Taxpayer Help Expands This Year with More in Person Hours 2023-2026

IRS Guidelines

The IRS provides specific guidelines for completing the income tax return worksheet. It is essential to follow these instructions closely to ensure accurate filing. Taxpayers should refer to the IRS website or the instructions accompanying the 2023 income tax return form for detailed information on eligibility, required documentation, and calculation methods. Understanding these guidelines can help avoid common mistakes that may lead to delays or penalties.

Filing Deadlines / Important Dates

Timely submission of your income tax return is crucial. For the 2023 tax year, the deadline for filing your federal income tax return is typically April 15 of the following year. If you require additional time, you may file for an extension, which typically grants an additional six months. However, it is important to note that an extension to file does not extend the deadline for payment of any taxes owed. Be sure to check specific state deadlines, as they may differ from federal timelines.

Required Documents

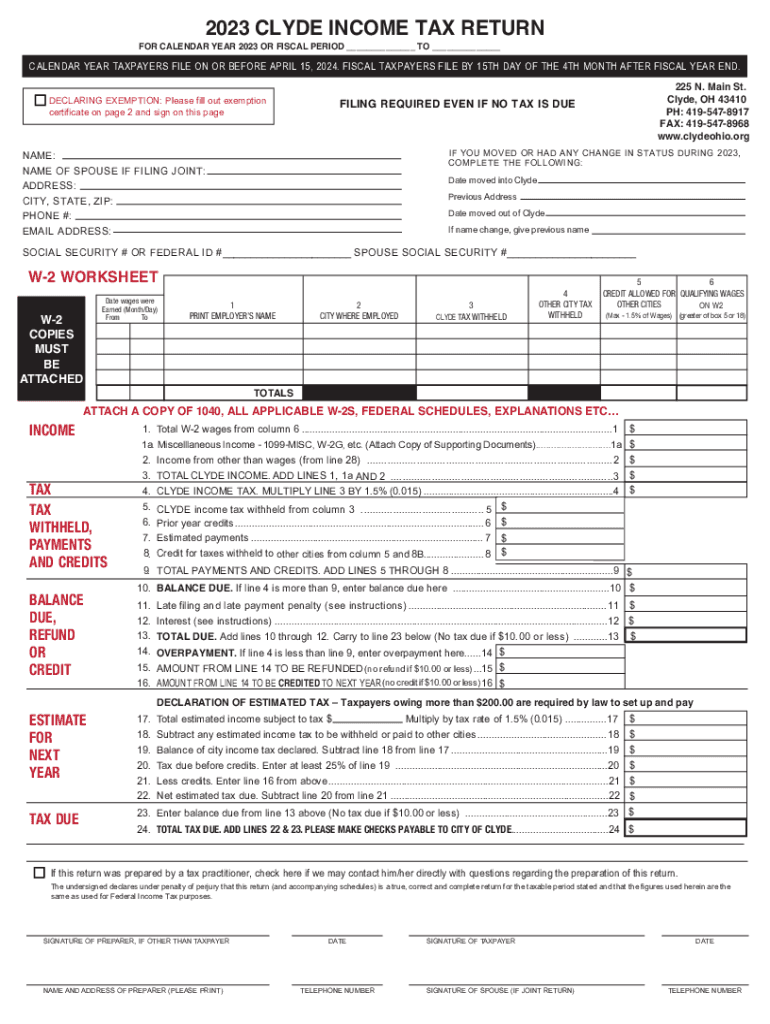

To accurately complete your income tax return worksheet, gather all necessary documents beforehand. Commonly required documents include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Receipts for deductible expenses, such as medical costs or charitable contributions

- Records of any other income sources

- Previous year’s tax return for reference

Having these documents organized will streamline the process and help ensure that all income and deductions are accurately reported.

Form Submission Methods

Taxpayers have several options for submitting their income tax return worksheet. These methods include:

- Online Submission: Many taxpayers choose to e-file their returns using tax preparation software, which often simplifies the process and provides immediate confirmation of receipt.

- Mail: If you prefer to file by paper, you can print your completed income tax return worksheet and mail it to the appropriate IRS address, which can vary based on your location and whether you are enclosing a payment.

- In-Person: Some taxpayers may opt to file in person at designated IRS offices or during tax preparation events, where assistance is available.

Eligibility Criteria

Eligibility for filing an income tax return worksheet depends on various factors, including income level, filing status, and age. Generally, individuals must file if their income exceeds certain thresholds set by the IRS. Special rules apply for dependents, self-employed individuals, and those claiming specific credits or deductions. It is advisable to review the IRS guidelines to determine if you are required to file and which forms are appropriate for your situation.

Taxpayer Scenarios

Different taxpayer scenarios can affect how the income tax return worksheet is completed. For instance:

- Self-Employed Individuals: Those who are self-employed must report business income and expenses, which may require additional forms.

- Students: Students may have unique deductions or credits available, such as education-related expenses.

- Retirees: Retired individuals may need to account for pensions, Social Security benefits, and other retirement income.

Understanding how these scenarios impact your tax situation can help ensure compliance and optimize potential refunds.

Quick guide on how to complete taxpayer help expands this year with more in person hours

Effortlessly Prepare Taxpayer Help Expands This Year With More In person Hours on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to quickly create, modify, and eSign your documents without delays. Manage Taxpayer Help Expands This Year With More In person Hours on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to Modify and eSign Taxpayer Help Expands This Year With More In person Hours with Ease

- Obtain Taxpayer Help Expands This Year With More In person Hours and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes only seconds and carries the same legal significance as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate creating new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choosing. Modify and eSign Taxpayer Help Expands This Year With More In person Hours and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct taxpayer help expands this year with more in person hours

Create this form in 5 minutes!

How to create an eSignature for the taxpayer help expands this year with more in person hours

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an income tax return worksheet?

An income tax return worksheet is a tool that helps individuals organize their financial information for tax filing. It typically includes sections for income, deductions, and credits, making it easier to prepare your tax return accurately. Using an income tax return worksheet can streamline the process and ensure you don't miss any important details.

-

How can airSlate SignNow help with my income tax return worksheet?

airSlate SignNow allows you to easily eSign and send your income tax return worksheet securely. With its user-friendly interface, you can fill out and share your worksheet with tax professionals or family members for review. This ensures that your tax documents are handled efficiently and securely.

-

Is there a cost associated with using airSlate SignNow for my income tax return worksheet?

Yes, airSlate SignNow offers various pricing plans to suit different needs, including options for individuals and businesses. The cost is competitive and provides great value considering the features available, such as eSigning and document management for your income tax return worksheet. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing income tax return worksheets?

airSlate SignNow provides features like customizable templates, secure eSigning, and document tracking for your income tax return worksheet. These tools help you manage your tax documents efficiently, ensuring that you can access and share them easily. Additionally, the platform supports collaboration, allowing multiple users to work on the worksheet simultaneously.

-

Can I integrate airSlate SignNow with other software for my income tax return worksheet?

Yes, airSlate SignNow offers integrations with various software applications, enhancing your workflow for managing your income tax return worksheet. You can connect it with popular accounting and tax preparation software to streamline your processes. This integration helps ensure that all your financial data is synchronized and easily accessible.

-

What are the benefits of using airSlate SignNow for my income tax return worksheet?

Using airSlate SignNow for your income tax return worksheet offers numerous benefits, including increased efficiency and security. The platform simplifies the eSigning process, reduces paperwork, and allows for easy collaboration with tax professionals. This ultimately saves you time and reduces the stress associated with tax season.

-

Is airSlate SignNow secure for handling my income tax return worksheet?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your income tax return worksheet and other documents are protected. The platform uses advanced encryption and secure storage methods to safeguard your sensitive information. You can trust that your tax documents are in safe hands.

Get more for Taxpayer Help Expands This Year With More In person Hours

- Kentucky form sos get

- Kentucky non profit corporation form

- Ky articles amendment form

- 8010str form

- Erecting a tenttemporary structure city of boston cityofboston form

- Certificate of good standing city of somerville somervillema form

- The 2015 2016 maryland official highway map maryland state form

- Maryland certification application county form

Find out other Taxpayer Help Expands This Year With More In person Hours

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy