Certificate of Georgia Fiscal Resident 2014

What is the tax residency self certification?

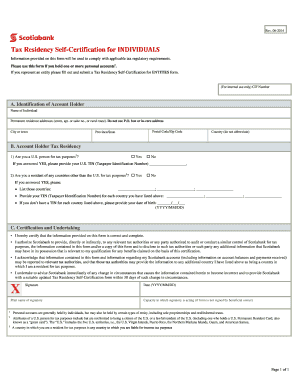

The tax residency self certification is a document used by individuals to confirm their tax residency status. This form is often required by financial institutions and other entities to ensure compliance with tax regulations. By completing this certification, individuals assert their residency status for tax purposes, which can influence withholding rates and reporting obligations. The form typically requires personal information, including name, address, and taxpayer identification number, along with a declaration of residency status.

Steps to complete the tax residency self certification

Completing the tax residency self certification involves several straightforward steps to ensure accuracy and compliance. First, gather necessary personal information, including your full name, address, and taxpayer identification number. Next, clearly indicate your residency status by selecting the appropriate options provided on the form. After filling out the required sections, review the document for any errors or omissions. Finally, sign and date the form to validate your certification. It is advisable to keep a copy for your records.

Legal use of the tax residency self certification

The tax residency self certification serves a critical legal function in confirming an individual's tax status. Financial institutions and other entities rely on this document to determine the appropriate tax treatment of income, ensuring compliance with Internal Revenue Service (IRS) regulations. Proper completion of the form can protect individuals from potential penalties associated with incorrect tax reporting. It is important to understand that providing false information on this certification can lead to serious legal consequences.

Required documents for tax residency self certification

When completing the tax residency self certification, certain documents may be necessary to support your claims. Typically, you will need to provide proof of identity, which may include a government-issued ID or passport. Additionally, documentation that verifies your residency, such as utility bills or lease agreements, may be required. Having these documents ready can streamline the process and ensure that your certification is accepted without delay.

IRS Guidelines for tax residency self certification

The IRS has specific guidelines regarding the use of the tax residency self certification. These guidelines outline the necessary information to be included on the form and the acceptable methods for submitting it. It is essential to follow these guidelines closely to avoid complications with your tax filings. The IRS may also provide updates or changes to these guidelines, so staying informed is crucial for compliance.

Penalties for non-compliance with tax residency self certification

Failing to comply with the requirements of the tax residency self certification can result in significant penalties. Individuals who provide inaccurate or incomplete information may face increased withholding rates, fines, or even legal action from tax authorities. It is important to take the certification process seriously and ensure that all information is truthful and complete to avoid these potential consequences.

Quick guide on how to complete certificate of georgia fiscal resident

Complete Certificate Of Georgia Fiscal Resident effortlessly on any gadget

Managing documents online has gained popularity among businesses and individuals. It offers an ideal environmentally friendly option to traditional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Handle Certificate Of Georgia Fiscal Resident on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign Certificate Of Georgia Fiscal Resident without effort

- Obtain Certificate Of Georgia Fiscal Resident and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you want to send your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tiresome form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your requirements in document management in just a few clicks from any device of your choice. Edit and eSign Certificate Of Georgia Fiscal Resident and ensure excellent communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct certificate of georgia fiscal resident

Create this form in 5 minutes!

How to create an eSignature for the certificate of georgia fiscal resident

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is tax residency self certification?

Tax residency self certification is a process that individuals and businesses use to confirm their tax residency status to financial institutions. This certification is essential for compliance with tax laws and can often be required when opening bank accounts or investing. Using airSlate SignNow, you can easily manage and sign documents related to tax residency self certification.

-

How can airSlate SignNow help with tax residency self certification?

airSlate SignNow provides an efficient platform for creating, sending, and electronically signing documents involved in the tax residency self certification process. With our user-friendly interface, you can quickly upload and manage your certification forms, ensuring that you stay compliant without any hassle. This streamlines your workflow and saves valuable time.

-

Is there a cost associated with using airSlate SignNow for tax residency self certification?

Yes, airSlate SignNow offers various pricing plans tailored to your needs, ensuring you have access to features that support tax residency self certification. Our plans are competitively priced, allowing you to choose one that fits your budget while maximizing efficiency. Sign up for a free trial to explore the benefits before committing.

-

What features does airSlate SignNow offer for tax residency self certification?

Our platform includes features such as document templates, customizable workflows, and integration capabilities that simplify the tax residency self certification process. You can automate reminders for signing and create a seamless user experience. These features ensure that all necessary steps are followed efficiently.

-

Can I integrate airSlate SignNow with other software for tax residency self certification?

Absolutely! airSlate SignNow easily integrates with various third-party applications, including CRM systems and document management tools, to enhance the tax residency self certification process. This integration allows for smoother data transfer and improves overall workflow efficiency, eliminating the need for manual data entry.

-

What are the benefits of using airSlate SignNow for tax residency self certification?

Using airSlate SignNow for tax residency self certification provides benefits like enhanced document security, reduced processing time, and improved compliance. You can ensure that your certifications are securely signed and stored, ready for submission whenever needed. This can signNowly lessen the stress involved in meeting tax regulations.

-

Is it easy to use airSlate SignNow for tax residency self certification?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to navigate the platform for tax residency self certification. The intuitive interface allows users to create, manage, and sign documents without technical expertise. Our extensive support resources are also available to assist you.

Get more for Certificate Of Georgia Fiscal Resident

- Sitelink web edition form

- Archdiocese of san antonio witness affidavit of dom to marry cc 1067 1069 form

- Fairfax water form

- Khyam ridgi dome xl instructions form

- Appfolio property manager user guide form

- Aqua tots application form

- School bus pre trip inspection form

- Cumulative standardized review spelling test grade 3 lessons 28 bb svusd form

Find out other Certificate Of Georgia Fiscal Resident

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors