Self Certification of Residency for Tax Purposes 2021-2026

What is the Self Certification of Residency for Tax Purposes

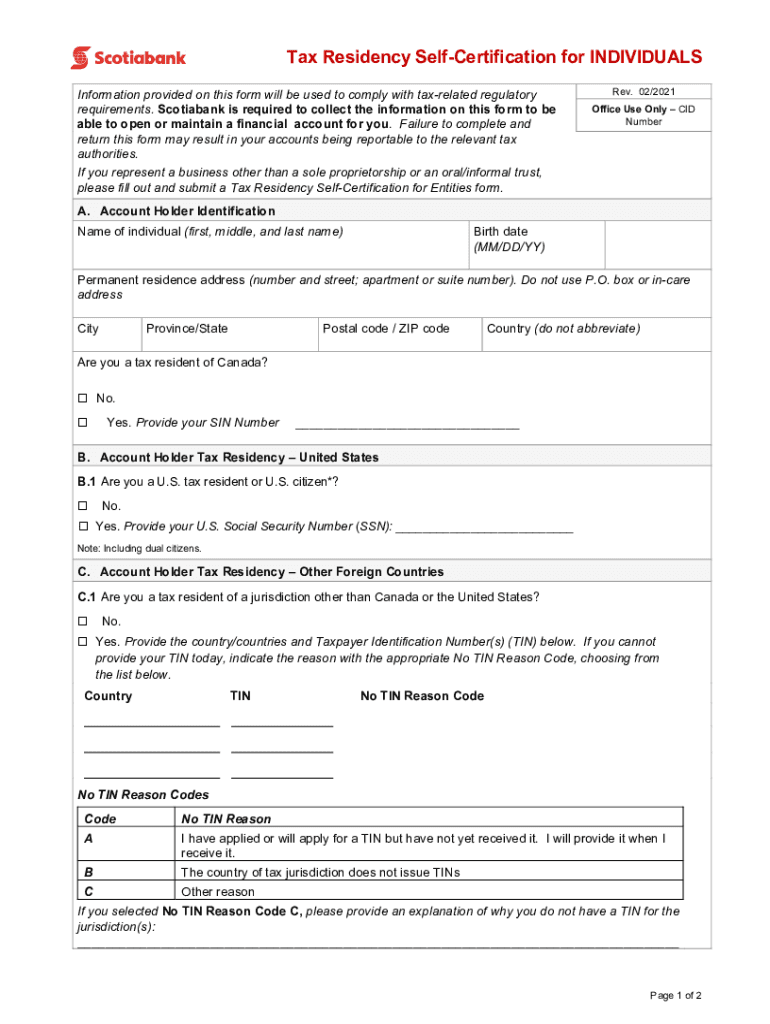

The Self Certification of Residency for Tax Purposes is a document that individuals complete to confirm their tax residency status. This certification is often required by financial institutions and other entities to comply with tax regulations, particularly when dealing with foreign accounts or investments. By providing this information, individuals help ensure that they are taxed appropriately according to their residency status. The form typically includes personal details, such as name, address, and taxpayer identification number, along with a declaration of residency.

Steps to Complete the Self Certification of Residency for Tax Purposes

Completing the Self Certification of Residency involves several straightforward steps:

- Gather necessary personal information, including your full name, address, and taxpayer identification number.

- Determine your residency status based on the criteria set by the IRS or relevant tax authorities.

- Fill out the form accurately, ensuring all information is correct and complete.

- Review the completed form for any errors or omissions.

- Submit the form to the requesting institution or entity, following their specific submission guidelines.

Required Documents

When completing the Self Certification of Residency, individuals may need to provide supporting documents to verify their residency status. Commonly required documents include:

- A government-issued identification card, such as a driver's license or passport.

- Proof of residency, which can include utility bills, lease agreements, or bank statements showing your name and address.

