for NON RESIDENT INDIVIDUALS, PARTNERSHIPS, TRUSTS 2023-2026

Understanding the TR1FT Form for Non-Resident Individuals, Partnerships, and Trusts

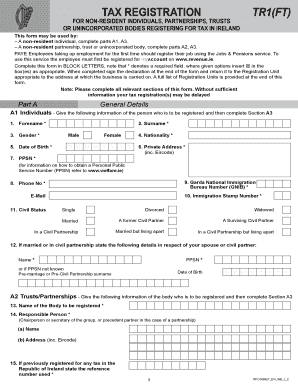

The TR1FT form is specifically designed for non-resident individuals, partnerships, and trusts engaging in business activities in Ireland. This form is essential for reporting income and tax obligations for those who do not reside in Ireland but have financial interests or operations there. Understanding the purpose and requirements of the TR1FT form is crucial for compliance with Irish tax laws.

Steps to Complete the TR1FT Form

Completing the TR1FT form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including personal identification details, income sources, and any applicable tax identification numbers. Next, carefully fill out each section of the form, ensuring that all figures are accurate and reflect the financial activities of the non-resident entity. Once completed, review the form for any errors before submission.

Legal Use of the TR1FT Form

The TR1FT form serves a legal purpose in the context of tax compliance for non-residents. It is used to declare income earned in Ireland and to determine tax liabilities. Proper use of this form helps avoid penalties and ensures that non-resident individuals and entities meet their legal obligations under Irish tax law. Failing to file the TR1FT form when required can result in significant legal repercussions.

Required Documents for the TR1FT Form

When preparing to file the TR1FT form, several documents are typically required. These may include proof of identity, such as a passport or driver's license, financial statements detailing income sources, and any relevant contracts or agreements that pertain to the income being reported. Having these documents readily available can streamline the filing process and ensure that all necessary information is included.

Filing Deadlines and Important Dates

Awareness of filing deadlines is crucial for compliance with tax regulations. The TR1FT form must be submitted by specific deadlines, which can vary depending on the type of income being reported and the taxpayer's circumstances. Typically, these deadlines align with the annual tax return schedule. It is advisable to check the latest guidelines to avoid late filing penalties.

Examples of Using the TR1FT Form

Understanding practical scenarios can help clarify the use of the TR1FT form. For instance, a non-resident individual earning rental income from property in Ireland would need to complete this form to report that income and pay any applicable taxes. Similarly, a partnership with operations in Ireland must file the TR1FT to declare its income and fulfill its tax obligations. These examples illustrate the form's relevance to various non-resident entities.

IRS Guidelines Related to the TR1FT Form

While the TR1FT form is specific to Ireland, it is essential for U.S. taxpayers to understand how it interacts with IRS guidelines. Non-residents must ensure compliance with both Irish tax laws and U.S. tax obligations. This includes reporting foreign income accurately on U.S. tax returns and understanding any tax treaties that may affect their tax liabilities in both jurisdictions.

Quick guide on how to complete for non resident individuals partnerships trusts

Effortlessly Prepare FOR NON RESIDENT INDIVIDUALS, PARTNERSHIPS, TRUSTS on Any Gadget

Digital document management has gained signNow traction among organizations and individuals alike. It offers a superb eco-friendly substitute to conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents promptly without any holdups. Manage FOR NON RESIDENT INDIVIDUALS, PARTNERSHIPS, TRUSTS on any gadget using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to edit and electronically sign FOR NON RESIDENT INDIVIDUALS, PARTNERSHIPS, TRUSTS effortlessly

- Locate FOR NON RESIDENT INDIVIDUALS, PARTNERSHIPS, TRUSTS and click on Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to apply your changes.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and electronically sign FOR NON RESIDENT INDIVIDUALS, PARTNERSHIPS, TRUSTS to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct for non resident individuals partnerships trusts

Create this form in 5 minutes!

How to create an eSignature for the for non resident individuals partnerships trusts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2014 Ireland TR1FT and how does it relate to airSlate SignNow?

The 2014 Ireland TR1FT is a specific tax form used in Ireland for certain financial transactions. airSlate SignNow provides an efficient platform for businesses to eSign and send documents like the 2014 Ireland TR1FT, ensuring compliance and ease of use.

-

How much does airSlate SignNow cost for handling documents like the 2014 Ireland TR1FT?

airSlate SignNow offers competitive pricing plans that cater to various business needs. For handling documents such as the 2014 Ireland TR1FT, you can choose a plan that fits your budget while enjoying the benefits of a cost-effective eSigning solution.

-

What features does airSlate SignNow offer for the 2014 Ireland TR1FT?

airSlate SignNow includes features like customizable templates, secure eSigning, and document tracking, which are essential for managing the 2014 Ireland TR1FT. These features streamline the signing process and enhance document management efficiency.

-

Can I integrate airSlate SignNow with other software for the 2014 Ireland TR1FT?

Yes, airSlate SignNow offers seamless integrations with various software applications, making it easy to manage the 2014 Ireland TR1FT alongside your existing tools. This integration capability enhances workflow efficiency and document handling.

-

What are the benefits of using airSlate SignNow for the 2014 Ireland TR1FT?

Using airSlate SignNow for the 2014 Ireland TR1FT provides numerous benefits, including faster turnaround times, enhanced security, and reduced paper usage. This not only saves time but also contributes to a more sustainable business practice.

-

Is airSlate SignNow user-friendly for completing the 2014 Ireland TR1FT?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete the 2014 Ireland TR1FT. The intuitive interface ensures that users can navigate the platform without any technical expertise.

-

How does airSlate SignNow ensure the security of the 2014 Ireland TR1FT?

airSlate SignNow prioritizes security by employing advanced encryption and compliance measures to protect documents like the 2014 Ireland TR1FT. This ensures that your sensitive information remains confidential and secure throughout the signing process.

Get more for FOR NON RESIDENT INDIVIDUALS, PARTNERSHIPS, TRUSTS

- Rev 718 form

- Form 126s

- Re proposed purchase of any horse form

- State of delaware certificate of incorporation a stock corporation form

- Certificate of incorporation state of delaware form

- Certificate of trust statutory trustdelaware forms workflow

- Pa certificate amendment llc fillable form fill online

- Certificate of foreign corporation amendment state of form

Find out other FOR NON RESIDENT INDIVIDUALS, PARTNERSHIPS, TRUSTS

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA