Form 71 661 23 8 1 000 Rev 2023

Understanding the Mississippi Installment Agreement Form 71-661

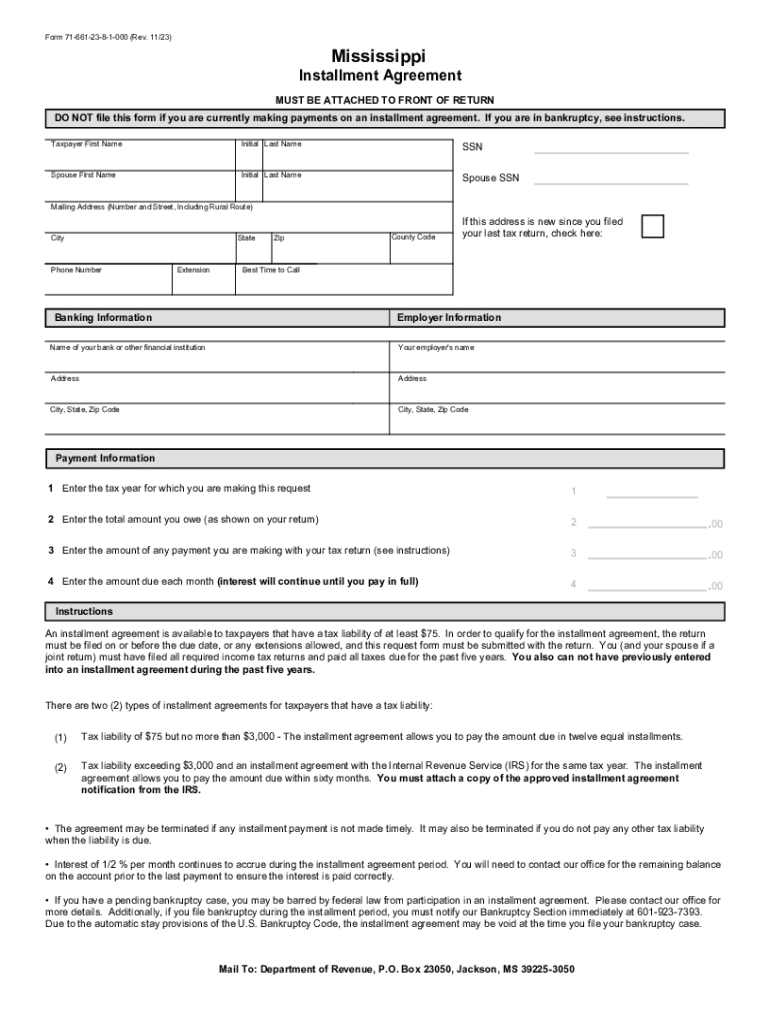

The Mississippi Installment Agreement, known as Form 71-661, is a crucial document for taxpayers who wish to establish a payment plan with the state. This form allows individuals or businesses to pay their tax liabilities over time rather than in a lump sum. It is designed for those who may be experiencing financial difficulties but still want to comply with their tax obligations. Understanding this form is essential for ensuring that you can manage your payments effectively while remaining in good standing with the state tax authority.

Steps to Complete the Mississippi Installment Agreement Form 71-661

Completing the Form 71-661 involves several key steps:

- Gather Necessary Information: Collect your personal details, tax identification number, and information about your tax liabilities.

- Complete the Form: Fill out all required sections, ensuring accuracy to avoid delays in processing.

- Specify Payment Terms: Clearly outline your proposed payment schedule, including the amount and frequency of payments.

- Review and Sign: Carefully review the completed form for any errors before signing it to confirm your agreement.

- Submit the Form: Send the completed form to the appropriate state tax office as instructed.

Legal Use of the Mississippi Installment Agreement Form 71-661

The legal use of Form 71-661 is essential for establishing a formal agreement between the taxpayer and the Mississippi Department of Revenue. By submitting this form, taxpayers acknowledge their tax liabilities and agree to a structured payment plan. This legal framework protects both the taxpayer and the state, ensuring compliance with tax laws while providing a manageable solution for payment. It is important to adhere to the terms outlined in the agreement to avoid penalties or further legal action.

Eligibility Criteria for the Mississippi Installment Agreement Form 71-661

To qualify for the Mississippi Installment Agreement, taxpayers must meet certain eligibility criteria:

- Outstanding Tax Liability: You must have an existing tax debt with the Mississippi Department of Revenue.

- Financial Hardship: You should demonstrate an inability to pay your tax liability in full due to financial difficulties.

- Compliance History: You must be in compliance with all previous tax obligations, including filing required returns.

How to Obtain the Mississippi Installment Agreement Form 71-661

The Form 71-661 can be obtained through the Mississippi Department of Revenue's official website or by visiting a local tax office. It is important to ensure that you are using the most current version of the form to avoid any issues during submission. Additionally, you may contact the department directly for assistance in obtaining the form or for any questions regarding the completion process.

Form Submission Methods for the Mississippi Installment Agreement

Once you have completed the Form 71-661, you can submit it through various methods:

- By Mail: Send the completed form to the designated address provided by the Mississippi Department of Revenue.

- In-Person: Deliver the form directly to a local tax office for immediate processing.

- Online Submission: Check if electronic submission is available for your convenience.

Quick guide on how to complete form 71 661 23 8 1 000 rev

Complete Form 71 661 23 8 1 000 Rev effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to generate, modify, and eSign your documents swiftly without delays. Manage Form 71 661 23 8 1 000 Rev on any platform using the airSlate SignNow Android or iOS applications and simplify any document-oriented process today.

The simplest method to modify and eSign Form 71 661 23 8 1 000 Rev without hassle

- Find Form 71 661 23 8 1 000 Rev and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive data with tools provided by airSlate SignNow designed specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Choose your preferred method to send your form, via email, SMS, invite link, or download it directly to your computer.

Eliminate the hassle of lost or misplaced documents, tiresome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all your document management requirements in just a few clicks from any device you select. Modify and eSign Form 71 661 23 8 1 000 Rev to ensure effective communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 71 661 23 8 1 000 rev

Create this form in 5 minutes!

How to create an eSignature for the form 71 661 23 8 1 000 rev

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Mississippi installment agreement?

A Mississippi installment agreement is a payment plan that allows taxpayers to pay their tax liabilities over time. This option is beneficial for those who cannot pay their taxes in full immediately. By setting up a Mississippi installment agreement, you can manage your payments more effectively and avoid penalties.

-

How can airSlate SignNow help with Mississippi installment agreements?

airSlate SignNow simplifies the process of creating and signing documents related to Mississippi installment agreements. Our platform allows you to easily draft, send, and eSign necessary forms, ensuring that your agreement is legally binding and securely stored. This streamlines your tax payment process and enhances your overall experience.

-

What are the costs associated with setting up a Mississippi installment agreement?

The costs for setting up a Mississippi installment agreement can vary based on the amount owed and the payment terms. However, using airSlate SignNow can help reduce administrative costs by providing an efficient way to manage your documents. Our platform offers competitive pricing, making it a cost-effective solution for handling your installment agreements.

-

What features does airSlate SignNow offer for managing Mississippi installment agreements?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing Mississippi installment agreements. These tools help ensure that all parties involved can easily access and sign documents, reducing delays and improving compliance. Additionally, our user-friendly interface makes it easy for anyone to navigate.

-

Are there any benefits to using airSlate SignNow for Mississippi installment agreements?

Yes, using airSlate SignNow for Mississippi installment agreements provides numerous benefits, including increased efficiency and reduced paperwork. Our platform allows for quick document turnaround, which can expedite the approval process for your installment agreement. Furthermore, the secure storage of documents ensures that your sensitive information is protected.

-

Can I integrate airSlate SignNow with other tools for managing Mississippi installment agreements?

Absolutely! airSlate SignNow offers integrations with various tools and platforms that can enhance your management of Mississippi installment agreements. Whether you use CRM systems, accounting software, or other document management solutions, our platform can seamlessly connect to streamline your workflow and improve productivity.

-

How does airSlate SignNow ensure the security of my Mississippi installment agreement documents?

airSlate SignNow prioritizes the security of your documents, including those related to Mississippi installment agreements. We utilize advanced encryption methods and secure cloud storage to protect your sensitive information. Additionally, our platform complies with industry standards to ensure that your data remains confidential and secure.

Get more for Form 71 661 23 8 1 000 Rev

- Announcement peer specialist certification training may 2012docx dbhdd georgia form

- Wic medical documentation form hawaii department of health

- Womens medical request form

- Burial transit permit form

- Public adjuster contract template form

- Danh sch 1 triu website c ranking pr khochatcom form

- State form 49607 r9 6 18

- Application for search and certified copy of birth record form

Find out other Form 71 661 23 8 1 000 Rev

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT