NOTE This Form Does Not Affect Your 12 Month Qualifying Period, and is NOT Part of the Tax Incentive Process 2018-2026

Understanding the Purpose of the Form

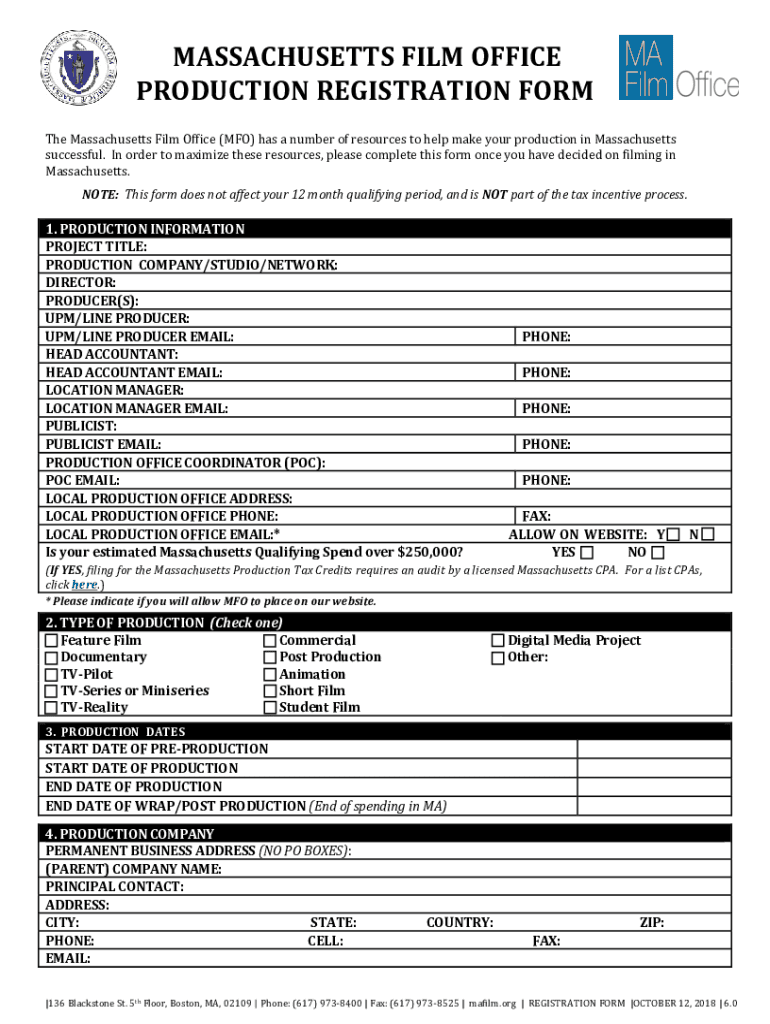

The form titled "NOTE This Form Does Not Affect Your 12 Month Qualifying Period, And Is NOT Part Of The Tax Incentive Process" serves a specific purpose in various administrative and compliance contexts. It clarifies that the completion of this form does not influence the 12-month qualifying period for certain benefits or programs. Additionally, it emphasizes that this form is separate from any tax incentive processes, ensuring that users understand its distinct role.

Steps to Complete the Form

Completing the form requires careful attention to detail. Begin by gathering all necessary information, such as personal identification and relevant dates. Follow these steps:

- Read the instructions provided with the form to understand the requirements.

- Fill in your personal details accurately, ensuring all information is up to date.

- Double-check your entries for any errors or omissions.

- Sign and date the form where indicated.

Once completed, review the form to ensure compliance with all specified guidelines.

Legal Use of the Form

This form is legally recognized and must be used in accordance with applicable laws and regulations. It is essential for individuals and businesses to understand the legal implications of submitting the form. Misrepresentation or errors may lead to complications in administrative processes or compliance issues. Always retain a copy of the submitted form for your records.

Eligibility Criteria for Using the Form

To utilize this form, individuals must meet specific eligibility criteria. Generally, it is intended for those who are involved in processes that require clarification of their qualifying periods or tax incentives. Ensure that you review the eligibility requirements outlined in the accompanying documentation to determine if this form applies to your situation.

Form Submission Methods

The completed form can typically be submitted through various methods, including:

- Online submission via designated platforms, if available.

- Mailing the form to the appropriate administrative office.

- In-person submission at specified locations.

Choose the method that best suits your needs and ensure that you follow any additional instructions provided for submission.

Key Elements of the Form

Understanding the key elements of the form is crucial for accurate completion. Important components include:

- Your personal identification information.

- Specific dates related to the qualifying period.

- A declaration stating the form's purpose and its separation from tax incentives.

Each element must be filled out with precision to avoid delays or complications in processing.

Quick guide on how to complete note this form does not affect your 12 month qualifying period and is not part of the tax incentive process

Effortlessly Prepare NOTE This Form Does Not Affect Your 12 Month Qualifying Period, And Is NOT Part Of The Tax Incentive Process on Any Device

Online document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage NOTE This Form Does Not Affect Your 12 Month Qualifying Period, And Is NOT Part Of The Tax Incentive Process on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

Steps to Modify and eSign NOTE This Form Does Not Affect Your 12 Month Qualifying Period, And Is NOT Part Of The Tax Incentive Process with Ease

- Locate NOTE This Form Does Not Affect Your 12 Month Qualifying Period, And Is NOT Part Of The Tax Incentive Process and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive details using features specifically available through airSlate SignNow.

- Create your eSignature with the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the information and then click the Done button to preserve your modifications.

- Choose your preferred method to share your form, whether by email, SMS, invitation link, or by downloading it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or errors necessitating the reprinting of new document copies. airSlate SignNow efficiently addresses your document management requirements in just a few clicks from your chosen device. Modify and eSign NOTE This Form Does Not Affect Your 12 Month Qualifying Period, And Is NOT Part Of The Tax Incentive Process to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct note this form does not affect your 12 month qualifying period and is not part of the tax incentive process

Create this form in 5 minutes!

How to create an eSignature for the note this form does not affect your 12 month qualifying period and is not part of the tax incentive process

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the form mentioned in the title?

The form serves to clarify that NOTE This Form Does Not Affect Your 12 Month Qualifying Period, And Is NOT Part Of The Tax Incentive Process. It is essential for users to understand that submitting this form will not influence their eligibility for any tax incentives.

-

How does airSlate SignNow ensure document security?

airSlate SignNow employs advanced encryption and security protocols to protect your documents. Users can rest assured that their information is safe, as NOTE This Form Does Not Affect Your 12 Month Qualifying Period, And Is NOT Part Of The Tax Incentive Process, ensuring compliance with data protection regulations.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Each plan is designed to provide value without affecting your financial incentives, as NOTE This Form Does Not Affect Your 12 Month Qualifying Period, And Is NOT Part Of The Tax Incentive Process.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your workflow. This integration capability allows you to manage documents efficiently, while keeping in mind that NOTE This Form Does Not Affect Your 12 Month Qualifying Period, And Is NOT Part Of The Tax Incentive Process.

-

What features does airSlate SignNow offer?

airSlate SignNow provides a range of features including eSigning, document templates, and real-time tracking. These features are designed to streamline your document management process, and it's important to note that NOTE This Form Does Not Affect Your 12 Month Qualifying Period, And Is NOT Part Of The Tax Incentive Process.

-

How can airSlate SignNow benefit my business?

By using airSlate SignNow, businesses can save time and reduce costs associated with document handling. The efficiency gained from this solution is signNow, especially since NOTE This Form Does Not Affect Your 12 Month Qualifying Period, And Is NOT Part Of The Tax Incentive Process.

-

Is there customer support available for airSlate SignNow users?

Absolutely! airSlate SignNow offers dedicated customer support to assist users with any inquiries or issues. Our support team is knowledgeable about the platform and can clarify that NOTE This Form Does Not Affect Your 12 Month Qualifying Period, And Is NOT Part Of The Tax Incentive Process.

Get more for NOTE This Form Does Not Affect Your 12 Month Qualifying Period, And Is NOT Part Of The Tax Incentive Process

Find out other NOTE This Form Does Not Affect Your 12 Month Qualifying Period, And Is NOT Part Of The Tax Incentive Process

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney

- Sign Michigan Mechanic's Lien Easy

- How To Sign Texas Revocation of Power of Attorney

- Sign Virginia Revocation of Power of Attorney Easy

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien

- Sign Arizona Notice of Rescission Safe

- Sign Hawaii Notice of Rescission Later

- Sign Missouri Demand Note Online

- How To Sign New York Notice to Stop Credit Charge

- How Do I Sign North Dakota Notice to Stop Credit Charge

- How To Sign Oklahoma Notice of Rescission