Right Start Mortgage 2017

What is the Right Start Mortgage

The Right Start Mortgage is a specialized loan program designed to assist first-time homebuyers in the United States. This mortgage option typically offers favorable terms, such as lower down payment requirements and competitive interest rates. The program aims to make homeownership more accessible for individuals and families who may not have substantial savings or credit history. Understanding the specifics of the Right Start Mortgage can help potential borrowers determine if it aligns with their financial goals.

How to Obtain the Right Start Mortgage

To obtain the Right Start Mortgage, prospective borrowers should follow a series of steps. First, they need to research lenders that offer this specific mortgage program. After identifying suitable lenders, applicants should gather necessary documentation, including proof of income, credit history, and identification. Once the paperwork is ready, applicants can submit their applications for review. Lenders will evaluate the application based on creditworthiness and financial stability before approving the mortgage.

Steps to Complete the Right Start Mortgage

Completing the Right Start Mortgage involves several key steps. Initially, borrowers should select a lender and complete a mortgage application. This application will require detailed financial information. Following submission, the lender will conduct a credit check and assess the applicant's financial situation. If approved, the borrower will receive a loan estimate outlining the terms of the mortgage. After reviewing the terms, the borrower can proceed to finalize the mortgage by signing the necessary documents and fulfilling any remaining conditions.

Eligibility Criteria

Eligibility for the Right Start Mortgage typically includes several criteria. Applicants usually need to be first-time homebuyers, which is defined as individuals who have not owned a home in the past three years. Additionally, there may be income limits based on the area’s median income. Lenders may also require a minimum credit score, although this can vary. Understanding these criteria is crucial for applicants to assess their chances of qualifying for the mortgage.

Required Documents

When applying for the Right Start Mortgage, borrowers must prepare several key documents. Commonly required items include proof of income, such as pay stubs or tax returns, and identification documents like a driver's license or Social Security card. Additionally, lenders may request bank statements to verify savings and assets. Having these documents ready can streamline the application process and improve the chances of approval.

Legal Use of the Right Start Mortgage

The Right Start Mortgage must be used in accordance with specific legal guidelines. Borrowers are typically required to use the funds for purchasing a primary residence. Additionally, the mortgage may come with stipulations regarding property types and locations. Understanding these legal requirements is essential for borrowers to ensure compliance and avoid potential issues with their mortgage agreement.

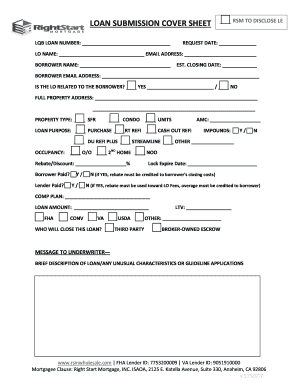

Quick guide on how to complete right start mortgage

Complete Right Start Mortgage effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Right Start Mortgage on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to edit and electronically sign Right Start Mortgage with ease

- Find Right Start Mortgage and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would like to deliver your form: by email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and mistakes that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Right Start Mortgage and ensure exceptional communication throughout any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct right start mortgage

Create this form in 5 minutes!

How to create an eSignature for the right start mortgage

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the right start mortgage?

The right start mortgage is a tailored financing option designed to help first-time homebuyers secure their dream home. It offers competitive rates and flexible terms, making it easier for individuals to manage their mortgage payments. With the right start mortgage, you can take the first step towards homeownership with confidence.

-

How does the right start mortgage work?

The right start mortgage works by providing borrowers with a structured loan that is specifically designed for those entering the housing market. It typically includes lower down payment requirements and favorable interest rates. This makes it an ideal choice for buyers who may not have substantial savings but are ready to invest in a home.

-

What are the benefits of choosing the right start mortgage?

Choosing the right start mortgage offers several benefits, including lower initial costs and the ability to build equity faster. Additionally, it provides access to educational resources and support for first-time buyers. This mortgage option is designed to make the home buying process smoother and more accessible.

-

What features should I look for in a right start mortgage?

When considering a right start mortgage, look for features such as flexible repayment terms, competitive interest rates, and options for down payment assistance. It's also important to check if the mortgage includes educational resources for first-time buyers. These features can signNowly enhance your home buying experience.

-

Are there any fees associated with the right start mortgage?

Yes, like most mortgage options, the right start mortgage may have associated fees, including origination fees and closing costs. However, many lenders offer programs to minimize these costs for first-time buyers. It's essential to review all potential fees with your lender to understand the total cost of your mortgage.

-

Can I refinance my right start mortgage later?

Yes, refinancing your right start mortgage is possible once you have built sufficient equity in your home. This can help you secure a lower interest rate or change the terms of your loan. It's advisable to consult with your lender to explore your refinancing options and determine the best time to do so.

-

How can I apply for a right start mortgage?

To apply for a right start mortgage, you can start by contacting a lender that offers this specific mortgage type. They will guide you through the application process, which typically includes providing financial documentation and undergoing a credit check. Make sure to ask about any special programs available for first-time buyers.

Get more for Right Start Mortgage

- 2013 sc isp form

- Child care workerssupply list waterloo catholic district form

- Sun life attending statement form

- Msp plan form

- Molecular diagnostic laboratory cancer and endocrine next generation sequencing requisition form

- Council member organized community event donor declaration form

- Unclaimed property search request form sun life

- Ind046e childrens critical illness rider questionnaire form

Find out other Right Start Mortgage

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself