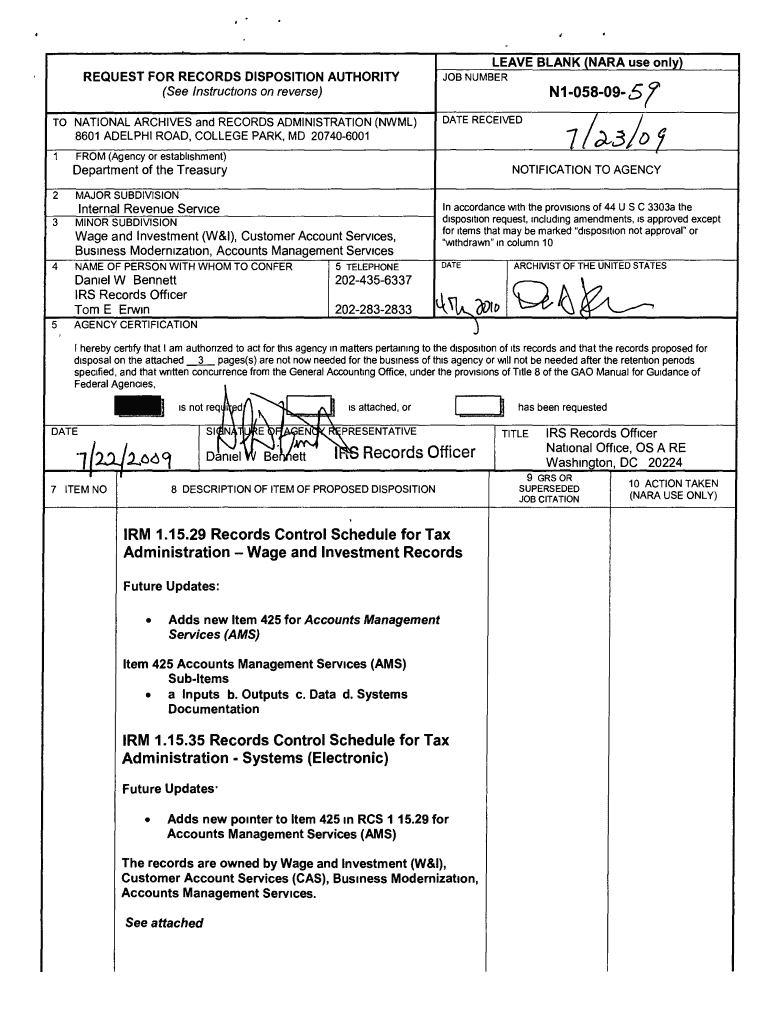

Records Control Schedule for Tax Administration Wage and Investment Records Archives Form

Understanding the Records Control Schedule for Tax Administration

The Records Control Schedule Document 12990 is essential for managing Wage and Investment records within the tax administration framework. This schedule outlines the retention periods for various types of tax-related documents. It serves as a guideline for federal agencies to ensure compliance with legal requirements regarding document retention. Understanding this schedule helps organizations maintain proper records management practices, reducing the risk of non-compliance with federal regulations.

Steps to Utilize the Records Control Schedule

To effectively use the Records Control Schedule Document 12990, follow these steps:

- Identify the specific records your organization maintains related to tax administration.

- Consult the schedule to determine the required retention period for each type of record.

- Implement a records management system that aligns with the retention guidelines.

- Regularly review and update your records management practices to ensure ongoing compliance.

Obtaining the Records Control Schedule Document

Organizations can obtain the Records Control Schedule Document 12990 through official government publications or agency websites. It is advisable to check the IRS or relevant tax administration sites for the most current version. Additionally, many libraries and legal resource centers may provide access to these documents, ensuring that businesses have the necessary tools for effective records management.

Key Elements of the Records Control Schedule

The Records Control Schedule Document 12990 includes several key elements that are crucial for compliance:

- Retention Periods: Specifies how long different types of records must be kept.

- Disposal Guidelines: Outlines the proper methods for disposing of records once the retention period has expired.

