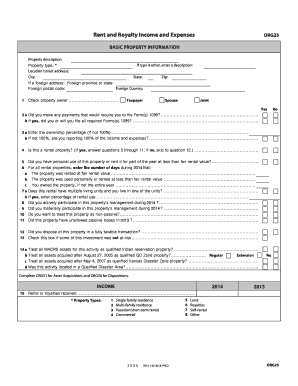

Rent and Royalty Income and Expenses ORG25 BASIC PROPERTY INFORMATION Property Description If Type is Other, Enter a Description 2014

Understanding the Rent and Royalty Income and Expenses Org25

The Rent and Royalty Income and Expenses Org25 is a specific form used for reporting income and expenses related to rental properties. This form captures essential information about the property, including its type, location, and any relevant descriptions. Properly filling out this form is crucial for accurate tax reporting and compliance with IRS guidelines.

Key details required on the form include:

- Property type: Specify whether the property is residential, commercial, or another type.

- Location: Provide the street address, city, state, and zip code. If the property is located outside the U.S., include the foreign province or region.

- Description: If the property type is categorized as "other," a detailed description must be entered to clarify the nature of the property.

Steps to Complete the Rent and Royalty Income and Expenses Org25

Completing the Rent and Royalty Income and Expenses Org25 involves several steps to ensure accuracy and compliance. Follow these steps to fill out the form effectively:

- Gather necessary information about the property, including its type and location.

- Determine the rental income received during the reporting period.

- Compile all related expenses, such as maintenance, repairs, and property management fees.

- Fill in each section of the form carefully, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

Legal Use of the Rent and Royalty Income and Expenses Org25

The Rent and Royalty Income and Expenses Org25 is legally recognized for tax reporting purposes in the United States. To ensure its legal validity, it must be filled out accurately and submitted in accordance with IRS regulations. This form serves as documentation for income and expenses, which can be crucial in the event of an audit.

It is important to maintain records of all supporting documents, such as receipts and statements, that substantiate the information reported on the form. This practice not only aids in compliance but also protects against potential penalties for non-compliance.

IRS Guidelines for the Rent and Royalty Income and Expenses Org25

The IRS provides specific guidelines regarding the use of the Rent and Royalty Income and Expenses Org25. Understanding these guidelines is essential for proper filing. Key points include:

- Ensure that all income and expenses reported are for the tax year specified.

- Follow the IRS instructions for categorizing expenses to maximize deductions.

- Be aware of deadlines for filing the form to avoid penalties.

Examples of Using the Rent and Royalty Income and Expenses Org25

Utilizing the Rent and Royalty Income and Expenses Org25 can vary based on individual circumstances. Here are a few scenarios:

- A property owner renting out a single-family home must report rental income and expenses related to maintenance and repairs.

- A landlord managing multiple rental units needs to compile income and expenses for each property separately to ensure accurate reporting.

- An investor with commercial properties may have additional considerations, such as depreciation and property management fees.

Required Documents for the Rent and Royalty Income and Expenses Org25

When completing the Rent and Royalty Income and Expenses Org25, certain documents are essential to support the information provided. These include:

- Rental agreements or leases that outline the terms of tenancy.

- Receipts for any expenses incurred, such as repairs or improvements.

- Bank statements reflecting rental income deposits.

Having these documents organized and accessible will facilitate a smoother filing process and ensure compliance with IRS requirements.

Quick guide on how to complete rent and royalty income and expenses org25 basic property information property description if type is other enter a description

Finish Rent And Royalty Income And Expenses ORG25 BASIC PROPERTY INFORMATION Property Description If Type Is Other, Enter A Description effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Rent And Royalty Income And Expenses ORG25 BASIC PROPERTY INFORMATION Property Description If Type Is Other, Enter A Description on any platform with airSlate SignNow Android or iOS applications and simplify any document-centric process today.

How to edit and eSign Rent And Royalty Income And Expenses ORG25 BASIC PROPERTY INFORMATION Property Description If Type Is Other, Enter A Description effortlessly

- Obtain Rent And Royalty Income And Expenses ORG25 BASIC PROPERTY INFORMATION Property Description If Type Is Other, Enter A Description and click Get Form to begin.

- Use the tools we provide to finish your form.

- Highlight pertinent sections of the documents or black out confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional hand-signed signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Edit and eSign Rent And Royalty Income And Expenses ORG25 BASIC PROPERTY INFORMATION Property Description If Type Is Other, Enter A Description and ensure excellent communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct rent and royalty income and expenses org25 basic property information property description if type is other enter a description

Create this form in 5 minutes!

How to create an eSignature for the rent and royalty income and expenses org25 basic property information property description if type is other enter a description

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is org25 and how does it benefit my business?

Org25 is an innovative feature of airSlate SignNow that enhances document management and eSigning. It streamlines workflows, allowing businesses to efficiently send, receive, and sign documents electronically. This increases productivity and ensures documents are processed faster, benefiting your business operations.

-

How much does it cost to use org25 with airSlate SignNow?

The pricing for org25 within airSlate SignNow is competitive and tailored to meet the needs of businesses of all sizes. You can choose from several plans, enabling you to select the features most relevant to your organization. This cost-effective solution ensures you get maximum value for electronic signature services.

-

What features does org25 include?

Org25 includes a comprehensive array of features designed to enhance eSignature processes. Key features encompass document templates, automated workflows, and secure cloud storage, all integrated into an intuitive interface. These capabilities help businesses streamline their document-signing tasks efficiently.

-

Can org25 integrate with other software I use?

Yes, org25 seamlessly integrates with popular business tools such as CRM and project management software. This integration allows for a more cohesive workflow as users can manage documents from various platforms without hassle. Enhancing your existing toolset with org25 can signNowly increase efficiency.

-

Is org25 secure for sensitive documents?

Absolutely, org25 prioritizes security to ensure that your sensitive documents are protected. With encryption protocols and secure storage options, airSlate SignNow provides a safe environment for eSigning. Businesses can rely on org25 for their compliance needs without worrying about data bsignNowes.

-

How can org25 improve my team's productivity?

By utilizing org25, teams can eliminate time-consuming manual processes associated with document signing. Features like bulk sending and automated reminders allow staff to focus more on their core tasks. This shift leads to improved efficiency and faster turnaround times for document-related workflows.

-

Is training available for new users of org25?

Yes, airSlate SignNow offers comprehensive training resources for new users of org25. This includes tutorials, webinars, and customer support to ensure a smooth onboarding process. Users can quickly familiarize themselves with the features to maximize the benefit of org25 in their business.

Get more for Rent And Royalty Income And Expenses ORG25 BASIC PROPERTY INFORMATION Property Description If Type Is Other, Enter A Description

- Quitclaim deed from an individual to a trust west virginia form

- West virginia trust form

- Short form settlement

- West virginia lien form

- Quitclaim deed from individual to two individuals in joint tenancy west virginia form

- Joint tenant tenancy 497431596 form

- Notice of mechanics lien supplier to contractor or subcontractor individual west virginia form

- Quitclaim deed by two individuals to husband and wife west virginia form

Find out other Rent And Royalty Income And Expenses ORG25 BASIC PROPERTY INFORMATION Property Description If Type Is Other, Enter A Description

- Sign Illinois Drug Testing Consent Agreement Online

- Sign Louisiana Applicant Appraisal Form Evaluation Free

- Sign Maine Applicant Appraisal Form Questions Secure

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online

- Can I Sign Idaho Affidavit of No Lien