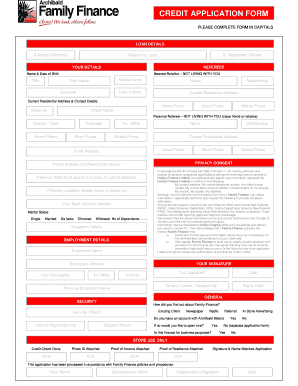

Credit Application Form Archibald New & Used Cars Kaitaia Northland Archibaldcars Co

Understanding the New Zealand Credit Application Form

The New Zealand credit application form is a document that individuals or businesses complete to request credit from a lender or financial institution. This form collects essential information about the applicant's financial history, income, and other relevant details to assess creditworthiness. It is crucial for lenders to evaluate the risk associated with granting credit and to make informed decisions.

Key Elements of the New Zealand Credit Application Form

Several key elements are typically included in the New Zealand credit application form. These elements help lenders gather necessary information efficiently:

- Personal Information: Name, address, date of birth, and contact details.

- Financial Information: Details about income, employment status, and existing debts.

- Credit History: Information regarding past credit accounts, payment history, and any defaults.

- Loan Details: The amount of credit requested and the purpose of the loan.

Steps to Complete the New Zealand Credit Application Form

Completing the New Zealand credit application form involves several straightforward steps:

- Gather Necessary Documents: Collect financial statements, proof of income, and identification.

- Fill Out the Form: Provide accurate and complete information in all required sections.

- Review Your Application: Double-check all entries for accuracy and completeness.

- Submit the Form: Follow the submission guidelines specified by the lender, whether online or in person.

Eligibility Criteria for the New Zealand Credit Application

Eligibility for credit approval through the New Zealand credit application form typically depends on various criteria set by the lender. Common factors include:

- Age: Applicants usually must be at least eighteen years old.

- Income Level: A minimum income requirement may be necessary to demonstrate repayment capacity.

- Credit History: A positive credit history can significantly influence approval chances.

- Employment Status: Stable employment or income sources are often preferred.

Legal Use of the New Zealand Credit Application Form

The New Zealand credit application form must be used in compliance with relevant laws and regulations. This includes ensuring that:

- Privacy Laws: Personal information must be handled according to privacy regulations.

- Fair Lending Practices: Lenders should adhere to fair lending laws to prevent discrimination.

- Disclosure Requirements: Lenders must provide clear information about terms and conditions associated with the credit.

Application Process & Approval Time

The application process for a New Zealand credit application typically involves the following stages:

- Submission: Once the form is submitted, the lender will review the application.

- Assessment: The lender assesses the applicant's creditworthiness based on the provided information.

- Approval or Denial: The lender will communicate the decision, which may take anywhere from a few hours to several days.

Quick guide on how to complete credit application form archibald new amp used cars kaitaia northland archibaldcars co

Complete Credit Application Form Archibald New & Used Cars Kaitaia Northland Archibaldcars Co effortlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing for the retrieval of the proper format and secure online storage. airSlate SignNow equips you with all the tools necessary to craft, modify, and eSign your documents rapidly without delays. Manage Credit Application Form Archibald New & Used Cars Kaitaia Northland Archibaldcars Co on any device using airSlate SignNow's Android or iOS applications and simplify any document-centric procedure today.

The optimal method to modify and eSign Credit Application Form Archibald New & Used Cars Kaitaia Northland Archibaldcars Co effortlessly

- Find Credit Application Form Archibald New & Used Cars Kaitaia Northland Archibaldcars Co and click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method for sending your form, either through email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or mislaid files, cumbersome form searches, or mistakes that necessitate the printing of new document versions. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Credit Application Form Archibald New & Used Cars Kaitaia Northland Archibaldcars Co and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the credit application form archibald new amp used cars kaitaia northland archibaldcars co

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the new zealand credit application form?

The new zealand credit application form is a document designed to collect essential information from applicants seeking credit. It streamlines the application process, ensuring that all necessary details are captured efficiently. By using this form, businesses can make informed decisions regarding credit approvals.

-

How can I access the new zealand credit application form?

You can easily access the new zealand credit application form through the airSlate SignNow platform. Simply log in to your account, navigate to the templates section, and search for the credit application form. This user-friendly interface allows for quick access and customization.

-

What are the benefits of using the new zealand credit application form?

Using the new zealand credit application form offers several benefits, including faster processing times and improved accuracy in data collection. It helps reduce paperwork and minimizes errors, allowing businesses to focus on their core operations. Additionally, it enhances the applicant experience by providing a clear and concise application process.

-

Is the new zealand credit application form customizable?

Yes, the new zealand credit application form is fully customizable to meet your business needs. You can add or remove fields, adjust the layout, and incorporate your branding elements. This flexibility ensures that the form aligns with your specific requirements and enhances your brand identity.

-

What integrations are available with the new zealand credit application form?

The new zealand credit application form integrates seamlessly with various third-party applications, including CRM systems and accounting software. This connectivity allows for automatic data transfer, reducing manual entry and improving efficiency. You can easily connect your existing tools to streamline your workflow.

-

How does airSlate SignNow ensure the security of the new zealand credit application form?

AirSlate SignNow prioritizes security by implementing advanced encryption and compliance measures for the new zealand credit application form. All data is securely stored and transmitted, ensuring that sensitive information remains protected. This commitment to security helps build trust with your applicants.

-

What is the pricing structure for using the new zealand credit application form?

The pricing for using the new zealand credit application form varies based on the plan you choose with airSlate SignNow. We offer flexible pricing options to accommodate businesses of all sizes. You can select a plan that best fits your needs and budget while enjoying the benefits of our eSigning solutions.

Get more for Credit Application Form Archibald New & Used Cars Kaitaia Northland Archibaldcars Co

- Open pdf file 49064 kb for regulations for large massgov form

- Massachusetts application bar form

- Court activity record information form

- Ma examinee form

- Ma form 7

- Maryland examination answers form

- How to file a small claim in the district court of maryland courts courts state md form

- Maryland state register of wills form

Find out other Credit Application Form Archibald New & Used Cars Kaitaia Northland Archibaldcars Co

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document