- Compliance Requirements: Details the legal obligations associated with record retention and disposal.

Legal Use of the Records Control Schedule

Utilizing the Records Control Schedule Document 12990 legally protects organizations from potential penalties associated with improper record management. Compliance with the established retention periods ensures that businesses are prepared for audits and inquiries from tax authorities. Understanding the legal implications of this schedule is vital for maintaining organizational integrity and accountability in tax-related matters.

Examples of Utilizing the Records Control Schedule

Practical examples of using the Records Control Schedule Document 12990 include:

- A business retaining payroll records for a minimum of four years as specified in the schedule.

- Implementing a secure disposal process for tax documents after the retention period has lapsed.

- Training staff on the importance of adhering to the schedule to avoid compliance issues.

Quick guide on how to complete records control schedule document 12990

Prepare records control schedule document 12990 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without interruptions. Manage records control schedule document 12990 on any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to edit and electronically sign records control schedule document 12990 without hassle

- Locate records control schedule document 12990 and click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive details with tools that airSlate SignNow supplies specifically for that reason.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all information and then click on the Done button to save your modifications.

- Select how you would like to send your form, via email, SMS, or invite link, or download it to the computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and electronically sign records control schedule document 12990 and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to records control schedule document 12990

Create this form in 5 minutes!

How to create an eSignature for the records control schedule document 12990

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask records control schedule document 12990

-

What is the Records Control Schedule For Tax Administration Wage And Investment Records Archives?

The Records Control Schedule For Tax Administration Wage And Investment Records Archives is a systematic approach to managing and preserving tax-related documents. It ensures compliance with federal regulations while optimizing record retention and retrieval processes. This schedule helps organizations maintain organized archives, making it easier to access important tax documents when needed.

-

How can airSlate SignNow help with the Records Control Schedule For Tax Administration Wage And Investment Records Archives?

airSlate SignNow provides a user-friendly platform for electronically signing and managing documents related to the Records Control Schedule For Tax Administration Wage And Investment Records Archives. With its robust features, businesses can streamline their document workflows, ensuring that all tax records are securely stored and easily accessible. This enhances compliance and reduces the risk of lost or misplaced documents.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various businesses. Whether you are a small business or a large enterprise, you can choose a plan that fits your budget while ensuring compliance with the Records Control Schedule For Tax Administration Wage And Investment Records Archives. Each plan includes essential features to help you manage your documents effectively.

-

What features does airSlate SignNow offer for managing tax records?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage, all of which are essential for managing tax records. These features support the Records Control Schedule For Tax Administration Wage And Investment Records Archives by ensuring that documents are signed, stored, and retrieved efficiently. Additionally, the platform provides audit trails for compliance tracking.

-

Is airSlate SignNow compliant with tax regulations?

Yes, airSlate SignNow is designed to comply with various tax regulations, including those related to the Records Control Schedule For Tax Administration Wage And Investment Records Archives. The platform employs advanced security measures to protect sensitive information and ensures that all electronic signatures meet legal standards. This compliance helps businesses avoid potential legal issues.

-

Can airSlate SignNow integrate with other software for tax management?

Absolutely! airSlate SignNow offers integrations with popular accounting and tax management software, enhancing its functionality for users managing the Records Control Schedule For Tax Administration Wage And Investment Records Archives. These integrations allow for seamless data transfer and improved workflow efficiency, making it easier to manage tax-related documents.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management provides numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. By adhering to the Records Control Schedule For Tax Administration Wage And Investment Records Archives, businesses can ensure that their tax documents are organized and easily accessible. This leads to better compliance and streamlined operations.

Get more for records control schedule document 12990

- Aux challenge 1 zipcon form

- Greensummit info session form

- 23a of the securities exchange act of 1934 sections 17a and 20a of the public utility holding company form

- Saha housing news october indd springfield apartment form

- Www rickcoramministries com form

- Spring humane society of polk county form

- Paths to success registration form pdf international council

- Entry form montreux comedy festival hmr international

Find out other records control schedule document 12990

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form