- Any previous tax residency certificates, if applicable.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines for completing the Self Certification of Residency. Individuals should ensure that they follow these guidelines to avoid potential issues. Key points include:

- Understanding the residency criteria based on the substantial presence test or green card status.

- Ensuring that the form is signed and dated to validate the information provided.

- Keeping a copy of the submitted form for personal records.

Penalties for Non-Compliance

Failing to complete the Self Certification of Residency accurately or submitting it when required can lead to significant penalties. These may include:

- Increased withholding taxes on income from U.S. sources.

- Potential audits by tax authorities, leading to further scrutiny of financial activities.

- Fines and interest on unpaid taxes if residency status is misrepresented.

Application Process & Approval Time

The application process for the Self Certification of Residency is generally straightforward. Once the form is completed and submitted, individuals can expect the following:

- Review by the requesting institution, which may take several days to weeks depending on their internal processes.

- Notification of approval or any required corrections to the submitted information.

- In most cases, individuals will receive confirmation of their residency status, allowing them to proceed with their financial transactions.

Quick guide on how to complete self certification of residency for tax purposes

Complete Self Certification Of Residency For Tax Purposes effortlessly on any gadget

Managing documents online has become increasingly popular among organizations and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, edit, and electronically sign your documents quickly and seamlessly. Handle Self Certification Of Residency For Tax Purposes on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to edit and electronically sign Self Certification Of Residency For Tax Purposes with ease

- Find Self Certification Of Residency For Tax Purposes and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Select important sections of your documents or redact sensitive information with the tools specifically offered by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional ink signature.

- Review all details and click on the Done button to save your changes.

- Decide how you wish to deliver your form, whether by email, SMS, or sharing an invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, exhausting form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and electronically sign Self Certification Of Residency For Tax Purposes and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct self certification of residency for tax purposes

Create this form in 5 minutes!

How to create an eSignature for the self certification of residency for tax purposes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is tax residency self certification individuals?

Tax residency self certification individuals refers to the process where individuals declare their tax residency status to comply with tax regulations. This certification is essential for financial institutions to determine the correct tax withholding rates. Using airSlate SignNow, you can easily manage and eSign your tax residency self certification documents.

-

How does airSlate SignNow facilitate tax residency self certification individuals?

airSlate SignNow streamlines the process of tax residency self certification individuals by providing a user-friendly platform for document creation and eSigning. Our solution allows you to fill out and sign necessary forms quickly, ensuring compliance with tax regulations. This efficiency saves time and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for tax residency self certification individuals?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of individuals and businesses. Our plans are designed to be cost-effective while providing all the necessary features for tax residency self certification individuals. You can choose a plan that best fits your requirements and budget.

-

What features does airSlate SignNow offer for tax residency self certification individuals?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for tax residency self certification individuals. These features enhance the user experience and ensure that your documents are handled securely and efficiently. Additionally, you can access your documents anytime, anywhere.

-

Can I integrate airSlate SignNow with other applications for tax residency self certification individuals?

Absolutely! airSlate SignNow offers seamless integrations with various applications, making it easier to manage your tax residency self certification individuals. Whether you use CRM systems, cloud storage, or other business tools, our platform can connect with them to streamline your workflow.

-

What are the benefits of using airSlate SignNow for tax residency self certification individuals?

Using airSlate SignNow for tax residency self certification individuals provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete the certification process quickly and securely, ensuring compliance with tax regulations while saving you valuable time.

-

How secure is airSlate SignNow for handling tax residency self certification individuals?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your documents, including those related to tax residency self certification individuals. You can trust that your sensitive information is safe and secure while using our platform.

Get more for Self Certification Of Residency For Tax Purposes

- Licensing status page new york form

- Mast climber safety checklist form

- To download the halal form new york state department of agriculture ny

- Heavy equipment operator certification card template form

- Atap nysla form

- Nyc dob schedule c form

- Pw1c form

- Nail specialty application new york state department of state form

Find out other Self Certification Of Residency For Tax Purposes

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement