LOAN SUBMISSION COVER SHEET Right Start Mortgage 2022-2026

Understanding the Loan Submission Cover Sheet for Right Start Mortgage

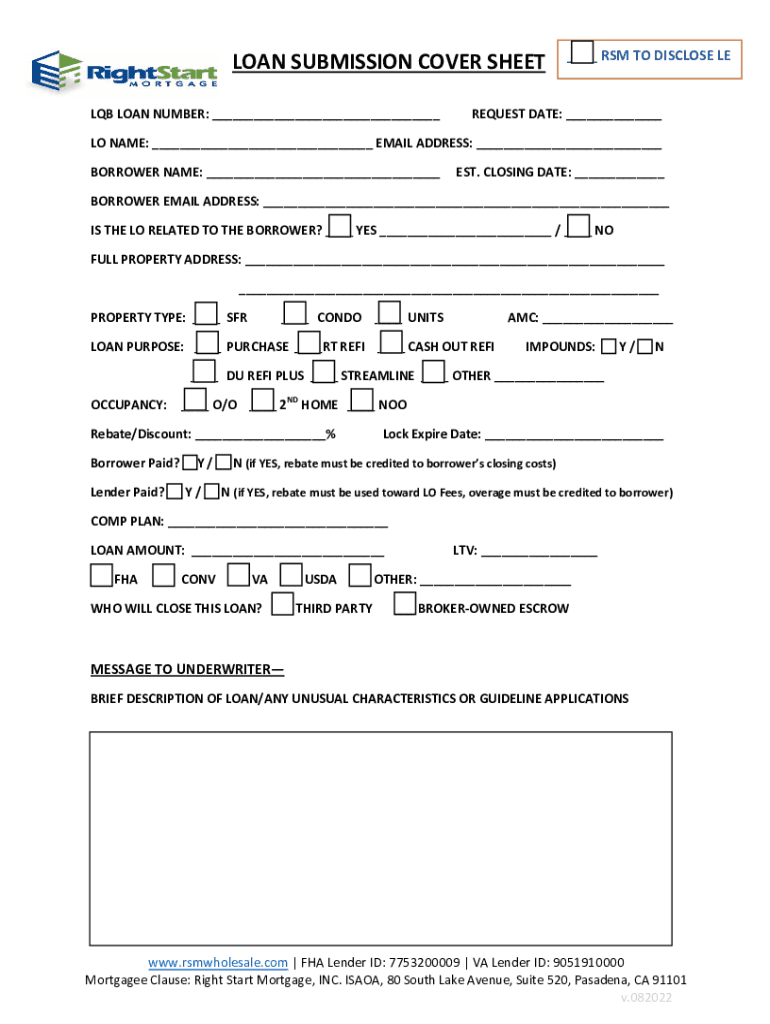

The Loan Submission Cover Sheet for Right Start Mortgage is a critical document used in the mortgage application process. It serves as a summary of the loan application and provides essential information to lenders. This sheet typically includes details such as the applicant's name, property address, loan amount, and contact information. Properly completing this cover sheet ensures that all necessary information is readily available, facilitating a smoother review process by the lender.

Steps to Complete the Loan Submission Cover Sheet for Right Start Mortgage

Completing the Loan Submission Cover Sheet involves several key steps:

- Gather necessary information: Collect all relevant details, including personal information, loan specifics, and property details.

- Fill out each section: Carefully enter information in the designated fields, ensuring accuracy to avoid delays.

- Review for completeness: Double-check the form for any missing or incorrect information before submission.

- Sign and date: Ensure that the applicant signs and dates the cover sheet to validate the submission.

How to Obtain the Loan Submission Cover Sheet for Right Start Mortgage

The Loan Submission Cover Sheet can typically be obtained through your lender or mortgage broker. Many lenders provide this document as part of their application package. Additionally, it may be available on the lender's website or through their customer service. If you are unsure where to find it, contacting your lender directly can provide guidance on how to access the form.

Key Elements of the Loan Submission Cover Sheet for Right Start Mortgage

Several key elements are essential to include on the Loan Submission Cover Sheet:

- Applicant Information: Names, addresses, and contact details of all applicants.

- Property Information: Address of the property being financed, including type and intended use.

- Loan Details: Requested loan amount, type of mortgage, and any specific terms.

- Disclosure Statements: Any necessary disclosures or acknowledgments required by the lender.

Legal Use of the Loan Submission Cover Sheet for Right Start Mortgage

The Loan Submission Cover Sheet is a legally binding document that must be completed accurately to comply with lending regulations. Misrepresentation or omission of information can lead to legal issues, including loan denial or fraud allegations. It is important to understand the legal implications of the information provided and to ensure that all entries reflect true and accurate data.

Eligibility Criteria for Right Start Mortgage

Eligibility for the Right Start Mortgage program typically includes several criteria that applicants must meet:

- Credit Score: A minimum credit score is often required to qualify for the program.

- Income Verification: Applicants must provide proof of income to demonstrate their ability to repay the loan.

- Debt-to-Income Ratio: Lenders assess the ratio of debt to income to ensure it falls within acceptable limits.

- Property Type: The property must meet specific criteria set by the lender, including location and condition.

Quick guide on how to complete loan submission cover sheet right start mortgage

Effortlessly prepare LOAN SUBMISSION COVER SHEET Right Start Mortgage on any device

Digital document management has gained immense popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents quickly and without complications. Handle LOAN SUBMISSION COVER SHEET Right Start Mortgage on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign LOAN SUBMISSION COVER SHEET Right Start Mortgage without difficulty

- Find LOAN SUBMISSION COVER SHEET Right Start Mortgage and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Modify and eSign LOAN SUBMISSION COVER SHEET Right Start Mortgage and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct loan submission cover sheet right start mortgage

Create this form in 5 minutes!

How to create an eSignature for the loan submission cover sheet right start mortgage

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the right start mortgage and how does it work?

The right start mortgage is a tailored mortgage solution designed to help first-time homebuyers secure financing. It simplifies the application process, making it easier to understand and manage. With airSlate SignNow, you can eSign all necessary documents quickly and securely, ensuring a smooth experience from start to finish.

-

What are the benefits of choosing the right start mortgage?

Choosing the right start mortgage offers several benefits, including competitive interest rates and flexible repayment options. This mortgage is specifically designed for those new to homeownership, providing guidance and support throughout the process. Additionally, airSlate SignNow enhances your experience by allowing you to manage documents effortlessly.

-

How much does the right start mortgage cost?

The cost of the right start mortgage can vary based on several factors, including your credit score and the loan amount. Typically, there are no hidden fees, and airSlate SignNow ensures transparency throughout the process. It's advisable to consult with a mortgage advisor to get a personalized quote.

-

What features are included with the right start mortgage?

The right start mortgage includes features such as low down payment options, fixed-rate terms, and personalized customer support. Additionally, airSlate SignNow provides an easy-to-use platform for eSigning documents, making the entire process more efficient. These features are designed to cater to the needs of first-time buyers.

-

Can I integrate the right start mortgage with other financial tools?

Yes, the right start mortgage can be integrated with various financial tools to streamline your home buying process. This includes budgeting apps and financial planning software. With airSlate SignNow, you can easily manage and eSign all related documents, ensuring everything is in one place.

-

How long does it take to get approved for the right start mortgage?

Approval times for the right start mortgage can vary, but many applicants receive a decision within a few days. The efficiency of the process is enhanced by airSlate SignNow's digital document management, which speeds up the eSigning and submission of necessary paperwork. It's important to have all required documents ready to expedite the approval.

-

What documents do I need for the right start mortgage application?

To apply for the right start mortgage, you typically need to provide proof of income, credit history, and identification. Additional documents may include tax returns and bank statements. Using airSlate SignNow, you can easily upload and eSign these documents, simplifying the application process.

Get more for LOAN SUBMISSION COVER SHEET Right Start Mortgage

- Mississippi lease to own option to purchase agreement form

- Sample new york exclusive right to sell listing agreement form

- Louisiana agency disclosure pamphlet form

- Louisiana agency disclosure form

- Roommate agreementcontractcreate ampamp download a free form

- Real estate agent work affiliation licensingregstatemaus form

- Short sale addendum to the purchase and sales agreement form

- Fillable online are you a customer or client nhgov fax form

Find out other LOAN SUBMISSION COVER SHEET Right Start Mortgage

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed