Revised BIR Form No 2200 M is Now Available for 2018-2026

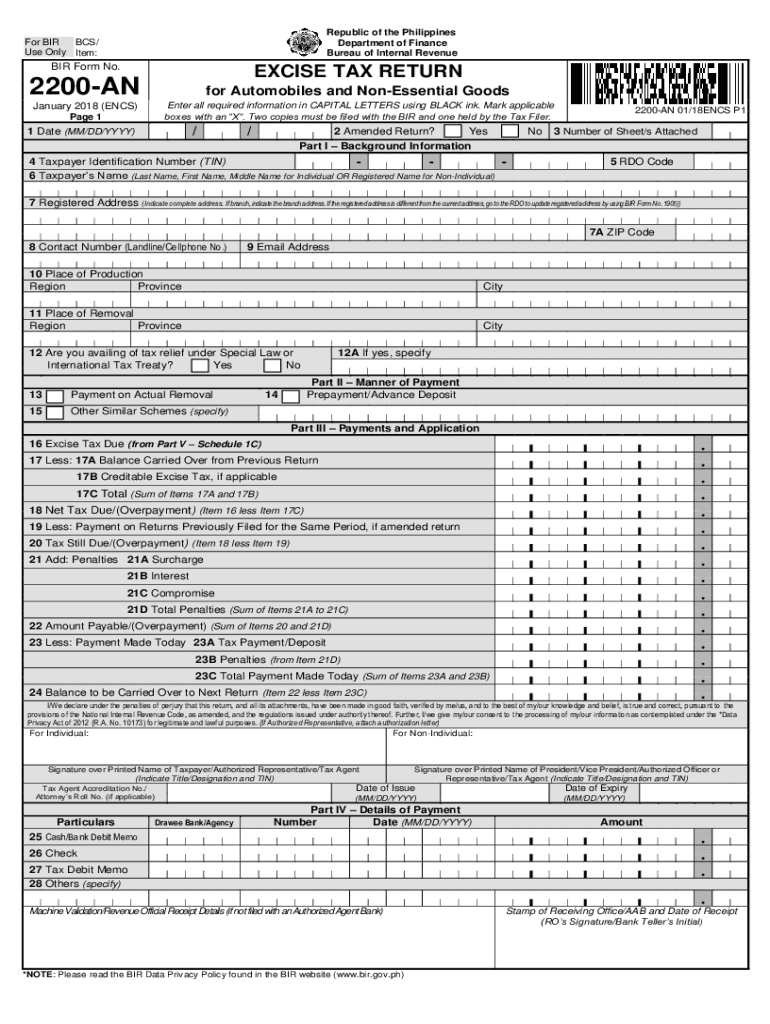

Understanding the Revised BIR Form No 2200 AN

The Revised BIR Form No 2200 AN is a crucial document for businesses in the United States that need to report excise taxes. This form is specifically designed for those involved in the sale of certain goods and services that are subject to excise tax regulations. Understanding its purpose is essential for compliance and accurate reporting.

This form helps businesses calculate and report their excise tax liabilities. It is vital for ensuring that all applicable taxes are paid and reported correctly to avoid penalties. The BIR Form No 2200 AN is typically used by manufacturers, importers, and sellers of specific products, such as alcohol, tobacco, and fuel.

Steps to Complete the Revised BIR Form No 2200 AN

Completing the Revised BIR Form No 2200 AN requires careful attention to detail. Here are the steps to follow:

- Gather all necessary information, including sales records, tax rates, and product details.

- Fill out the form by entering your business information at the top, including your name, address, and Tax Identification Number (TIN).

- Detail the products sold that are subject to excise tax, including quantities and applicable tax rates.

- Calculate the total excise tax owed based on your sales and the current tax rates.

- Review the completed form for accuracy before submission.

By following these steps, businesses can ensure that they accurately report their excise tax liabilities and remain compliant with federal regulations.

Required Documents for the Revised BIR Form No 2200 AN

When preparing to submit the Revised BIR Form No 2200 AN, certain documents are necessary to support your claims and calculations. These include:

- Sales invoices or receipts that detail the sale of excise taxable goods.

- Records of previous excise tax returns to ensure consistency and accuracy.

- Documentation of any exemptions or deductions claimed.

- Tax payment records to verify amounts paid in previous filings.

Having these documents ready will facilitate a smoother filing process and help substantiate your tax calculations if needed.

Filing Deadlines for the Revised BIR Form No 2200 AN

Timely filing of the Revised BIR Form No 2200 AN is essential to avoid penalties. The filing deadlines typically align with the end of the tax period for which the excise tax is being reported. Generally, businesses must submit this form:

- Quarterly, if they have a quarterly excise tax liability.

- Annually, for those with an annual reporting requirement.

It is important to check specific deadlines for your business type and ensure that the form is submitted on time to avoid additional fees or penalties.

Penalties for Non-Compliance with the Revised BIR Form No 2200 AN

Failure to comply with the requirements of the Revised BIR Form No 2200 AN can result in significant penalties. These may include:

- Fines for late filing or underreporting of excise taxes.

- Interest on unpaid taxes, which can accumulate over time.

- Potential audits by tax authorities, leading to further scrutiny of your business practices.

Understanding these penalties underscores the importance of accurate and timely filing of the form to maintain compliance and avoid unnecessary financial burdens.

Digital vs. Paper Version of the Revised BIR Form No 2200 AN

Businesses can choose between submitting the Revised BIR Form No 2200 AN in digital or paper format. Each method has its advantages:

- The digital version allows for quicker processing and easier record-keeping.

- The paper version may be preferred by those who are more comfortable with traditional filing methods.

Regardless of the method chosen, it is essential to ensure that all information is complete and accurate to avoid complications with tax authorities.

Quick guide on how to complete revised bir form no 2200 m is now available for

Effortlessly Prepare Revised BIR Form No 2200 M Is Now Available For on Any Device

The management of online documents has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and digitally sign your documents promptly without any hold-ups. Manage Revised BIR Form No 2200 M Is Now Available For on any device using airSlate SignNow's Android or iOS applications and simplify any document-related processes today.

The easiest way to modify and digitally sign Revised BIR Form No 2200 M Is Now Available For without hassle

- Find Revised BIR Form No 2200 M Is Now Available For and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of your documents or conceal sensitive details with the tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred way to send your form via email, text message (SMS), invitation link, or download it onto your computer.

Put an end to the worry of lost or mislaid documents, tedious form searches, or mistakes requiring you to print new copies. airSlate SignNow addresses all your document management needs with just a few clicks, from any device you choose. Edit and eSign Revised BIR Form No 2200 M Is Now Available For to ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct revised bir form no 2200 m is now available for

Create this form in 5 minutes!

How to create an eSignature for the revised bir form no 2200 m is now available for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pricing structure for airSlate SignNow?

The pricing for airSlate SignNow starts at competitive rates, making it a cost-effective solution for businesses looking to streamline their document signing process. With plans tailored to different needs, you can choose the one that best fits your budget while enjoying the benefits of a powerful eSigning tool. Explore our pricing options to find the best fit for your organization.

-

What features does airSlate SignNow offer?

airSlate SignNow provides a comprehensive suite of features designed to enhance your document management experience. Key features include customizable templates, real-time tracking, and secure cloud storage, all aimed at simplifying the signing process. With these tools, you can efficiently manage your documents and improve workflow productivity.

-

How does airSlate SignNow benefit businesses?

By using airSlate SignNow, businesses can signNowly reduce the time and resources spent on document signing. The platform allows for quick and secure eSigning, which enhances operational efficiency and improves customer satisfaction. Ultimately, adopting airSlate SignNow can lead to increased productivity and cost savings for your organization.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow offers seamless integrations with various software applications, enhancing its functionality. Whether you use CRM systems, project management tools, or cloud storage services, airSlate SignNow can connect with them to streamline your workflow. This integration capability ensures that you can manage your documents efficiently across different platforms.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely, airSlate SignNow prioritizes the security of your documents. The platform employs advanced encryption and compliance with industry standards to ensure that your sensitive information remains protected. You can confidently use airSlate SignNow for all your eSigning needs, knowing that your data is secure.

-

How easy is it to use airSlate SignNow?

airSlate SignNow is designed with user-friendliness in mind, making it accessible for everyone, regardless of technical expertise. The intuitive interface allows users to quickly navigate through the signing process, ensuring a smooth experience. With minimal training, you can start sending and signing documents in no time.

-

What types of documents can I sign with airSlate SignNow?

You can sign a wide variety of documents using airSlate SignNow, including contracts, agreements, and forms. The platform supports multiple file formats, allowing you to upload and send documents easily. This versatility makes airSlate SignNow an ideal solution for businesses across different industries.

Get more for Revised BIR Form No 2200 M Is Now Available For

- Merchantability and otherwise are excluded form

- 7 day notice to pay rent or lease terminates residential form

- 7 day notice to pay rentor lease terminates non residential form

- Office building net lease dated as of march 24 secgov form

- County maine on form

- Under maine law the notice to pay period form

- Is seven 7 days form

- The same parties of even date herewith and is secured according to the security agreement form

Find out other Revised BIR Form No 2200 M Is Now Available For

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form