FinCEN Form 105 CMIR0529 Ffiec

What is the FinCEN Form 105?

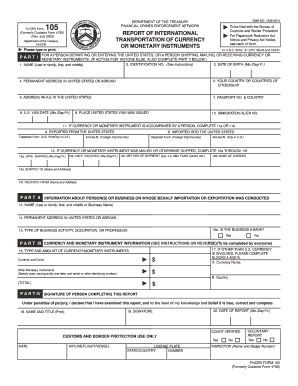

The FinCEN Form 105, officially known as the Currency Monetary Instrument Report (CMIR), is a document required by the Financial Crimes Enforcement Network (FinCEN) in the United States. It is used to report the transportation of currency or monetary instruments exceeding ten thousand dollars into or out of the U.S. This form plays a crucial role in preventing money laundering and ensuring compliance with U.S. financial regulations. Individuals or entities transporting large sums of money must complete this form accurately to avoid potential legal issues.

How to use the FinCEN Form 105

To use the FinCEN Form 105, individuals must fill it out when they are physically transporting currency or monetary instruments that exceed the reporting threshold. The form requires detailed information about the traveler, the amount of currency, and the purpose of the transport. It is essential to provide accurate and truthful information, as discrepancies can lead to penalties or legal consequences. Once completed, the form must be submitted to the appropriate authorities, either at the border or through designated channels.

Steps to complete the FinCEN Form 105

Completing the FinCEN Form 105 involves several key steps:

- Gather necessary information, including personal identification, travel details, and the amount of currency being transported.

- Obtain the form from the FinCEN website or designated locations.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for accuracy and completeness before submission.

- Submit the form to the appropriate authority at the time of transport.

Legal use of the FinCEN Form 105

The legal use of the FinCEN Form 105 is mandated by U.S. law to enhance transparency in financial transactions. It is essential for individuals transporting large sums of money to comply with this requirement to avoid legal repercussions. Failure to file the form or providing false information can result in severe penalties, including fines and possible criminal charges. Understanding the legal implications of this form is critical for anyone involved in transporting significant amounts of currency.

Filing Deadlines / Important Dates

Filing deadlines for the FinCEN Form 105 are typically aligned with the date of transport. Individuals must submit the form at the time they are crossing U.S. borders with currency or monetary instruments exceeding ten thousand dollars. It is advisable to check for any updates or changes to filing requirements on the FinCEN website to ensure compliance with current regulations.

Penalties for Non-Compliance

Non-compliance with the FinCEN Form 105 requirements can lead to significant penalties. Individuals who fail to file the form or provide inaccurate information may face fines that can reach thousands of dollars. In severe cases, non-compliance can result in criminal charges, including money laundering or other financial crimes. Awareness of these penalties is crucial for anyone transporting large amounts of currency to ensure they adhere to legal requirements.

Quick guide on how to complete fincen form 105 cmir0529 ffiec

Complete FinCEN Form 105 CMIR0529 Ffiec effortlessly on any device

Online document management has gained traction with businesses and individuals. It offers an ideal eco-conscious alternative to conventional printed and signed paperwork, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly without delays. Manage FinCEN Form 105 CMIR0529 Ffiec on any platform with airSlate SignNow Android or iOS applications and simplify any document-oriented operation today.

The easiest way to modify and eSign FinCEN Form 105 CMIR0529 Ffiec without stress

- Locate FinCEN Form 105 CMIR0529 Ffiec and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight signNow sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that require new document prints. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Adjust and eSign FinCEN Form 105 CMIR0529 Ffiec and guarantee exceptional communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fincen form 105 cmir0529 ffiec

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the fincen form 105 and why is it important?

The fincen form 105 is a crucial document used for reporting certain transactions to the Financial Crimes Enforcement Network. It helps in combating money laundering and ensuring compliance with federal regulations. Understanding this form is essential for businesses involved in financial transactions.

-

How can airSlate SignNow help with completing the fincen form 105?

airSlate SignNow provides an intuitive platform that simplifies the process of completing the fincen form 105. With our eSignature capabilities, you can easily fill out, sign, and send the form securely. This streamlines your compliance efforts and saves valuable time.

-

What are the pricing options for using airSlate SignNow for the fincen form 105?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those requiring the fincen form 105. Our plans are designed to be cost-effective, ensuring you get the best value for your investment. You can choose a plan that fits your budget and usage requirements.

-

Are there any features specifically designed for the fincen form 105?

Yes, airSlate SignNow includes features that enhance the completion and submission of the fincen form 105. These features include customizable templates, secure storage, and audit trails to ensure compliance. Our platform is designed to make the process as seamless as possible.

-

Can I integrate airSlate SignNow with other tools for managing the fincen form 105?

Absolutely! airSlate SignNow offers integrations with various business tools that can help you manage the fincen form 105 more efficiently. Whether you use CRM systems or document management software, our platform can connect seamlessly to enhance your workflow.

-

What are the benefits of using airSlate SignNow for the fincen form 105?

Using airSlate SignNow for the fincen form 105 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and stored securely, helping you maintain compliance with regulatory requirements.

-

Is airSlate SignNow compliant with regulations related to the fincen form 105?

Yes, airSlate SignNow is designed to comply with regulations surrounding the fincen form 105. We prioritize security and compliance, ensuring that your documents meet all necessary legal standards. This gives you peace of mind when handling sensitive information.

Get more for FinCEN Form 105 CMIR0529 Ffiec

- Alaska uniform residential landlord ampamp tenant act

- Tenants failure to keep all plumbing fixtures in the dwelling unit as clean and form

- Failure of tenant to use in a reasonable manner all electrical plumbing sanitary form

- Which may cause damage to the premises form

- Lease agreement with kendall fee llc secgov form

- Chicago residential landlord and tenant ordinance rlto form

- Notice to landlord insufficient notice of rent increase form

- Notice to landlord improper rent increase form

Find out other FinCEN Form 105 CMIR0529 Ffiec

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed