Rent and Royalty Income and Expenses ORG25 BASIC P 2023-2026

Understanding the Rent and Royalty Income and Expenses ORG25

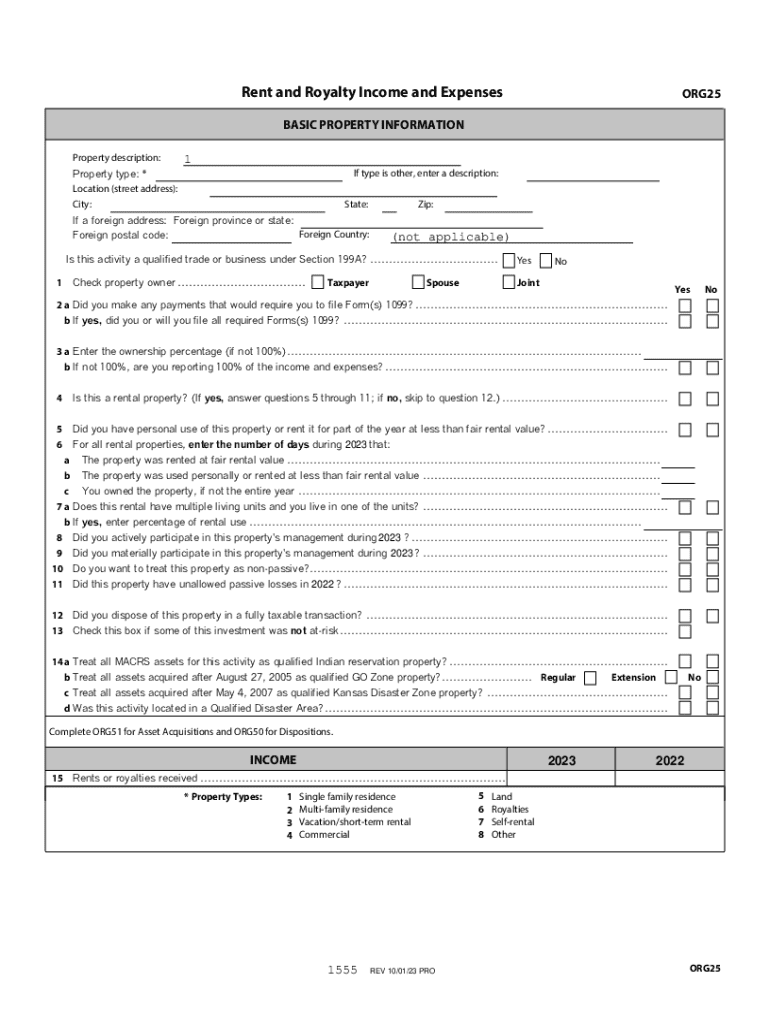

The Rent and Royalty Income and Expenses ORG25 is a crucial form used by individuals and businesses to report income generated from rental properties and royalties. This form is essential for accurately documenting income and expenses associated with real estate properties, ensuring compliance with IRS regulations. It helps taxpayers itemize their income and deductions, which can significantly impact their overall tax liability.

Steps to Complete the Rent and Royalty Income and Expenses ORG25

Completing the Rent and Royalty Income and Expenses ORG25 involves several important steps:

- Gather all necessary financial documents related to your rental properties, including income statements and expense receipts.

- Fill out the income section by reporting all rental income received during the tax year.

- Document all allowable expenses, such as property management fees, repairs, and maintenance costs.

- Ensure that all figures are accurate and reflect your financial records.

- Review the completed form for any errors before submission.

Legal Use of the Rent and Royalty Income and Expenses ORG25

The Rent and Royalty Income and Expenses ORG25 must be used in accordance with IRS guidelines. This form is legally required for taxpayers who earn rental income or royalties. Failing to submit this form or providing inaccurate information can result in penalties and increased scrutiny from the IRS. It is important to understand the legal implications of the information reported on this form to avoid potential issues.

IRS Guidelines for the Rent and Royalty Income and Expenses ORG25

The IRS provides specific guidelines for completing the Rent and Royalty Income and Expenses ORG25. Taxpayers should refer to the most current IRS publications for detailed instructions on what constitutes reportable income and deductible expenses. Key points include:

- Understanding what qualifies as rental income.

- Identifying which expenses are deductible.

- Keeping accurate records to support claims made on the form.

Filing Deadlines for the Rent and Royalty Income and Expenses ORG25

Timely filing of the Rent and Royalty Income and Expenses ORG25 is crucial to avoid penalties. The standard deadline for submitting this form aligns with the federal tax return deadline, typically April 15. However, if you file for an extension, ensure that you still comply with the extended deadline to avoid any late fees or interest charges.

Examples of Using the Rent and Royalty Income and Expenses ORG25

Understanding practical applications of the Rent and Royalty Income and Expenses ORG25 can clarify its importance. For instance, a landlord renting out a residential property must report all rental income received and can deduct expenses such as mortgage interest, property taxes, and repair costs. Similarly, an author receiving royalties from book sales would report their income and any related expenses incurred in the publishing process.

Quick guide on how to complete rent and royalty income and expenses org25 basic p

Effortlessly prepare Rent And Royalty Income And Expenses ORG25 BASIC P on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed materials, enabling you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Rent And Royalty Income And Expenses ORG25 BASIC P on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Rent And Royalty Income And Expenses ORG25 BASIC P effortlessly

- Locate Rent And Royalty Income And Expenses ORG25 BASIC P and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes just moments and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing fresh copies. airSlate SignNow caters to your document management needs in just a few clicks from your preferred device. Modify and electronically sign Rent And Royalty Income And Expenses ORG25 BASIC P while ensuring exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct rent and royalty income and expenses org25 basic p

Create this form in 5 minutes!

How to create an eSignature for the rent and royalty income and expenses org25 basic p

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is org25 and how does it benefit my business?

Org25 is a powerful feature within airSlate SignNow that streamlines document management and eSigning processes. By utilizing org25, businesses can enhance their workflow efficiency, reduce turnaround times, and improve overall productivity. This solution is designed to cater to organizations of all sizes, making it an ideal choice for those looking to optimize their document handling.

-

How much does org25 cost?

The pricing for org25 varies based on the specific plan you choose with airSlate SignNow. Generally, it offers competitive rates that provide excellent value for the features included. For detailed pricing information, it's best to visit our pricing page or contact our sales team for a personalized quote.

-

What features are included in the org25 plan?

The org25 plan includes a comprehensive suite of features such as customizable templates, advanced security options, and real-time tracking of document status. Additionally, users can benefit from integrations with popular applications, making it easier to manage documents across different platforms. These features are designed to enhance user experience and streamline workflows.

-

Can org25 integrate with other software applications?

Yes, org25 seamlessly integrates with a variety of software applications, including CRM systems, cloud storage services, and productivity tools. This integration capability allows businesses to create a cohesive workflow, reducing the need for manual data entry and improving overall efficiency. Check our integrations page for a complete list of compatible applications.

-

Is org25 suitable for small businesses?

Absolutely! Org25 is designed to be scalable and user-friendly, making it an excellent choice for small businesses. With its cost-effective pricing and robust features, small businesses can leverage org25 to enhance their document management processes without breaking the bank. It's an ideal solution for those looking to grow and streamline operations.

-

What are the security features of org25?

Org25 prioritizes security with features such as encryption, secure access controls, and audit trails. These measures ensure that your documents are protected from unauthorized access and that you can track all actions taken on your documents. With org25, you can have peace of mind knowing that your sensitive information is secure.

-

How can org25 improve my team's productivity?

By implementing org25, your team can signNowly reduce the time spent on document management tasks. The intuitive interface and automation features allow for quicker eSigning and document sharing, enabling your team to focus on more critical tasks. This boost in productivity can lead to faster project completion and improved overall performance.

Get more for Rent And Royalty Income And Expenses ORG25 BASIC P

Find out other Rent And Royalty Income And Expenses ORG25 BASIC P

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later